Blockchain technology is evolving at an unprecedented pace, and among its most innovative extensions are “blockchain oracles“.

Imagine a bridge that connects the digital world of blockchains with real-world data and events – that’s what oracles do.

Whether it’s stock prices, weather data, or any other piece of information from the outside world, oracles ensure that blockchains can access and respond to them.

As this sector grows, a multitude of oracles have surfaced in the market, each with its unique offerings. This article will demystify the world of blockchain oracles, break down their significance, and introduce you to the 7 best oracles we think are worth considering as potential investment opportunities.

What are Blockchain Oracles?

At their core, blockchain oracles, also known as decentralized oracles, serve as data feeds for blockchains. You can think of them as translators or intermediaries. Blockchains, by design, cannot directly access or recognize data outside their network. This is where oracles come into play.

Blockchain oracles bridge the digital realm of blockchains with external data sources, making it possible for smart contracts to interact with real-world information. For instance, if a smart contract is designed to execute a transaction based on tomorrow’s weather, an oracle would fetch this data from a weather service and relay it to the blockchain.

There are various types of oracles, depending on the source of information, trust level, and direction of data (from or to the blockchain). The decentralized nature of certain oracles ensures that the data they provide is trustworthy, reliable, and tamper-resistant.

Why are Blockchain Oracles Important?

In order for blockchains to be truly transformative, they must be responsive to the ever-changing real-world scenarios and data. This is where blockchain oracles become indispensable. Here are the main benefits they bring to the crypto space:

Real-World Interaction for Smart Contracts

At the heart of many blockchain platforms lie smart contracts – self-executing contracts where the terms of agreement or conditions are written into code. These contracts automate and streamline processes, but they need reliable real-world data to trigger actions. Blockchain oracles supply this data, allowing smart contracts to, for example, pay out an insurance claim after verifying a flight delay.

Enhanced Security and Trustworthiness

Decentralized oracles, source data from multiple points rather than a single source. This multiplicity ensures that the information is not only accurate but also immune to manipulation, thereby incresing the inherent trustworthiness of blockchains.

Versatility and Expanded Application

Oracles open up a world of possibilities for blockchain applications, expanding their relevance beyond mere currency transactions. With oracles, DApps (Decentralized Applications) can cater to sectors like finance, insurance, supply chain, and even entertainment, tapping into real-time data streams to create dynamic, responsive solutions.

Interconnectivity Between Different Systems

Not all systems and platforms communicate using the same language or protocols. Oracles can act as interpreters, enabling smooth communication between varied systems, ensuring that blockchain platforms can be integrated seamlessly into existing infrastructures.

Given all these important features, it’s evident that without reliable oracles, the blockchain landscape would be limited, unable to fully interact with or respond to real-world scenarios and data streams.

7 Best Blockchain Oracles to Invest In

The blockchain oracle space boasts a plethora of options for the investment. But with so many players in the field, which ones truly stand out and offer genuine potential? We’ve researched and compiled a list of what we think are the top nine oracle cryptocurrencies that have consistently show robustness, adaptability, and forward momentum. Dive in to discover your next potential investment.

1. Chainlink (LINK)

Chainlink, a pioneer among oracle networks, revolutionized the way off-chain data integrates with smart contracts, specifically on Ethereum. It has risen to prominence by not only facilitating over 1,000 project integrations but also accessing more than 1 billion data points, securing a whopping $75 billion in value across 700 oracle networks.

Serving top-tier DeFi applications like Synthetix, Aave, and Compound, Chainlink’s decentralized oracles have become the backbone of data verification for household names like AccuWeather, FedEx, and the Associated Press. With Chainlink’s imminent adoption of crypto staking, LINK holders are gearing up to fortify the network even further, marking an exciting evolution in decentralized computing.

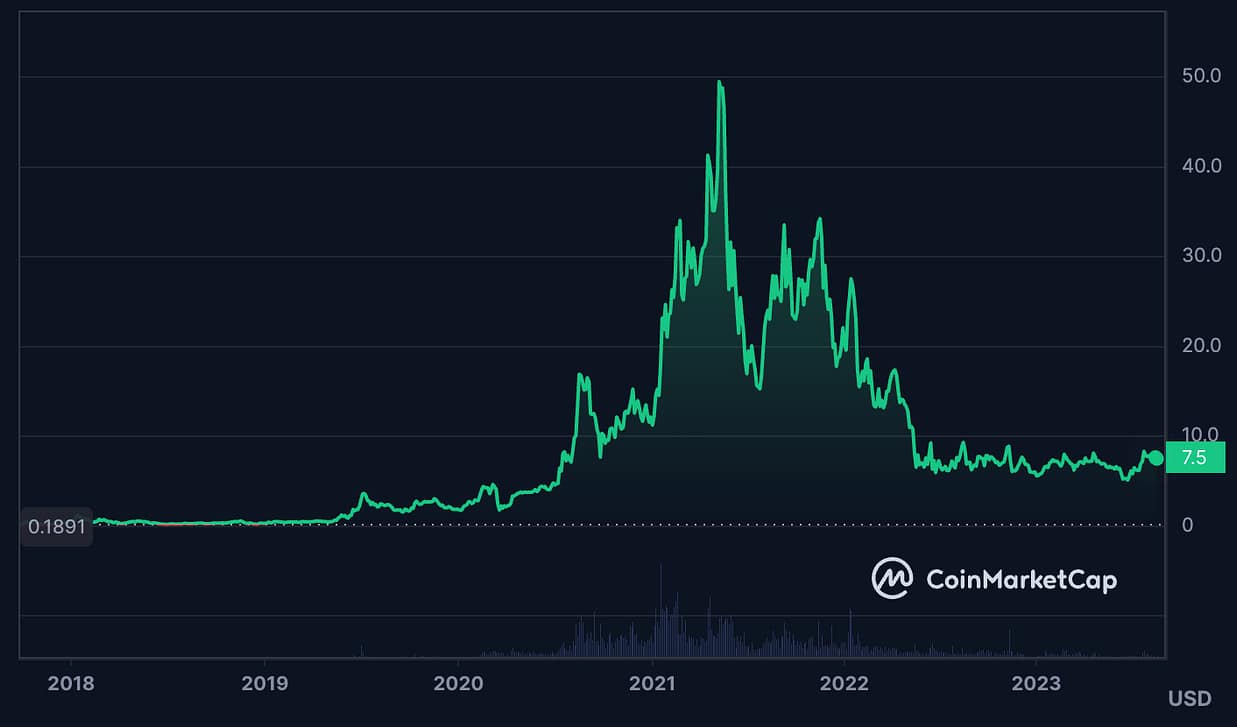

LINK Market Performance

As of August 2023, LINK has a price of $7.49. Its 24-hour trading volume has touched $169,517,574, emphasizing the high market involvement. Boasting a market capitalization of $4,032,218,010, LINK has firmly rooted itself at the 20th spot in the market rankings. Notably, its all-time high was in May 2021 with a price of $52.88.

LINK Price Predictions

Heading into the near future, DigitalCoinPrice predicts an average price of $15.60 for LINK in 2023, with potential growth to around $25.00 by 2025. Looking further into the horizon, by 2030, the average price may soar to $75.63. Meanwhile, Priceprediction.net predicts a slightly different trajectory, forecasting LINK to average at $8.50 in 2023, $18.65 by 2025, and a substantial leap to $127.99 by 2030. These predictions hint at Chainlink’s potential in the coming years, solidifying its standing in the market.

Click here to buy LINK instantly

2. Band Protocol (BAND)

Band Protocol, an integral name among blockchain oracles, operates seamlessly across the expansive Cosmos ecosystem, known for its interoperable networks. This protocol stands out for its robust data feeds for smart contracts that are integrated with BandChain, the protocol’s proprietary public blockchain.

What distinguishes Band Protocol is the process wherein validators on BandChain source data through APIs or various web origins, further disseminating this data to different entities. Thanks to the Inter-Blockchain Communication (IBC) protocol of Cosmos, Band Protocol has the capability to transmit this data across diverse blockchain networks.

However, the true essence of Band Protocol lies in its unique adaptability. Users are endowed with the power to craft custom oracle scripts, enabling them to tap into multiple external data streams from the real world. Relying on the Delegated Proof of Stake (DPoS) consensus mechanism, validators are mandated to stake the BAND token, ensuring the credibility and authenticity of the data they retrieve and validate.

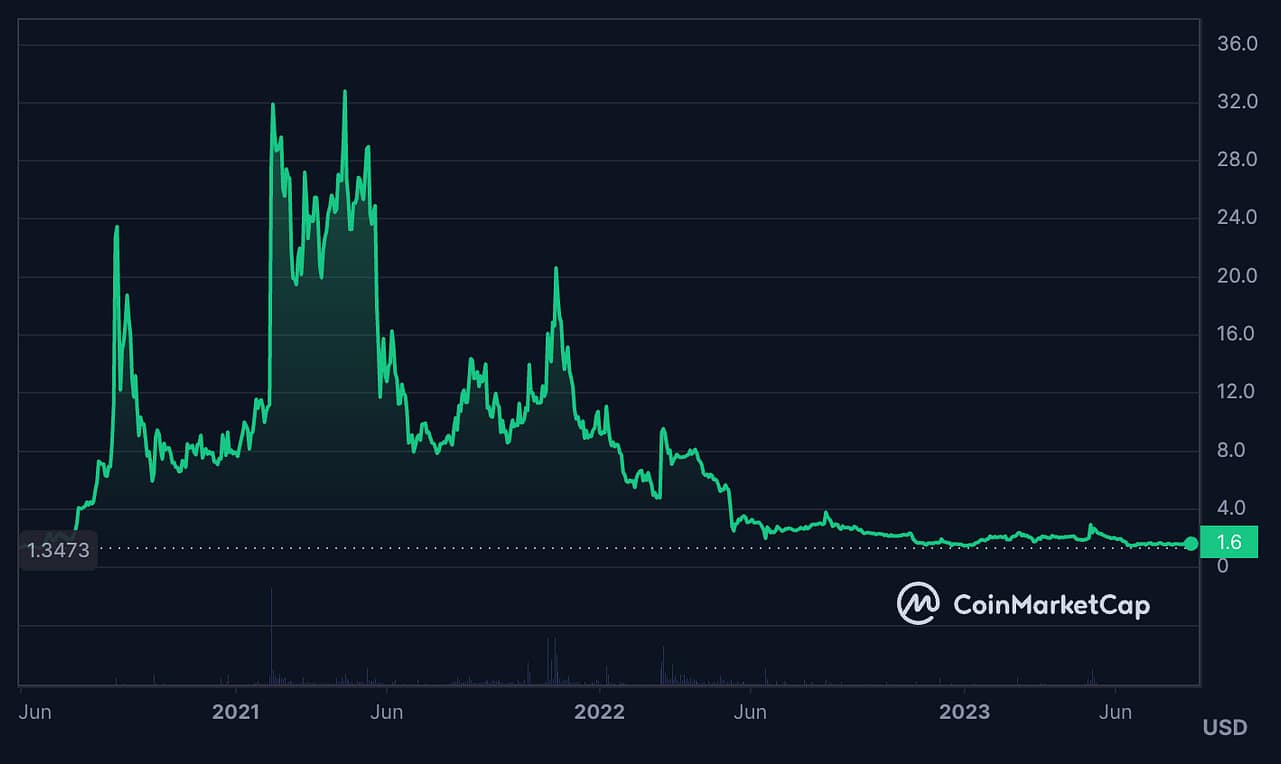

BAND Market Performance

As of August 2023, BAND‘s market price stands at $1.19. It boasts a trading volume of $6,194,542 within the last 24 hours, indicating a modest engagement level. With a market cap of $158,060,145 and a circulating supply close to its total supply at 132,945,509 BAND, Band Protocol occupies the 165th position in the market rankings. It’s important to note that its zenith was reached in April 2021, recording a price of $23.19.

BAND Price Predictions

Gazing into the crystal ball, DigitalCoinPrice predicts that by 2023 BAND could reach an average of $2.51, progressing to approximately $4.13 in 2025. The long-term vision for 2030 projects an average price close to $12.07. In a parallel perspective, Priceprediction.net‘s forecast for 2023 centers around $1.42, increasing to roughly $3.07 by 2025, and a potentially impressive ascent to around $20.24 by 2030. These figures suggest BAND’s latent potential to flourish in the forthcoming phases of the crypto marketplace.

Click here to buy BAND instantly.

3. Universal Market Access (UMA)

UMA, which means Universal Market Access, stands out as a paramount choice for developers venturing into the realm of blockchain oracles. Rooted in the Ethereum platform, UMA provides users with intuitive smart contract templates, tailored for sculpting financial smart contracts and creating synthetic assets. These synthetic financial contracts, essentially tokenized embodiments of real-world assets like derivatives, employ smart contracts to mirror the performance and pricing dynamics of their tangible counterparts. The advantage? Investors get an opportunity to delve into markets typically characterized by daunting entry barriers.

UMA’s appeal isn’t merely confined to its utility; it’s about the ease of use. UMA’s platform has been hailed for its user-centric design, presenting a commendable alternative to more complex blockchain oracles like Chainlink. By pivoting towards the digitization of established real-world financial products, UMA sets its sights on bridging the existing chasm between decentralized finance (DeFi) markets and traditional financial ecosystems. Moreover, the fact that UMA is both wholly decentralized and staunchly open-source amplifies its credibility, ensuring that data procured maintains its sanctity.

Only armed with a crypto wallet, individuals from any corner of the globe can partake. UMA’s vision is clear: to pioneer a truly global DeFi ecosystem that’s universally accessible, and with its ongoing efforts in innovating synthetic asset creation and financial contracts on blockchain, it seems well on its path.

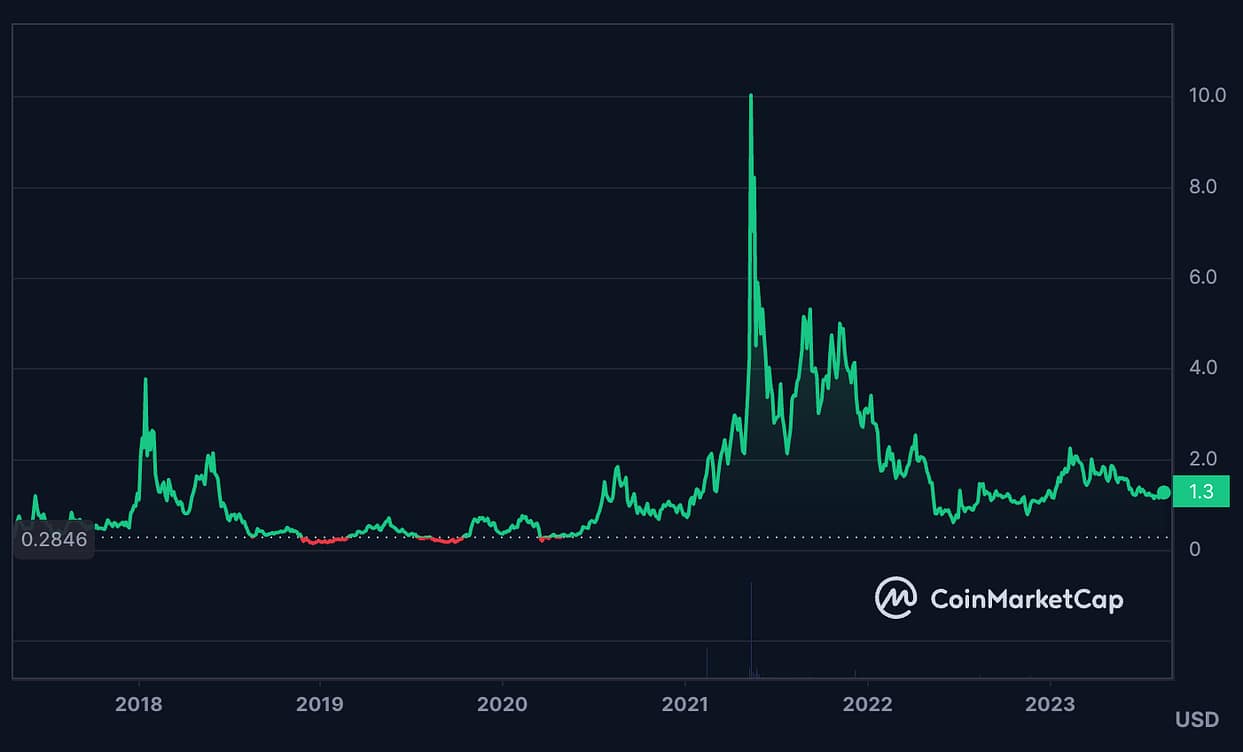

UMA Market Performance

UMA’s price in August 2023 hovers around $1.63. With a trading volume reaching $6,709,380 in the past 24 hours, it reflects a decent market engagement. Its market capitalization is marked at $119,813,384. Given that there’s a circulating supply of 73,307,390 UMA out of a total supply of 114,875,818 UMA, it sits at the 182nd position in market rankings. Notably, UMA’s all-time high was achieved in February 2021, with a remarkable price of $43.37.

UMA Price Predictions

Diving into future prospects, DigitalCoinPrice anticipates UMA‘s average price to be around $3.50 for 2023, progressing to approximately $5.62 by 2025, and projecting an average of $16.68 come 2030. On the other hand, Priceprediction.net estimates UMA’s average price for 2023 at around $1.86, with a growth to about $4.05 in 2025, and a potential climb to a substantial $25.70 by 2030. These projections underline UMA’s potential to scale and evolve in the ensuing years of the crypto domain.

Click here to buy UMA instantly.

4. iExec (RLC)

Born from a convergence of cloud computing, AI, and big data, iExec introduces a fresh perspective into the realm of blockchain oracles tailored for the DeFi sector. It pioneers a marketplace dedicated to cloud computing services, melding the conventional web2 applications with the revolutionary web3. Through its rich suite of user-friendly APIs, developers can craft custom oracles for their web3 applications. Plus, users have the unique ability to lease out their computing services without forfeiting asset ownership. The RLC token, which is integral to iExec, operates on the Ethereum blockchain, offering flexibility for storage, trading, and transactions.

RLC Market Performance

As of August 2023, RLC is trading at a price of $1.28. Over a 24-hour period, the trading volume for RLC has been recorded at $7,675,403. With a current market capitalization of $92,653,846, RLC is positioned at the 250th spot in the cryptocurrency market rankings. This is based on a circulating supply of 72,382,548 RLC out of a total supply of 86,999,785 RLC tokens. Reflecting on its past, RLC hit an all-time high price of $16.26 in May 2021.

RLC Price Predictions

For 2023, DigitalCoinPrice predicts an average RLC price of $2.34, while Priceprediction.net estimates it at $1.36. By 2025, the former anticipates it to rise to $4.57, and the latter projects an average of $2.81. Looking further ahead to 2030, DigitalCoinPrice forecasts RLC’s price to touch an average of $13.03, contrasting with Priceprediction.net’s more bullish prediction of $18.40.

Click here to buy RLC instantly.

5. XYO Network

Distinguishing itself in the realm of blockchain oracles, the XYO Network is acclaimed for its distinctive services. Operating on an Ethereum-based protocol, XYO hinges on a decentralized ensemble of anonymous gadgets. These devices source accurate geospatial details about a person or object, allowing applications to execute smart contract operations demanding location confirmation.

The operational bedrock of XYO is its proof-of-origin consensus algorithm. This algorithm harnesses ‘bound witness’ interactions to authenticate the precise whereabouts of specific entities or individuals. A deep dive into its structure reveals four pivotal components: sentinels, bridges, diviners, and archivists, each performing specialized functions:

- Sentinels act as location reporters, storing temporary heuristics solutions

- Bridges decode geospatial data and relay information from sentinels to archivists.

- Diviners serve as analytical instruments, devising solutions to intricate challenges.

- Archivists shoulder the responsibility of data storage, supplying this stored data to diviners when needed.

Furthermore, XYO is ambitiously developing a state-of-the-art data marketplace. It aspires to set the gold standard for various applications, digital platforms, and blockchain technologies contingent on verifiable data. With a goal of amplifying data certainty and trustworthiness, XYO is spearheading endeavors to empower individuals with rightful ownership of the data they generate.

XYO Market Performance

XYO‘s price as of August 2023 sits at $0.003524. With a trading volume over the past day reaching $405,639, its market capitalization amounts to $47,498,659. The token has been extensively adopted with a circulating supply of 13,476,747,692 XYO out of a total supply of 13,931,216,938 XYO, positioning it at rank #378 in the market hierarchy. Its past performance peaked in November 2021, recording an all-time high of $0.08203.

XYO Price Predictions

In the context of 2023, DigitalCoinPrice and Priceprediction.net project average price points of $0.00708 and $0.004 for XYO, respectively. Fast-forwarding to 2025, DigitalCoinPrice envisions it reaching $0.0126, while the latter forecasts $0.009. By the year 2030, DigitalCoinPrice is optimistic about XYO climbing to an average of $0.0363, contrasting with Priceprediction.net’s more bullish projection of $0.055.

Click here to buy XYO instantly.

6. DIA (DIA)

Carving a distinct niche in the blockchain oracle spectrum is DIA, also known as the Decentralized Information Asset. This open-source oracle platform was made to cater to the unique demands of the DeFi ecosystem. Anchoring its operation on crypto-economic stimuli, DIA promotes the provision, dissemination, and utilization of transparent price data, a process fortified by multi-party verification. What sets DIA apart is its ability to offer customizable data feeds. Users have the liberty to sculpt these feeds, determining the methodologies and data sources that align best with their requirements.

DIA’s commendable approach to accessibility shines through in its cost-free services. The platform’s emphasis on a collaborative, community-driven verification process for price data pertaining to both financial and digital assets instills a high degree of trust in its authenticity. Moreover, DIA’s impressive scalability ensures it remains agile, adapting seamlessly to the ever-evolving DeFi terrain. Expanding its horizon beyond just one platform, DIA extends its oracle services to an array of blockchains like Ethereum, Fantom, Solana, Avalanche and more.

DIA Market Performance

As of August 2023, DIA‘s price stands at $0.2583. The past 24 hours have seen a trading volume of $10,446,698, leading to a market capitalization of $28,572,637. With a circulating supply of 110,617,604 DIA out of its total supply of 168,817,248 DIA, the token currently holds the #497 spot in the market ranking. DIA’s historical price performance peaked in May 2021, reaching an all-time high of $5.79.

DIA Price Predictions

Delving into the 2023 forecasts, DigitalCoinPrice pegs DIA‘s average price at $0.54, while Priceprediction.net’s estimate stands slightly lower at $0.29. Fast forwarding to 2025, DigitalCoinPrice projects a rise to $0.88, with Priceprediction.net’s prediction being $0.64. By 2030, the two platforms’ predictions diverge significantly. DigitalCoinPrice is optimistic about DIA reaching $2.68, whereas Priceprediction.net paints a more bullish picture, anticipating a rise to $4.17.

Click here to buy DIA instantly.

7. Augur (REP)

Augur, with its native token REP, stands as a decentralized oracle and prediction market protocol built on the Ethereum blockchain. Enabling users to stake their REP tokens on the outcome of real-world events, Augur has garnered attention for its unique approach to harnessing crowd wisdom. The protocol facilitates the creation of prediction markets where individuals can buy or sell shares in the possible outcomes of an event. When the event concludes, the holders of the shares corresponding to the correct outcome are rewarded. REP tokens play an integral role in this ecosystem, serving as a form of staking mechanism. Token holders also have the responsibility of reporting and disputing outcomes, ensuring the accuracy and reliability of the platform.

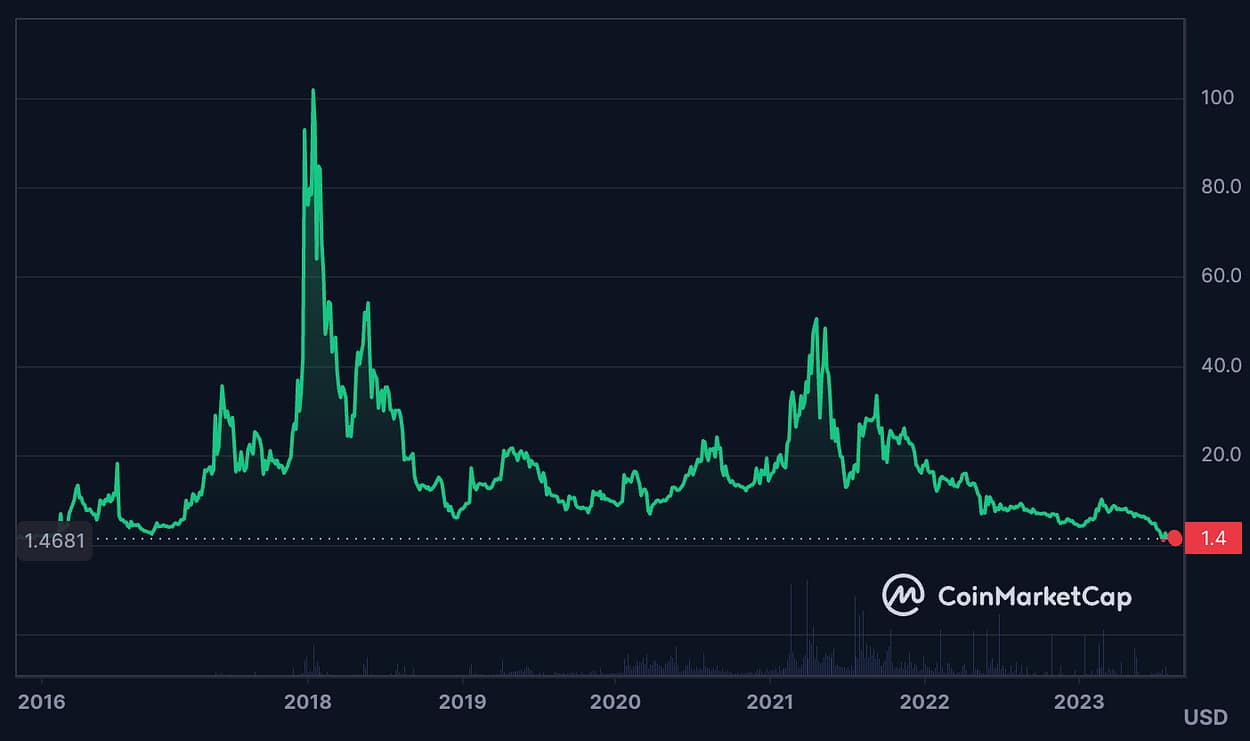

REP Market Performance

As we approach the end of August 2023, Augur’s REP is priced at $1.42. The trading volume for the last 24 hours tallies up to $1,035,431, contributing to its market capitalization of $15,596,702. Augur’s tokenomics reveal a circulating supply of 11,000,000 REP, which is also its total supply, indicating full distribution. In terms of market ranking, REP claims the #651 position. A glance at its historical price trajectory reveals a notable peak in January 2018 when REP reached an impressive all-time high of $123.24.

REP Price Predictions

Moving on to price predictions for 2023, DigitalCoinPrice and Priceprediction.net have varying forecasts. While DigitalCoinPrice predicts an average price of $2.52 for REP, Priceprediction.net expects it to hover around $1.97. Advancing to 2025, DigitalCoinPrice envisions REP climbing to $4.82, whereas Priceprediction.net offers a slightly more conservative estimate of $4.24. Fast forwarding to the year 2030, DigitalCoinPrice’s prediction stands at $14.54, a figure considerably overshadowed by Priceprediction.net’s bullish forecast of $28.84 for REP.

Click here to buy REP instantly.

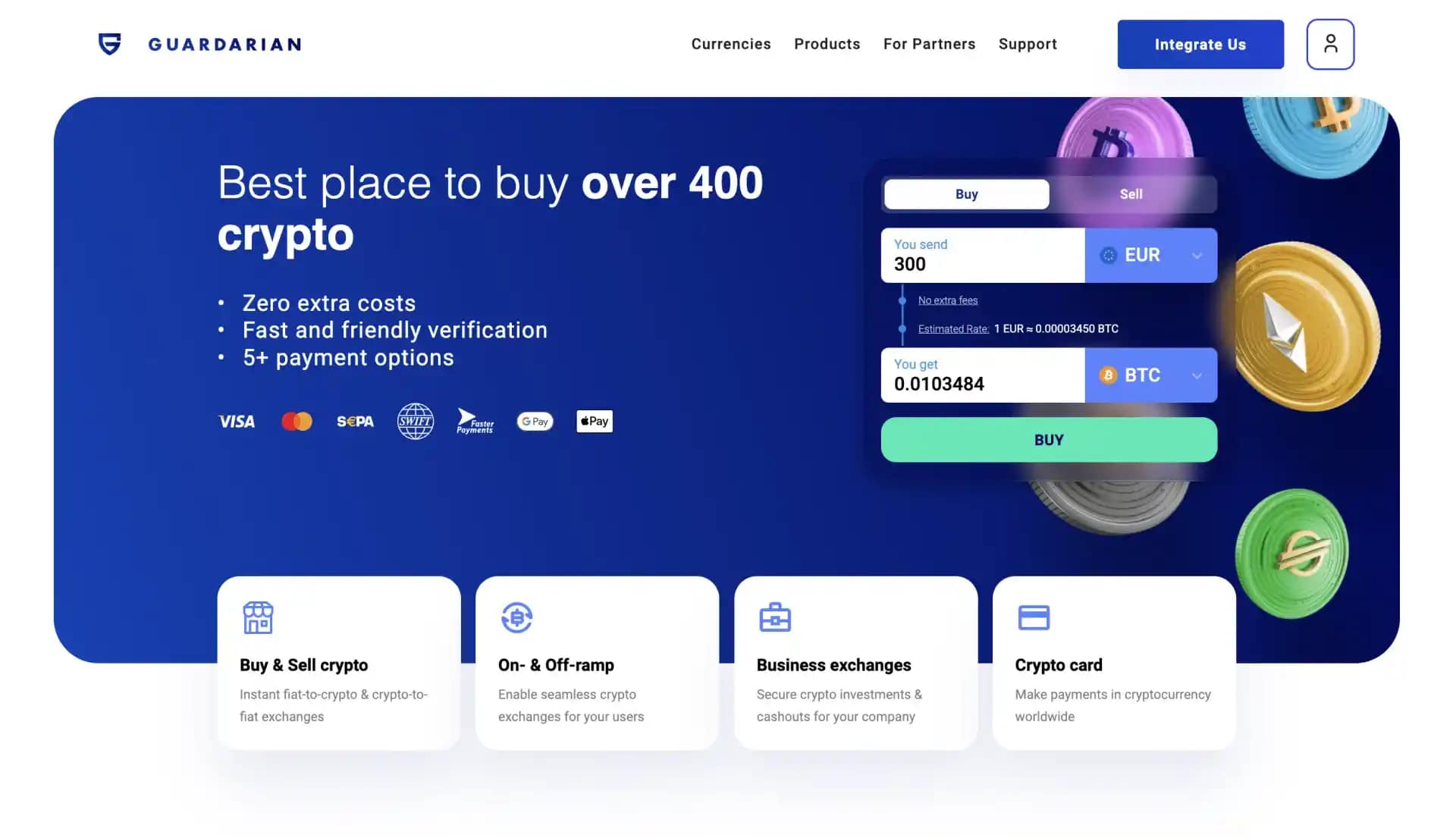

How to Invest in Blockchain Oracles Instantly with Guardarian

Thinking about investing into one of the blockchain oracles? Guardarian makes it seamless. Buy & sell over 400 different cryptos instantly, without registration and at the best rates possible.

Follow these easy steps and start your oracle investment journey:

- Go to www.guardarian.com. From the dropdown menu, pick the cryptocurrency of your choice.

- Choose your payment currency and the investment amount. Once set, hit the “Buy” button.

- Provide your crypto wallet address and select from the list of payment methods.

- Complete our quick and intuitive checkout process.

- Check your wallet – in just a few moments, your assets will be deposited.

With Guardarian, investing in blockchain oracles is not only efficient but also user-centric, giving you the benefit of minimal fees and smooth transactions. Visit our website and dive into the world of blockchain oracles with confidence!

Or start right here ⬇️

Conclusion

Blockchain oracles have emerged as pivotal bridges, connecting blockchains to real-world data and ensuring a more integrated and dynamic digital ecosystem. As we’ve explored in this article, their role in enhancing the capabilities of blockchain systems is profound, driving innovation and expanding potential applications.

For those keen on stepping into the oracle investment landscape, platforms like Guardarian offer a streamlined approach. While the world of blockchain oracles is evolving, having a reliable gateway can make the journey both accessible and efficient.

The information provided in this content is for informational purposes only and should not be considered as financial or investment advice. Always DYOR and consult with a trained professional before making any investment decisions.