Digital currencies have come a long way in just over a decade. What started as a niche technology has now become a mainstream financial tool, increasingly embraced by businesses across industries. From e-commerce to B2B operations, virtual currencies offer a range of benefits – especially when businesses transact using stablecoins like USDT for enhanced security and predictability.

Whether you’re integrating a crypto payment solution or exploring advanced trading options, understanding the advantages of digital currency can help future-proof your business. Here are seven key reasons to adopt digital currencies today.

1. Tap Into Global Markets and Boost Revenue

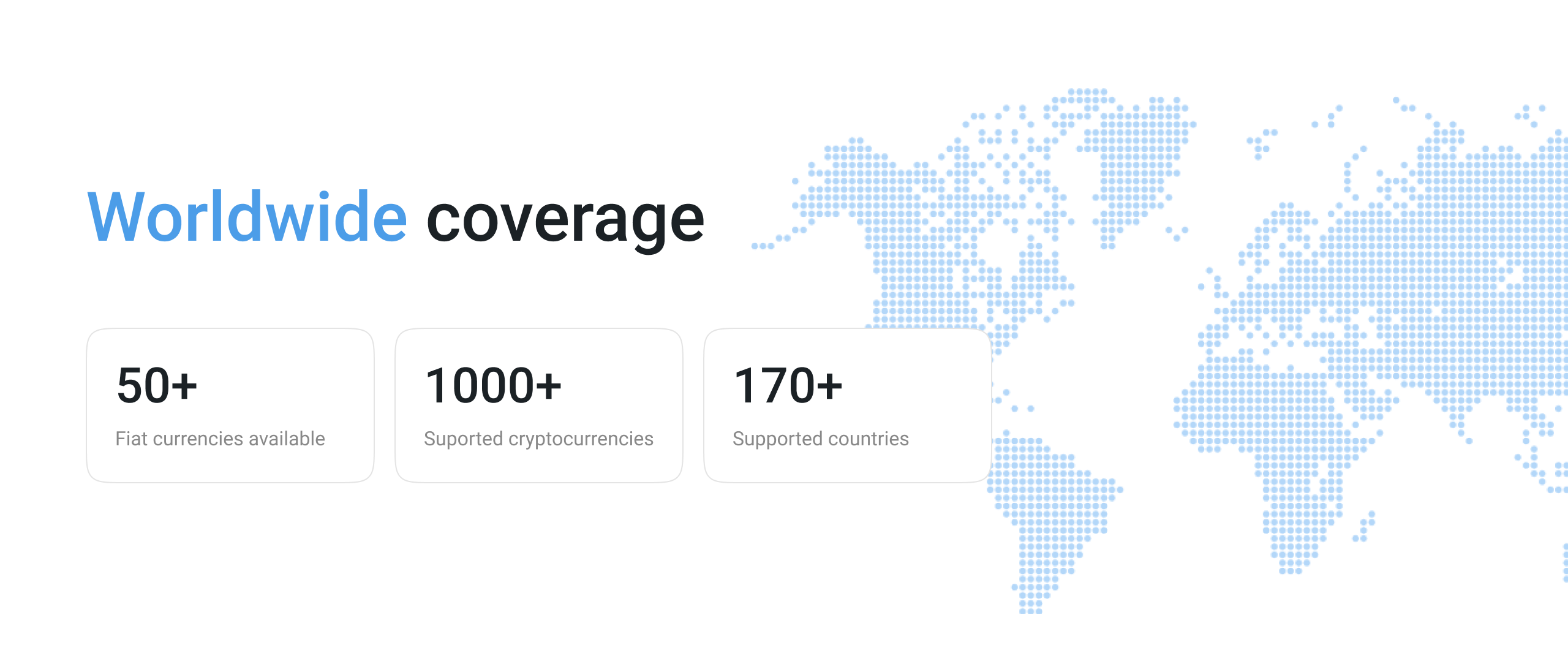

Digital currencies open doors to a worldwide customer base. With millions of users around the globe, businesses can expand beyond geographical boundaries and attract clients who prefer fast, borderless transactions. By integrating Guardarian, businesses can securely operate in over 170 countries and allow customers to buy USDT directly, making payments easier, more predictable, and helping tap into new markets to increase revenue.

2. Enhanced Security and Fraud Prevention

Blockchain technology ensures that every transaction is encrypted, verified, and recorded on a decentralized ledger. This makes it nearly impossible to hack or alter transaction records. For businesses, using stablecoins like USDT reduces exposure to volatility while maintaining the security and transparency of blockchain. Additionally, transactions are irreversible, eliminating the risk of chargebacks – a common issue in traditional payment methods.

3. Lower Transaction Fees

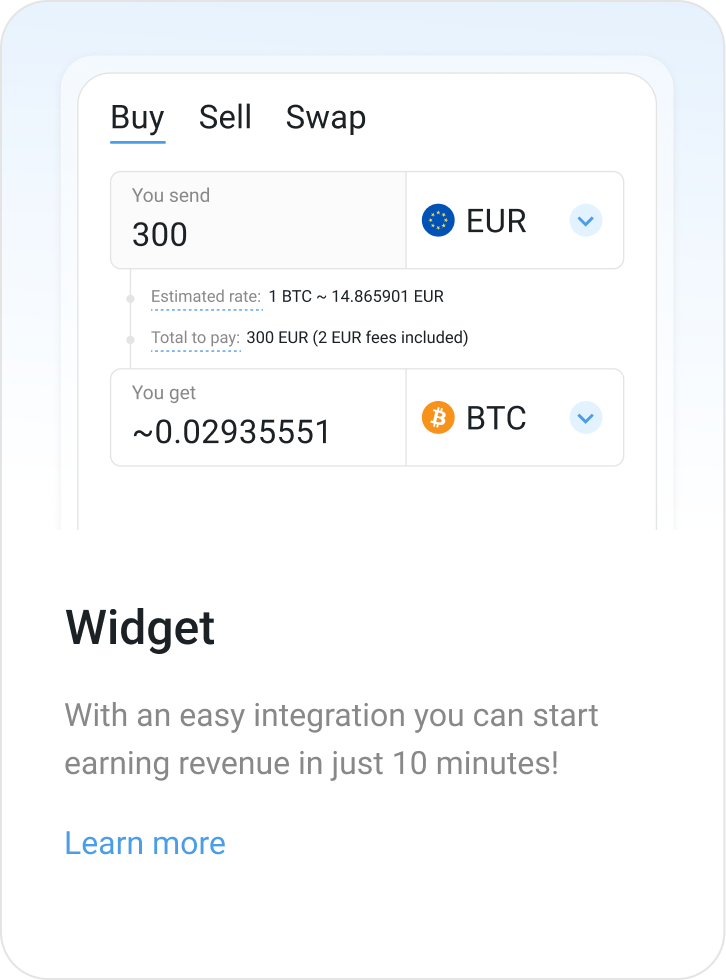

Traditional payment methods often involve multiple intermediaries, resulting in high transaction fees. Digital currencies allow businesses to bypass banks and processors, cutting costs significantly. By implementing a crypto widget, customers can pay directly with digital assets, and businesses can settle amounts in fiat, saving on currency conversion fees and enhancing profit margins.

4. Streamlined Cross-Border Transactions

Accepting digital currencies simplifies international payments. With no reliance on exchange rates or banking intermediaries, transactions become faster, cheaper, and more predictable. Businesses can manage global operations more efficiently, whether it’s paying suppliers, receiving payments, or sending remittances – all while using stablecoins for security.

5. Instant Payments and Improved Cash Flow

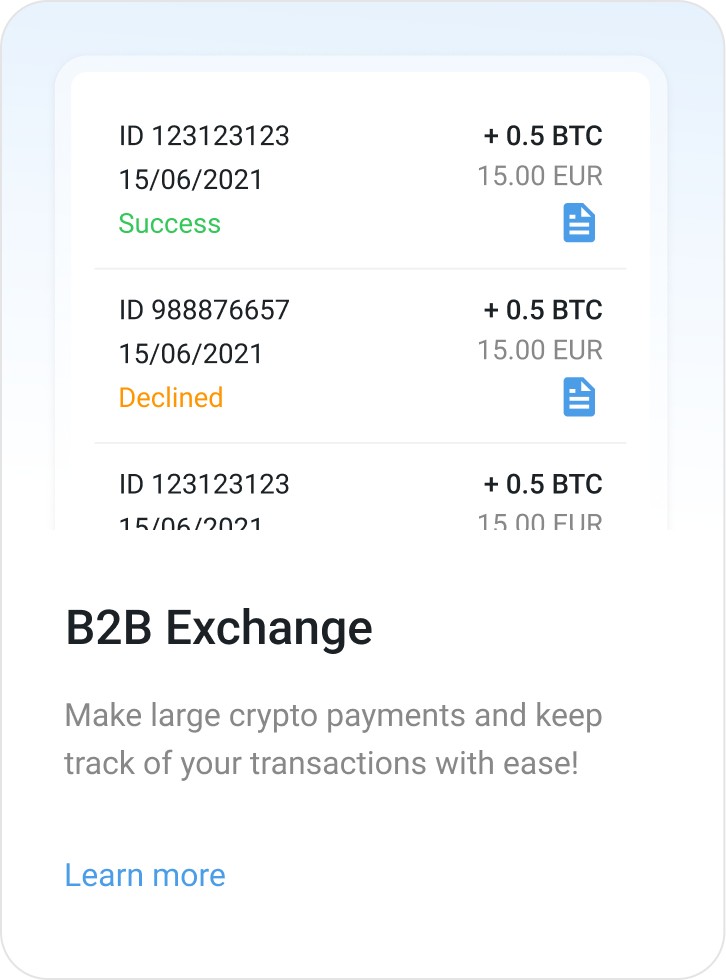

Digital currencies enable near-instantaneous transactions, improving cash flow and operational efficiency. Unlike traditional banking systems, which can take days to process payments, digital currencies allow businesses to access funds immediately. This speed is particularly advantageous for industries with frequent refunds, recurring payments, or high-volume B2B transactions.

6. Future-Proof Your Business

Digital currency adoption is growing rapidly. Many businesses already accept crypto payments, and those who integrate virtual currencies early gain a competitive edge. Using a b2b crypto exchange for transactions positions your business as innovative and forward-thinking, appealing to modern, tech-savvy clients.

7. Financial Inclusion and Flexibility

Digital currencies empower underserved populations who lack access to traditional banking. By accepting stablecoins like USDT, businesses can provide a seamless, secure payment option for unbanked or underbanked customers, increasing financial inclusivity. Additionally, stablecoins offer predictable value, reducing risks associated with volatility and allowing businesses to plan finances with confidence.

Whether through a crypto widget or a b2b crypto exchange, stablecoins provide a safe, reliable, and future-ready option for businesses in the digital economy. Embrace digital currencies today to unlock faster, cheaper, and more secure financial operations.