Stablecoins are like the steady hand in the world of cryptocurrency. While Bitcoin and Ethereum can see massive price swings, stablecoins are pegged to stable assets like the US dollar, euro, or even gold. This makes them perfect for everyday transactions, savings, and global payments. But why exactly are they becoming so popular?

A Quick Look at the Most Trusted Stablecoins

Several stablecoins have earned trust and widespread use, and they’re leading the charge in the market:

- USDT (Tether) & USDC (Circle) – The dollar-backed giants.

- DAI (MakerDAO) – A decentralized alternative for more control.

- PYUSD (PayPal) – A bridge between traditional finance and crypto.

- EURR, USDR, USDQ, EURQ – Expanding options with euro and dollar-pegged choices, now available on Guardarian.

These stablecoins offer the best of both worlds: the speed and borderless nature of crypto with the stability of traditional money, that’s why in 2024, stablecoins processed $27.6 trillion in transactions—more than Visa and Mastercard combined. Their market cap is rapidly approaching $200 billion, and for good reason: they address real financial problems and offer reliable solutions in an ever-changing financial landscape.

How Stablecoin Issuers Make Money

Wondering how issuers of stablecoins like Tether and USDC make money? Here’s how it works:

- You buy stablecoins (e.g., $100 USDC).

- The issuer holds that money in secure reserves, often in U.S. Treasuries.

- They earn 5%+ annual interest on those reserves.

With minimal overhead and no need for bank branches, the profits soar. For example, Tether made $13 billion in 2024— more than Goldman Sachs, with a fraction of the costs.

Where Stablecoins Are Making a Real Difference

- Cheaper Cross-Border Payments: traditional remittance services charge 2-3% per transfer. Stablecoins? Less than a cent, and done in minutes. This is changing the game for international money transfers.

- Freelancers & Global Commerce: From remote workers to global import/export businesses, stablecoins are becoming the go-to solution for fast, low-fee payments across borders.

- Africa: A Stablecoin Success Story: In countries like Nigeria and South Africa, where local currencies are volatile, stablecoins like USDT and USDC help people protect savings and facilitate global trade. In 2023, 43% of Africa’s crypto volume came from stablecoins—surpassing Bitcoin and Ethereum.

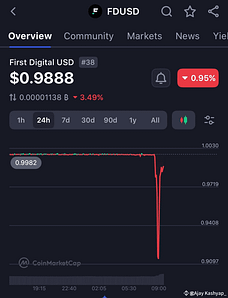

⚠️ When Stablecoins Fail: The $FDUSD Depegging Drama

Not all stablecoins are bulletproof.

What went wrong?

- Lack of real-time reserve transparency

- Market panic triggering a sell-off

- Slow issuer response

This is a reminder that not all stablecoins are created equal.

How to Pick the Right Stablecoin

Price stability is just the start. If you’re considering using stablecoins seriously, here’s what you should ask before buying:

✅ Are reserves audited and transparent? (Look for S&P Global or Bluechip ratings)

✅ Are they backed by safe, low-risk assets (like U.S. Treasuries)?

✅ Are they widely accepted in DeFi and exchanges?

✅ Does the coin maintain its peg during market turbulence?

Choosing a stablecoin with solid backing means less risk and fewer headaches.

Ready to dive into the world of stablecoins? Guardarian offers a seamless way to buy, sell, swap stablecoins with over 50+ fiat currencies and 8 local payment methods. Low fees, low KYC. Click here to start!