By 2026, choosing a fiat-to-crypto on-ramp is no longer about “does it support Bitcoin?” Almost all of them do. The real questions are much more boring — and much more important.

- How much crypto do you actually get in the end?

- When does KYC suddenly kick in?

- How often does a “2-minute purchase” turn into a 40-minute headache?

Guardarian and MoonPay are both well-known fiat-to-crypto on-ramps. But they solve these problems in very different ways. This Guardarian vs MoonPay comparison in 2026 looks at fees, KYC requirements, limits, payment methods, and real transaction speed to help you choose the right fiat-to-crypto on-ramp.

Below is a practical, no-fluff comparison based on how these platforms behave in real life.

Key Takeaways

Short version:

-

Guardarian is built around a simpler flow with fewer steps and faster setup. This makes it suitable for everyday users and smaller businesses that need a quick integration without complex configuration.

-

MoonPay follows a more structured integration model. It requires more setup and configuration, but offers clearly defined processes, detailed documentation, and predictable behavior, which is often important for larger businesses.

Neither approach is objectively better. It depends on what annoys you more: friction or structure.

Quick Comparison: Guardarian vs MoonPay at a Glance

This table gives a quick side-by-side look at Guardarian and MoonPay. Both let you buy crypto with fiat, but they differ in fees, KYC requirements, supported countries, and how fast you actually receive your funds. Use it to get a general idea first — we’ll go into the details and edge cases below.

| Feature | Guardarian | MoonPay |

| Fee model | Fees included in the final rate | Separate transaction & network fees |

| Payment methods | Visa, Mastercard SEPA, local transfers Apple Pay, Google Pay PIX, SPEI, Open Banking (depends on region) |

Visa, Mastercard, Maestro SEPA, Faster Payments, ACH Apple Pay, Google Pay PayPal, Venmo, Revolut, PIX (depends on region and bank) |

| KYC | Sometimes simplified for small amounts | Commonly required |

| Exchange speed | Usually minutes | Minutes to hours |

| Refunds | Very limited after sending crypto | Very limited after sending crypto |

| Business integration | Widget, API, B2B Exchanges, G-Payments, Custody & OTC, Partner support tools Simple integration |

API & SDK, on- & off-ramps, NFT Checkout, MoonPay Commerce, Partner tools |

What Are Guardarian and MoonPay?

Guardarian overview

Guardarian is a fiat on-ramp built around a simple idea: buy crypto quickly, without turning the process into a fintech onboarding flow.

You don’t need to create a full account just to make a purchase. You see a rate, you pay, you receive crypto. That’s the pitch.

Another key point is pricing. Guardarian shows you a final rate upfront, with fees already included. There are no extra line items popping up at the last step. For many users, that alone removes a lot of friction.

Guardarian also markets speed. In normal conditions, crypto is delivered within minutes. When things slow down, it’s usually because of banks or compliance — not because the system itself is slow.

MoonPay overview

MoonPay sits on the other end of the spectrum as a regulated fiat-to-crypto on-ramp

It’s one of the most widely integrated on-ramps in the industry. Large wallets, exchanges, and NFT platforms use it for a reason: it behaves like a regulated fintech product.

MoonPay’s flow is more structured. Accounts, verification steps, clear states, and very detailed documentation. For end users, this can feel more complicated. For businesses and compliance teams, it’s exactly what they want.

Feature-by-Feature Breakdown

Below, we break down Guardarian and MoonPay feature by feature. Instead of general claims, we focus on how each service handles fees, payments, KYC, delivery, and edge cases in real-world use. This makes it easier to see where the differences actually matter.

Fees & Final Rate Transparency

When comparing Guardarian vs MoonPay fees, the main difference is how transparent the final rate is for users buying crypto with fiat.

With Guardarian, what you see is what you get. You don’t need to calculate anything. You just decide whether the final amount looks fair. Guardarian’s approach to fees is simpler and more transparent than many other platforms, ensuring that what you see is exactly what you get with no hidden surprises.

MoonPay fees have a more traditional approach, with separate transaction and network costs. Fees are broken down into components: transaction fee, network fee, and sometimes a partner or ecosystem fee. This approach can be more mentally taxing, especially for beginners who just want to buy €50 worth of crypto and move on.

Payment Methods

On paper, both platforms look similar. In practice, details matter.

- Guardarian supports cards, Apple Pay, Google Pay, SEPA transfers, and a number of local payment methods like PIX or SPEI. This makes it surprisingly flexible outside of the EU and US.

- MoonPay payment methods include cards and Apple Pay, though availability often depends on your bank. For bank transfers, MoonPay supports SEPA, Faster Payments in the UK, and ACH in the US.

One important reality check: card failures are not rare on either platform. Issuer blocks, 3DS issues, and crypto restrictions are still a thing in 2026. This is not a Guardarian or MoonPay problem — it’s a banking problem.

Supported Countries & Fiat Currencies

Guardarian takes a flexible approach. Instead of a simple “supported / not supported” list, it shows which payment methods work in which countries. This is powerful, but it requires attention.

MoonPay is stricter and clearer. It publishes a list of unsupported countries. If you’re on that list, the answer is simply “no”.

MoonPay’s approach is a bit more straightforward. Guardarian’s approach gives you more options — if you’re willing to check the details.

KYC / Compliance

KYC requirements are one of the biggest differences in the Guardarian vs MoonPay comparison, especially for small purchases.

Guardarian mentions a Low-KYC flow for transactions under €700, which means you can make quicker purchases without dealing with the lengthy verification process common on other platforms. In most cases it works exactly as advertised. However, sometimes KYC still triggers. Region, payment method, and risk signals all matter.

MoonPay KYC is far more predictable and usually required upfront. Verification is usually part of the flow, especially for new users or when MoonPay limits are exceeded. You know upfront that MoonPay verification will be required.

In short:

- Guardarian offers flexibility, but no guarantees.

- MoonPay offers guarantees, but fewer shortcuts.

Supported Crypto Assets & Networks

Both platforms allow users to buy crypto with a card or bank transfer, but the available payment methods and success rates differ by region.

Guardarian advertises support for over 1000 assets and multiple networks for major coins. This is useful if you actively move funds across chains.

MoonPay also supports many assets, but availability can depend on local regulations.

One thing both platforms are very clear about: sending crypto to the wrong address or network is irreversible. No support ticket will save you there.

UX & Ease of Use

(Source: Guardarian)

Guardarian feels like a fast exchange. Minimal steps. Minimal friction. You’re in and out.

(Source: MoonPay)

MoonPay feels like a fintech app. Structured screens. Clear states. More steps — but also fewer surprises.

Some users prefer speed. Others prefer clarity. This is mostly a personal preference.

Delivery & Settlement

In terms of crypto on-ramp speed, both Guardarian and MoonPay aim for fast delivery, but real-world timing depends on banks, compliance, and blockchain conditions.

Guardarian usually delivers crypto within minutes after payment approval. When it doesn’t, the delay is almost always caused by compliance checks or blockchain congestion.

MoonPay explains how long transactions take more formally, especially for verified users. Verified users with card payments usually get crypto quickly, but delays can happen — especially during peak network activity.

Neither platform can fully control banks or blockchains.

Refunds, Chargebacks & Disputes

Here’s the uncomfortable truth: crypto is unforgiving. Once crypto is sent to your wallet, both platforms treat the transaction as final. No cancellations. No reversals. No “oops” button.

Both Guardarian and MoonPay refunds only apply if the payment fails before crypto is delivered. After that, the funds are effectively gone. However, Guardarian is clear about its refund policy, ensuring no unexpected charges or cancellations after a transaction is made.

Customer Support

Guardarian provides instant live support during exchanges and a rich knowledge base, which helps ensure your questions are addressed quickly without waiting for long response times. As an alternative, the platform can be contacted via email support.

MoonPay offers a help center and live chat, which can be reassuring when a payment is stuck or verification fails.

Security Measures & Trust

Both platforms operate under strict compliance requirements and clearly communicate the risks of crypto transactions.

- Guardarian is a regulated service, following standard checks to keep things safe. It sometimes blocks transactions if something looks off, but it’s for security. Once you send crypto, it’s gone — no refunds.

- MoonPay really pushes safety and warns users about scams and fake support accounts. They’re clear that once you send crypto, it’s final, and they do checks to catch fraud — even if you don’t always notice them.

For Business: Integrations

Guardarian for partners

Guardarian offers businesses simple tools like widgets and APIs to easily accept crypto payments. They also provide B2B solutions for seamless integration into your platform. With live support and a knowledge base, getting started is quick and straightforward—no heavy compliance hassle. It’s a flexible option for companies of any size.

Guardarian’s business integrations are designed to be fast and simple, with easy access to live support and a comprehensive knowledge base to help you get started without delays.

MoonPay for developers

MoonPay provides a mature B2B stack: widget, SDK, API, and extensive documentation. It is built for more complex business integrations, making it a great fit for larger platforms with strict compliance needs.

However, for regular users looking for a quick and easy experience, its detailed processes and verification steps might feel a bit too much. It’s better suited for businesses than casual crypto buyers.

Pros & Cons Summary

To make things easier, we’ve summarized the main pros and cons of Guardarian and MoonPay below. This isn’t about declaring a “winner”, but about clearly showing the trade-offs each platform comes with.

Guardarian — pros & cons

| Pros | Cons |

| Simple checkout | Less transparent fee breakdown |

| Final rate shown upfront | KYC triggers can feel unpredictable |

| Possible Low-KYC for small purchases | |

| Flexible regional coverage | |

| Live support and knowledge base |

MoonPay — pros & cons

| Pros | Cons |

| Clear rules and documentation | KYC is unavoidable |

| Strong compliance and bank trust | More steps in the flow |

| Enterprise-grade integrations | Fees feel less clear |

| Live support available |

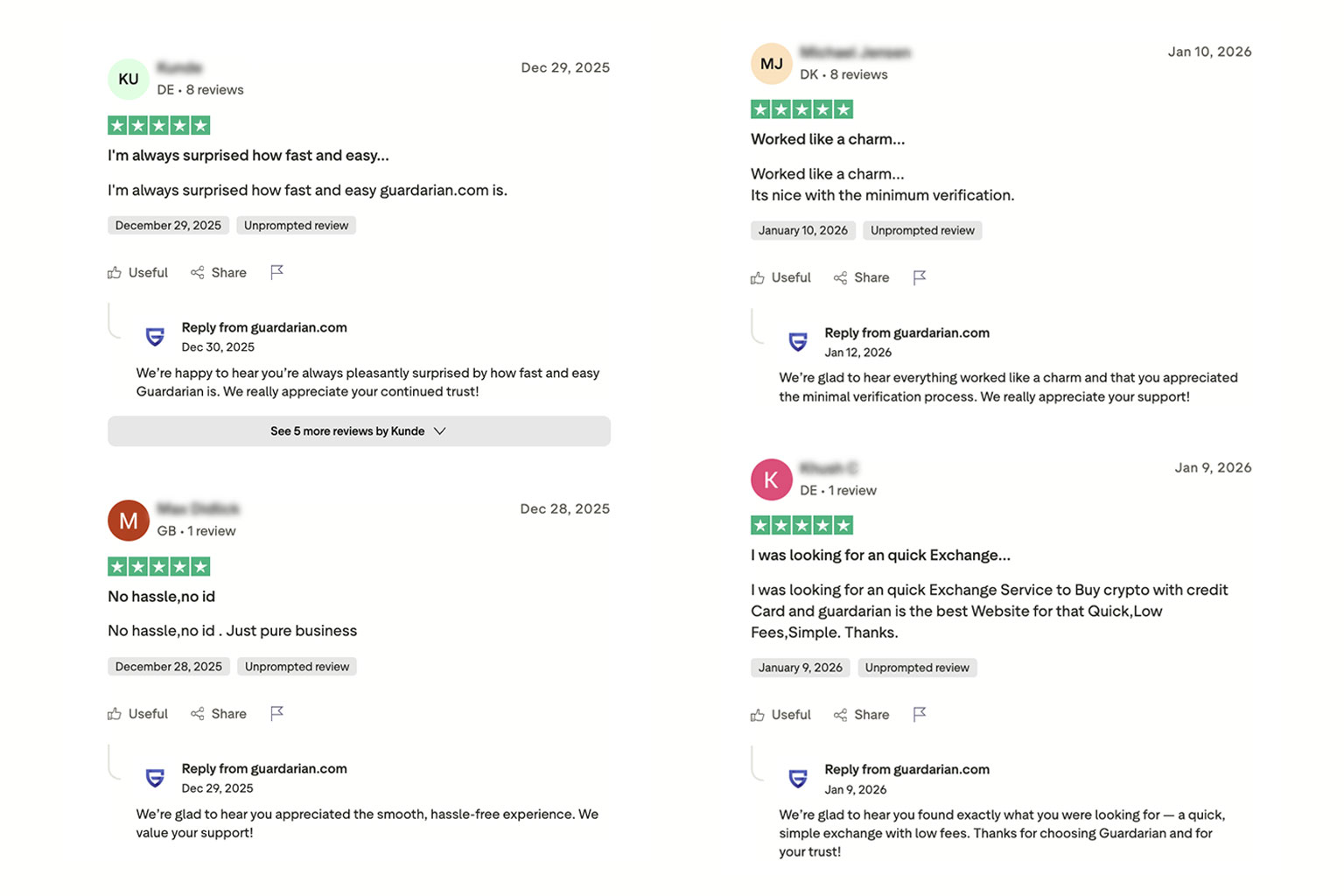

Real User Opinions: What the Community Says

Reviews of Guardarian

(Source: Trustpilot)

Most people refer to Guardarian as simple and fast. You pick a coin, pay, and usually get your crypto without extra hassle.

- A lot of users like that you don’t need a full exchange account — no trading dashboards, no overload.

- Fees are often described as okay and predictable due to the “No extra fees” system, not perfect, but not shocking either.

- Support replies quickly, especially when someone leaves a public complaint.

- Some users say that verification, when it happens, is quick and doesn’t turn into a long bureaucratic mess.

Don’t forget to share your experience with Guardarian on Trustpilot. Many users appreciate the simplicity and speed of Guardarian, and your review can help others

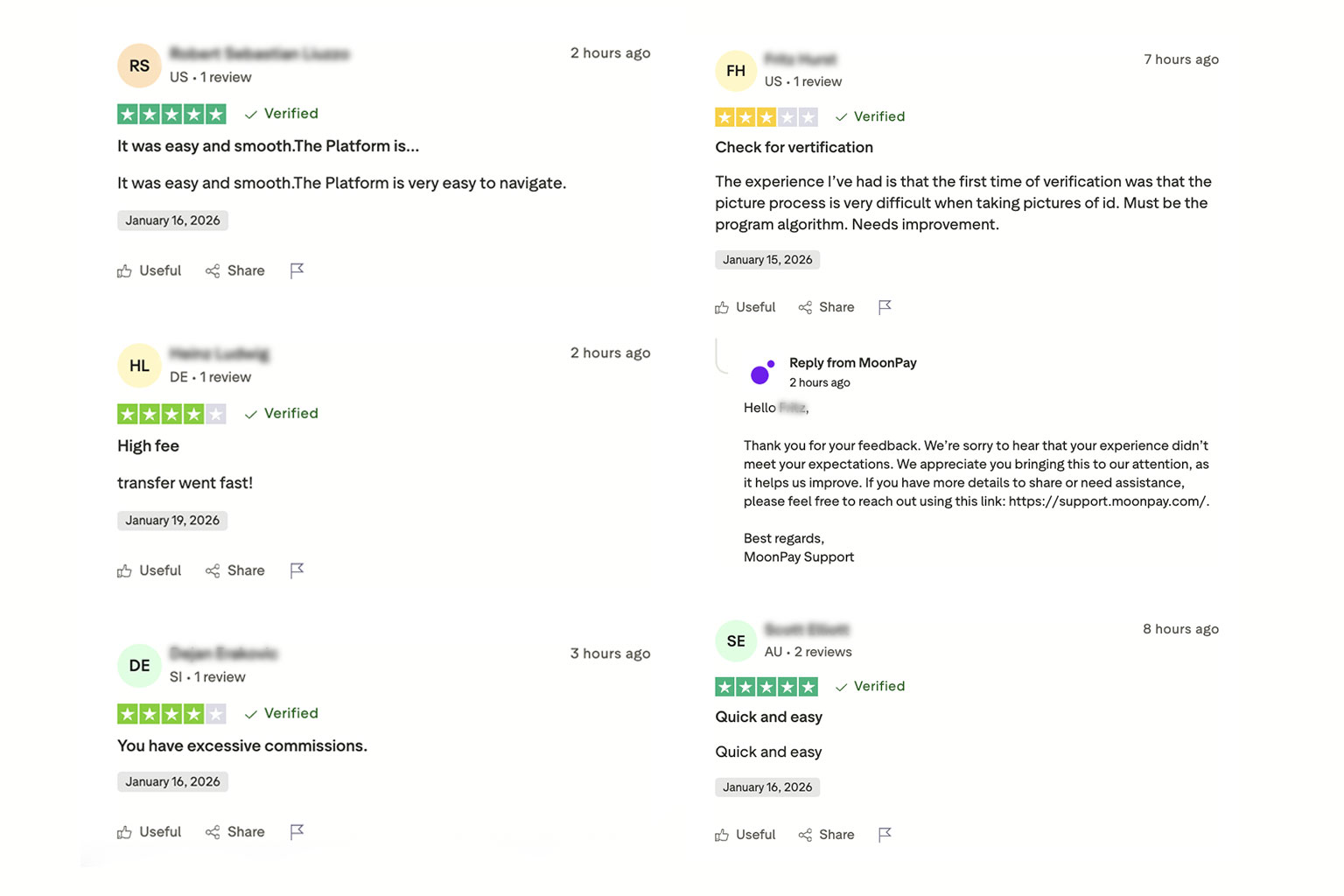

Reviews of MoonPay

(Source: Trustpilot)

Some people say MoonPay is also easy and fast to use — you pick a coin, pay, and usually get the crypto quickly without confusing menus. Support replies to most complaints and tries to help within a day.

- The biggest complaint is fees — many say buying through MoonPay ends up expensive or less clear than expected.

- Some users report delays or issues with transactions — like funds not arriving or purchases getting cancelled without clear notice.

- There are reviews where people feel scammed or lost money — sometimes due to external fraud, sometimes because they couldn’t access the crypto they bought.

- A few talk about support being slow or not helpful enough in tricky situations.

Which Should You Choose?

At this point, the choice comes down to your use case. Guardarian and MoonPay are among the most popular fiat-to-crypto on-ramps in 2026. While both let users buy crypto with cards or bank transfers, their approach to fees, KYC, and transaction flow is fundamentally different.

Below, we’ll break it down simply so you can see which option makes more sense for you.

Choose Guardarian if…

You value speed, simplicity, and a clear final rate, and you’re making smaller or occasional purchases. Since Guardarian’s streamlined process means fewer steps and faster transactions, it is ideal for those who want to buy crypto quickly and with minimal effort.

Choose MoonPay if…

By now, the differences between Guardarian and MoonPay should be fairly clear. Both platforms do their job, just in different ways. If you know what matters most to you — speed, predictability, fees, or compliance — the right choice usually becomes obvious.

FAQ

Is Guardarian/MoonPay available in my country?

It depends on local regulations and payment methods. Guardarian requires checking payment-method availability. MoonPay lists unsupported regions.

What payment methods work best for the lowest total cost?

Bank transfers are usually cheaper than cards or Apple Pay. But always compare the final amount you receive — not just the fee percentage.

Why did my card purchase fail?

Common reasons include bank crypto restrictions, 3DS failures, issuer limits, or fraud filters. This affects the entire industry.

When does KYC kick in?

Guardarian may allow Low-KYC for small transactions, but it’s not guaranteed. MoonPay usually requires KYC, especially for new users.

How long does delivery take and what causes delays?

Minutes in ideal conditions. Longer when banks, compliance, or networks slow things down.

Can I cancel or get a refund?

Only if the payment fails before the crypto is sent. Once crypto is delivered, transactions are final.

How We Compared Guardarian vs MoonPay

To keep this comparison practical, we focused on things that actually matter in real use — fees, payment methods, KYC triggers, delivery speed, and regional availability.

We based the analysis on official documentation, support articles, and how these on-ramps behave in real purchase flows. Wherever possible, we used primary sources and applied the same criteria to both platforms.