Blockchain technology has opened a new realm of possibilities, with innovations in decentralized finance, digital scarcity, and ownership. New organizational and ownership models are becoming possible, with users being the sole owners and administrators of the products, services, and platforms they create.

Due to their decentralised nature, these global communities face challenges in coordination, governance and decision making. So, they employ different crypto tokens to overcome challenges and optimise their operations.

There are multiple different types of crypto tokens which we discuss in greater detail in this article. But today we will focus on the two important members of the blockchain world – governance tokens & utility tokens.

In this article, we will delve into the details of both types of tokens and compare them to help you understand their key differences and similarities.

Let’s begin with… 👇

What is a Governance Token?

Governance tokens (sometimes called governance coins) represent ownership in a decentralized protocol. These tokens give holders certain rights that allow them to influence the direction of the protocol. The specific rights and decision-making processes may vary depending on the protocol, but they can include proposals for new products or features, budget allocation, and partnerships or integrations.

One way governance token holders can exercise their influence is by submitting formal proposals. These proposals are then subject to a set of criteria, and if they meet them, they are put to the vote. Governance token holders can vote on the proposed changes during the voting process.

This allows for a decentralized and democratic decision-making process where the community of token holders can come to a consensus on the direction the protocol will be heading in.

In decentralized autonomous organizations (DAOs), governance tokens play a crucial role in decision-making. No defined leadership structure exists in such organizations, and ownership is distributed among token holders.

Governance tokens allow these distributed owners to make decisions collectively and democratically without the need for a central authority. This is particularly important in the absence of traditional hierarchical leadership structures.

It is worth noting that the specific mechanisms and processes for exercising these rights can vary widely across protocols. Some protocols may use on-chain voting, while others may use off-chain voting or a combination of both. Some protocols may also have different quorums or thresholds that voters must meet before passing a proposal.

Additionally, some protocols may have additional requirements for proposal submission, such having as a certain number of tokens or a specific period that a token holder must have held their tokens before they can submit a proposal.

Overall, governance tokens are an essential part of decentralized protocols. They give token holders the power to make democratic decisions about the direction and progress of the protocol.

What is a Utility Token?

Utility tokens, also known as application tokens or user tokens, are a type of digital asset that has a specific use within a particular ecosystem or platform. Unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which primarily serve as a means of exchange, utility tokens provide access to specific features or services within a blockchain network or decentralized application (dApp).

One of the primary use cases of utility tokens is to provide access to a platform’s services or features. For example, a dApp may require users to hold a certain amount of its utility tokens to use its services.

Another use case for utility tokens is to incentivize participation within a network or its global community. For example, a platform may offer rewards in the form of utility tokens for users who contribute to the network. Such contribution may be providing computational resources or adding valuable content.

Many crypto projects use utility tokens for fundraising purposes. A company or project can issue utility tokens through an initial coin offering (ICO) to raise funds for development or expansion. Investors in the ICO can then use the tokens they receive to access the platform’s services or features.

In summary, utility tokens are a type of digital asset that serves a specific purpose within a particular ecosystem, such as providing users with access to a product or service.

Governance Token vs Utility Token

One of the critical differences between utility tokens and other types of tokens, such as governance tokens, is the primary objective of the token. While governance tokens primarily give holders a say in the management and direction of a project, utility tokens allow users to access or use a specific product or service within the ecosystem.

It is also important to note that utility tokens are often pre-mined, meaning they are created in a specific quantity and distributed by the team behind the project. This is a critical difference between utility tokens and other types of digital assets, such as Bitcoin, which are created continuously through mining.

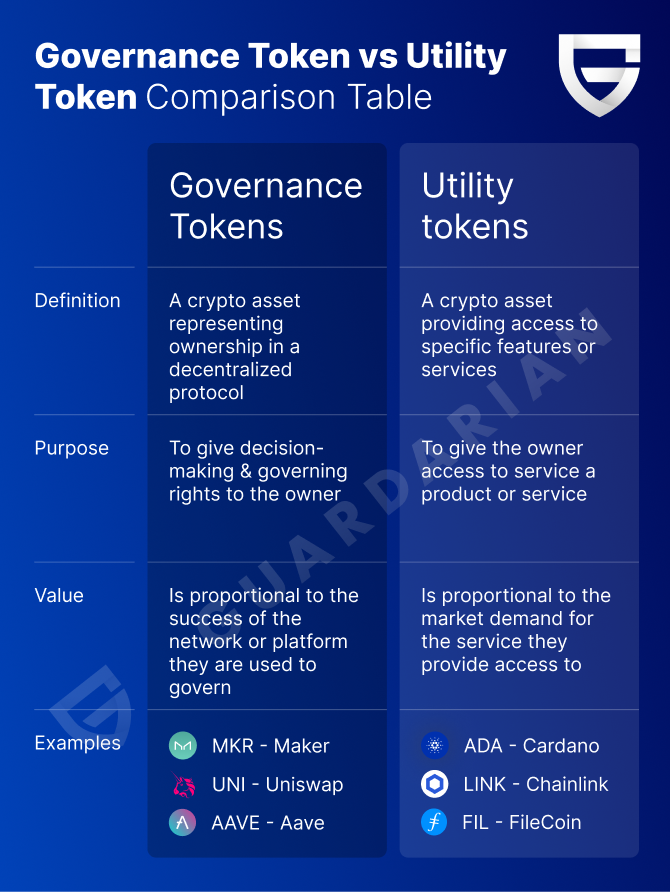

Here is a table giving a brief overview of the difference between governance and utility tokens:

Differences

The following are some of the critical differences between utility and governance tokens:

- Purpose: Governance tokens allow blockchains or DAOs to decentralize decision-making and community governance. In contrast, utility tokens provide access to certain features or services inside a decentralized application or platform.

- Voting Rights: Governance tokens give holders the right to vote on proposals and make decisions, while utility tokens do not have voting rights.

- Value: Governance tokens’ value is directly proportional to the success and acceptance of the network or platform they govern. In contrast, utility tokens’ value is directly proportional to the market demand for the features or services they provide access to.

Similarities

The following are significant similarities between utility and governance tokens:

- Decentralized systems make use of both governance and utility tokens.

- Depending on supply and demand, the value of each kind of token may go up or down, making them potentially valuable investments.

- Governance tokens can also be classified as utility tokens. A utility token allows users access to the protocol’s products and services or to exercise rights. The value of governance tokens lies in the ability to steer the future of a system. And this is in itself a utility, which makes governance tokens utility tokens.

How to buy Crypto Tokens?

If you are thinking of buying any of the tokens mentioned above or any other cryptocurrency – make sure to check out Guardarian. With us you can buy & sell 400+ different cryptos securely and without registration.

Our simple and seamless process will make sure that your assets will be on their way to your wallet in minutes. In addition, our service is non-custodial, meaning that we don’t hold on to your assets, putting you in full control. 🙂

Come give us a try at www.guardarian.com. and start saving time & money with each exchange!

The Takeaway

Utility and governance tokens are two of the most important and popular cryptocurrency tokens in decentralized networks. Both are essential to the governance and operation of these systems, but for different reasons.

The former is used for steering an organisation’s or protocols future direction, while the latter is used to provide access to products or services.

Importantly, governance tokens also fall under the utility token umbrella since the ability to vote and govern a network is in itself a utility. This may confuse beginners trying to understand tokenomics, but starting from now on – definitely not you. 💪

We hope you enjoyed this article and if you’d like to get the latest news, insights and write-ups from the world of blockchain – make sure to subscribe to our social media.