The digital finance ecosystem of 2026 has witnessed a profound transformation in how enterprises view and integrate cryptocurrency payment rails. For a modern business, choosing between fiat-to-crypto gateways like Guardarian and Transak is no longer a peripheral technical decision but a core strategic choice that influences user acquisition, global reach, and operational overhead.

As the industry moves toward high-throughput Layer-2 networks and stablecoin-centric settlement models, the distinction between a “boutique,” agile partner and a “large-scale,” institutional infrastructure provider becomes the primary axis of comparison.

Key Takeaways

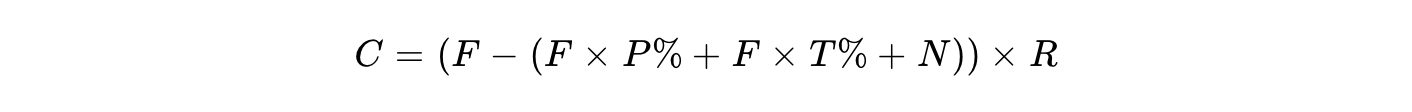

- Asset Support: Guardarian leads the market with 1,000+ supported tokens across various networks, while Transak maintains a curated list of approximately 136 assets.

- Integration Speed: Guardarian allows businesses to go live in roughly 10 minutes via a customizable widget; Transak typically follows a longer, enterprise-level SDK integration cycle.

- Pricing Transparency: Guardarian uses a single all-in rate to prevent “sticker shock,” whereas Transak employs a complex formula involving separate transaction, network, and partner fees.

- Support Model: Guardarian provides a boutique experience with its business support for every partner, contrasting with Transak’s primarily automated, ticket-based support.

Guardarian vs Transak: Which on-ramp is better?

Determining the superior on-ramp requires a nuanced understanding of a company’s specific “friction tolerance” and its desired “time-to-market.”

| Feature | Guardarian | Transak |

| Core Philosophy | Agility and user conversion; treats onboarding friction as the “enemy.” | Institutional stability: focuses on a deeply embedded, white-label experience. |

| Ideal For | Startups and mid-sized platforms needing fast time-to-market. | Large-scale entities like MetaMask seeking a consistent brand feel. |

| Integration Style | 10-minute setup via a functional widget with personal support. | Significant development commitment using a “corporate-heavy” SDK. |

| User Experience | Frictionless “no-account” swaps and simplified KYC verification paths. | Rigid, multi-level KYC and mandatory account creation. |

Guardarian overview

Guardarian is an industry-leading fiat-to-crypto exchange service that has bridged the traditional and digital financial worlds since 2017. Headquartered in the European Union and operating under strict compliance standards, the platform is optimized for non-custodial exchanges, meaning it does not hold user funds, thereby reducing counterparty risk.

Its business-facing solution, Guardarian for Business, is trusted by over 400 clients and offers a suite of tools including customizable widgets, REST APIs, and the G-Payments solution for seamless fiat-crypto settlement.

The core of the Guardarian experience is “speed and simplicity,” catering to users who want to acquire assets without the cognitive load of a complex fintech dashboard.

Transak overview

Transak is a global Web3 infrastructure provider that specializes in connecting fiat payment methods to decentralized application (dApp) environments. Registered in major jurisdictions including the USA, UK, EU, and Australia, Transak provides highly regulated payment rails designed to onboard the next “billion users” to Web3.

Its product suite focuses heavily on embedded checkout flows, NFT purchases, and B2B stablecoin payouts. Transak is a venture-backed entity, having raised approximately $20 million to expand its global footprint, and is integrated into some of the most prominent wallets and decentralized finance (DeFi) protocols in the industry.

What are Guardarian and Transak: Crypto payment solutions

In the contemporary fintech landscape, these platforms function as the “connective tissue” between the legacy banking system and the burgeoning on-chain economy. They provide the infrastructure that allows a business to accept fiat payments (USD, EUR, GBP) and settle them in digital assets (BTC, ETH, USDC) or vice versa.

For a business client, these solutions act as a “compliance-as-a-service” layer. Instead of a merchant having to build a global network of banking relationships and develop an internal KYC/AML department, they can simply “plug in” to the API of Guardarian or Transak.

This effectively offloads the regulatory burden, fraud monitoring, and liquidity management to the provider, allowing the merchant to focus on their core product offering, whether that is an e-commerce platform, a gaming application, or a cross-border remittance service.

Business features breakdown: Guardarian vs Transak

A successful business integration depends on the technical synergy between the payment provider and the host application. While both companies offer similar end-goals, their methods of delivery differ significantly in terms of development effort and operational flexibility.

Integration & Settlement

- Guardarian’s integration philosophy is centered on the concept of “zero setup cost” and rapid deployment. Their customizable widget is designed for non-technical users to implement via an iframe in roughly ten minutes.

For developers seeking a custom user interface without the technical debt of a full SDK, Guardarian provides a lightweight, non-custodial REST API. This is particularly advantageous for businesses that want to maintain a unique checkout feel while offloading the backend transaction logic to a specialist.

Settlement via the G-Payments solution is immediate, allowing businesses to receive funds directly into their crypto wallets or bank accounts as soon as the transaction is finalized on the blockchain.

- Transak’s integration is more documentation-heavy and often requires a more intensive development cycle. They offer SDKs for web and mobile platforms, which facilitate deeply embedded, white-labeled payment flows.

While this allows for a “seamless” feel, it necessitates a multi-step onboarding process for the business, including a full Know Your Business (KYB) review before production API keys are issued.

Transak’s settlement options are increasingly focused on stablecoins, providing businesses with a “stablecoin playbook” for 2026 that includes cross-border B2B payments, corporate treasury management, and automated payroll.

Fees & Final rate transparency

Fee transparency is perhaps the most significant “conversion driver” in the crypto payment industry.

- Guardarian utilizes a single, “all-in” rate transparency model. In this system, the user is presented with a final amount of cryptocurrency they will receive for their fiat input. There are no hidden network fees, transaction charges, or partner spreads added at the last moment of the checkout process.

This psychological advantage is critical for reducing “sticker shock,” which is a leading cause of user abandonment in fintech flows.

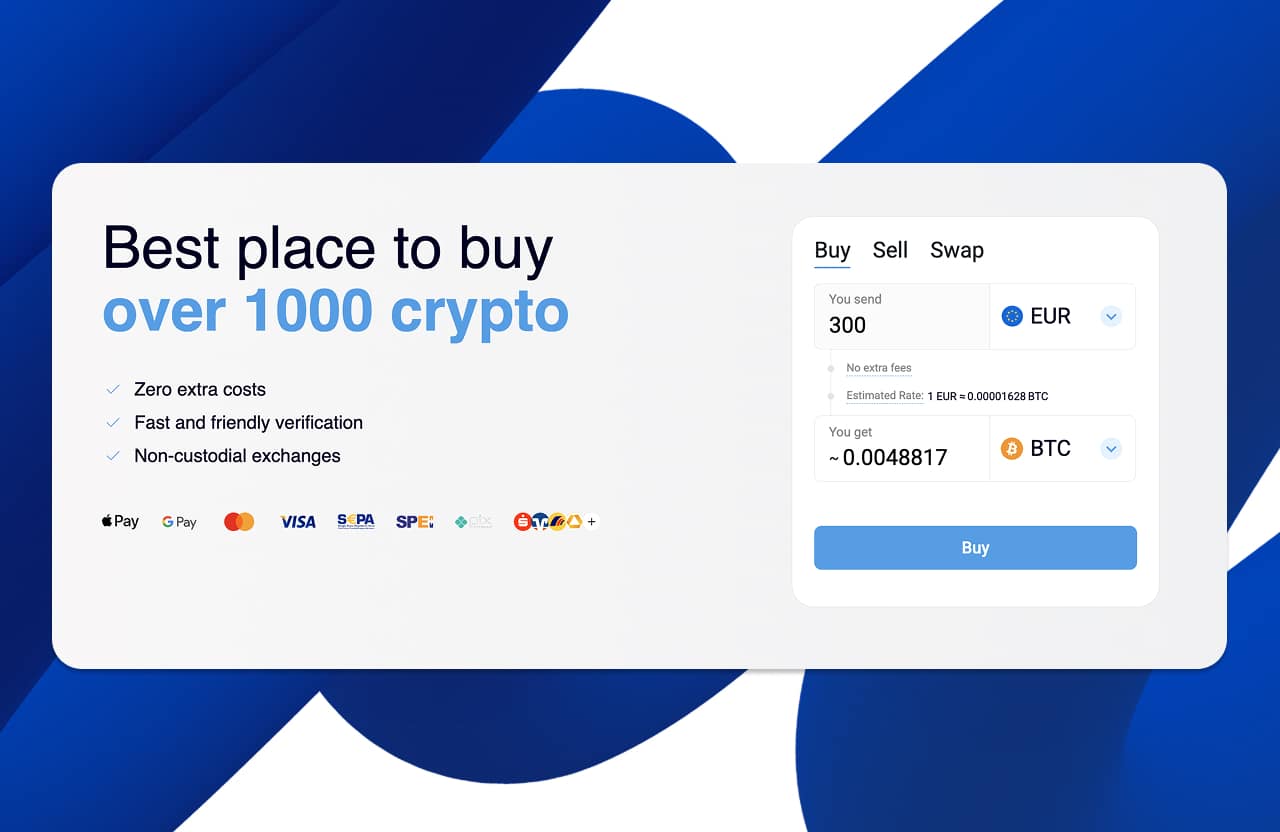

- Transak’s fee structure is more granular and, consequently, more complex for the end-user to parse. The final amount of cryptocurrency received (C) is calculated via a specific formula that accounts for multiple variables:

Where:

- F is the initial fiat amount.

- P is the partner fee (configurable by the business).

- T is the Transak fee (based on the payment method).

- N is the network/gas fee (set by the market).

- R is the exchange rate (sourced from multiple liquidity providers).

While this breakdown is technically transparent, it often leads to situations where the user receives less crypto than they initially anticipated because network gas prices fluctuate or bank processing fees were higher than the initial estimate.

For a business, the Guardarian “all-in” model is often the safer bet for maintaining a high conversion funnel.

| Fee Component | Guardarian Model | Transak Model |

|---|---|---|

| Transaction Fee | Included in final rate | 0.99% to 4.5% (Variable) |

| Network (Gas) Fee | Included in final rate | Separate, market-driven |

| Partner Fee | Custom/Included | Configurable (Added on top) |

| Visibility | Upfront & Guaranteed | Breakdown at final step |

Here are the detailed Transak exchange fees:

| Payment Method | Supported Fiat Currencies | Transak Fee | Minimal Amount |

| Credit/Debit Card | AUD, BHD, BMD, BRL, CAD, CHF, CZK, DKK, EUR, GBP, GEL, HKD, HUF, ILS, INR, ISK, KWD, MXN, MYR, NOK, NZD, PHP, PLN, RON, RSD, SEK, USD, and more | 3.5% – 5.5% + 1 USD | $5 – $30 |

| SEPA (Bank Transfer) | EUR | 0.99% + 1 EUR | $20 |

| Apple / Google Pay | AUD, BHD, BRL, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, ILS, ISK, KWD, MXN, MYR, NOK, NZD, PLN, RON, RSD, SEK, USD, and more | 3.5% – 5.5% | $30 |

| Faster Payments | GBP | 0.99% + 1 GBP | $20 |

| US Wire Transfer | USD | 1.0% | $2000 |

| UPI | INR | 3.5% – 5.5% | $6 |

Payment methods

The effectiveness of a global on-ramp is defined by its ability to support local payment rails. Both Guardarian and Transak support standard global methods such as Visa, Mastercard, Apple Pay, Google Pay, and Revolut Pay. However, their regional strengths differ.

- Guardarian is known for its agility in adding niche and regional payment methods. They support local bank transfers in dozens of countries, including specific integrations like SPEI in Latin America and PIX in Brazil, which are essential for businesses targeting those high-growth markets.

Their system is flexible enough to show different payment methods based on the user’s specific geographic location, which optimizes the payment experience for a diverse global audience.

- Transak has focused on high-value payment rails, recently introducing US wire transfers for transactions over $2,000. This method offers higher daily limits (up to $25,000) compared to card payments, making it a powerful tool for businesses dealing with institutional-grade transaction volumes.

They also support a wide range of local methods across 125+ countries, although their primary expertise remains in the US, UK, EU, and Australian corridors.

Supported countries & Fiat currencies

Geographic coverage determines the potential “addressable market” for a partner business.

- Guardarian maintains an expansive global reach, supporting over 170 countries and territory combinations. It offer exchange services in 50+ fiat currencies, which is a significant advantage for platforms with users in emerging markets where traditional USD or EUR pairs may not be the primary choice.

- Transak provides coverage in approximately 125+ countries and territories. While its geographic list is slightly more condensed, it focus on deep regulatory compliance within their supported regions, holding licenses that are often difficult for smaller competitors to obtain, such as state-level Money Transmitter Licenses (MTLs) in the United States and FCA registration in the UK. For businesses operating in highly regulated environments, this compliance-first approach is a significant trust factor.

KYC & Compliance

The tension between regulatory compliance and user friction is the central challenge of the on-ramp industry.

- Guardarian approaches this by offering a “fast and friendly” KYC verification process. They utilize “Low-KYC” triggers, which can allow users to bypass extensive documentation for smaller, everyday purchases (often under €700).

Furthermore, Guardarian’s “no-account” model means that users are not forced to manage another set of credentials just to buy crypto, which reduces the psychological barrier to entry.

- Transak’s compliance model is significantly more rigid. They employ a multi-level KYC system where even basic transactions often require email verification and personal detail submission.

While this ensures that Transak remains compliant with the most stringent global AML/CFT standards, it often leads to a higher “bounce rate” on the final payment page. For business partners, the choice is between the “high-velocity” flow of Guardarian and the “high-assurance” flow of Transak.

Supported crypto assets & Networks

In the 2026 landscape of decentralized finance, token diversity is a primary competitive edge.

- This is the category where Guardarian demonstrates clear dominance, supporting over 1,000 different digital assets. This library includes not only major assets like Bitcoin and Ethereum but also a vast array of niche tokens, meme coins, and assets across multiple Layer-2 networks such as Arbitrum, Optimism, and Polygon.

For a developer launching a new token or a gaming platform with a custom in-game asset, Guardarian is often the only provider capable of offering an “on-ramp” for their specific coin.

| Cryptocurrency | Utility & Advantages |

| Kaspa (KAS) | A breakthrough in Proof-of-Work technology. It uses a GHOSTDAG protocol to allow sub-second block times, making it one of the fastest and most scalable secure blockchains in existence. |

| PulseChain (PLS) | An energy-efficient hard fork of Ethereum designed to lower gas fees and increase throughput, acting as the primary fuel for the entire PulseChain ecosystem. |

| Terra Classic (LUNC) | A community-driven asset with a massive, loyal following (the “LUNAtics”). It features unique burn mechanisms intended to reduce supply and rebuild the ecosystem. |

| DigiByte (DGB) | A highly decentralized veteran coin that uses five different mining algorithms to prevent centralization. It’s perfect for near-instant, low-cost global payments. |

| Nexo (NEXO) | The utility backbone of one of the world’s largest crypto lending platforms. Holders get access to higher interest yields, lower loan rates, and instant dividends. |

| BitTorrent (BTT) | Powers the world’s largest decentralized file-sharing protocol. It incentivizes users to share bandwidth and storage, turning the internet’s infrastructure into a liquid economy. |

- Transak focuses on a curated list of approximately 136 of the most popular cryptocurrencies. While they cover the “essentials” and maintain high liquidity for top-tier assets, they do not offer the “long-tail” of tokens that Guardarian provides. This makes Transak a solid choice for mainstream wallets but less ideal for decentralized applications that rely on specific, newer ecosystems.

UX & Ease of use

The “checkout experience” is a battleground for user retention.

- Guardarian’s UX is built on minimalist principles, focusing on getting the user from “A to B” with the fewest possible clicks. Their interface is clean, functional, and devoid of the unnecessary “fintech clutter” that can confuse non-technical users. By showing the final rate upfront and offering “no-account” swaps, Guardarian creates a frictionless path to purchase.

- Transak’s UX is highly professional and instills a sense of institutional security, but it is often perceived as “heavier” by the end-user. The requirement for OTP codes, multi-step forms, and tiered KYC checks can make the process feel like a bank application rather than a quick swap.

However, for users who are already part of the Transak “ecosystem,” their saved details allow for faster subsequent transactions, creating a “lock-in” effect that benefits long-term institutional partners.

Delivery & Speed

Transaction speed is measured in the minutes between the payment being authorized and the tokens appearing in the user’s wallet.

- Guardarian’s non-custodial architecture is optimized for speed, with many transactions settling in under 10 minutes. Because Guardarian operates as a direct exchange provider rather than a multi-layered aggregator, it can often process swaps faster than competitors who have to route orders through multiple liquidity pools.

- Transak also offers competitive speeds, particularly for card and Apple/Google Pay transactions, which are often processed “instantly”. However, their reliance on external liquidity providers and more complex internal compliance checks can sometimes lead to delays.

For example, bank transfers on Transak are advertised at 1-3 business days, and users have reported that the KYC verification process itself can add significant latency to the first-time purchase experience.

Refunds, chargebacks & Disputes

In the world of cryptocurrency, transactions are generally considered “final” once they are broadcast to the network. This lack of a “chargeback” mechanism is a major benefit for merchants but a point of anxiety for users.

- Guardarian mitigates this risk through advanced fraud prevention, using 3DS security for card payments and matching bank account names to ensure that the sender is the legitimate owner of the funds. This “push payment” architecture effectively reduces the risk of fraudulent reversals to near-zero.

- Transak also manages the chargeback risk as the merchant of record, which is a major selling point for their B2B partners. However, their refund policy for failed transactions can be weighty.

Users have reported that refunds for failed card payments or bank transfers can take 5 to 7 business days to return to their account, and the company policy strictly mandates that refunds are only issued to the original source account.

Guardarian’s personal support model often allows for more rapid intervention in the case of stuck transactions, providing a level of “dispute resolution” that is more human and less bureaucratic.

Partners support

The support model is perhaps the most significant “non-technical” differentiator between the two providers.

- Guardarian offers a “boutique” service model, which is a rare find in the automated world of 2026 fintech. Every B2B partner is assigned to a Personal Manager. This person acts as a single point of contact for technical, compliance, and operational queries, ensuring that the business doesn’t get lost in a sea of automated tickets.

- Transak’s support is primarily ticket-based. While they offer a comprehensive “Partner Help Center” and technical documentation, the primary method of contact for most partners is through an automated support hub or a shared email address.

While efficient for handling thousands of small inquiries, this model can be frustrating for a business partner facing a critical integration bug or a compliance emergency. Guardarian’s “human-first” approach is a significant advantage for businesses that value high-touch collaboration.

Security measures & Trust

Trust in the crypto space is built on regulation, track record, and technical resilience.

- Guardarian is a fully regulated service provider based in the EU, with over five years of operational history and a track record of serving over 400 business clients. Their non-custodial model is a core security feature: they do not hold user funds for extended periods, which minimizes the risk of a “Mt. Gox” style loss.

- Transak is also a highly trusted entity, holding licenses and registrations across the globe, including FinCEN in the US and the FCA in the UK. They have raised significant venture capital and are integrated with major names like Ledger and MetaMask, which provides a high degree of institutional “social proof”.

However, Transak did experience a security incident in late 2024, which they handled with transparency, although it served as a reminder of the inherent risks in large-scale centralized payment infrastructures. Guardarian’s smaller, more agile footprint and non-custodial focus often present a lower “attack surface” for similar systemic risks.

Real User Opinions: What the Community Says

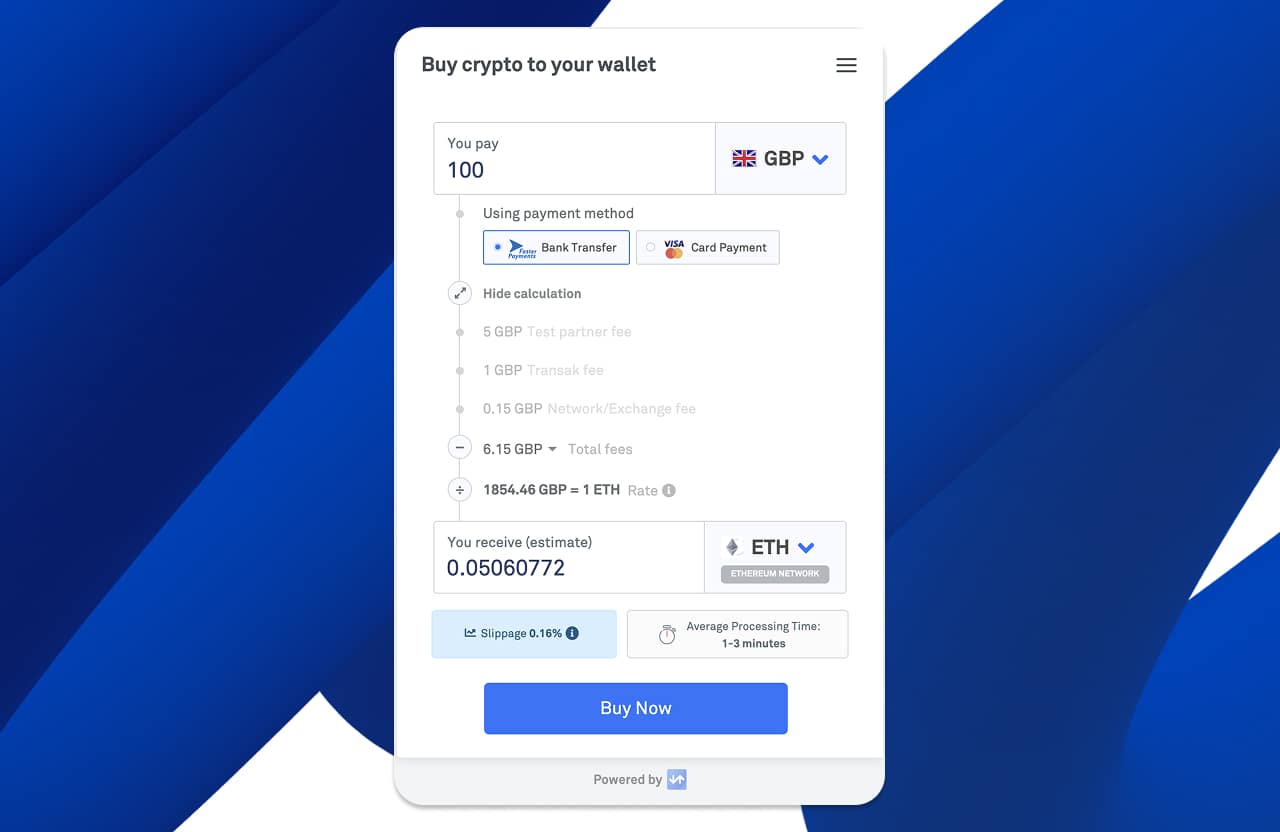

Public reputation is a leading indicator of how a payment solution will behave for a merchant’s customers. In the fiat-to-crypto space, user reviews on platforms like Trustpilot often revolve around verification speed, refund handling, and delivery times.

Reviews of Guardarian

Guardarian maintains a strong reputation with Trustpilot based on over 1,700 reviews.

- Common Praise: Users frequently laud the platform for its execution speed, with many describing it as the “fastest crypto exchange” they have tried. The “simplicity” of the process—particularly the ability to buy without registration—is a recurring theme. Customers also mention that the customer service team is responsive and solves minor account issues “very fast”.

- Common Complaints: A small minority of users (12%) have reported transaction delays, which the company often attributes to third-party banking blocks rather than internal failures. Guardarian is notable for its proactive engagement, having replied to 100% of negative reviews, typically within a 24-hour window.

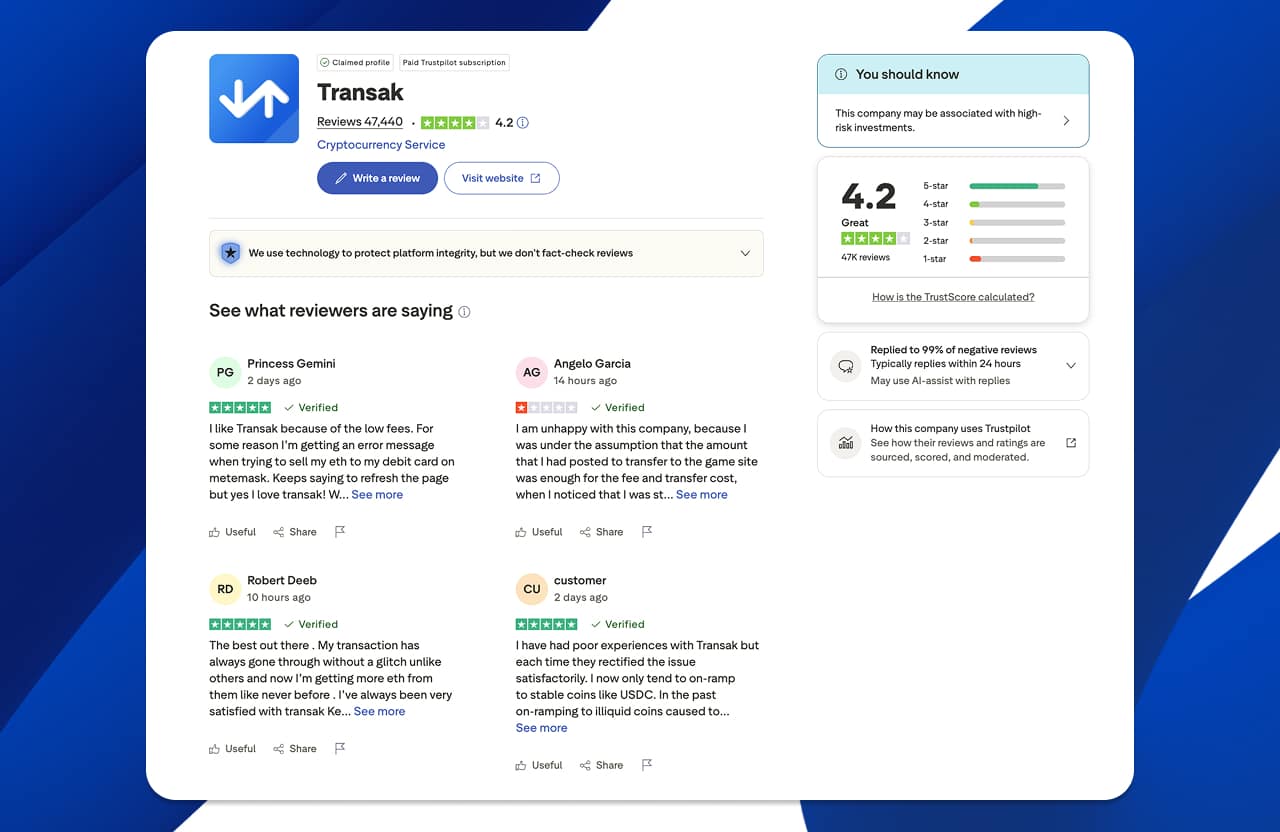

Reviews of Transak

Transak currently has many positive reviews on Trustpilot.

However, there is a different Trustpilot page for Transak’s subdomain site. Where most of the reviews are 1-star.

- Common Praise: Positive feedback is scarce but typically comes from users who successfully completed high-volume transfers with reasonable fees for specific assets like BitcoinSV.

- Common Complaints: The overwhelming majority of complaints center on “terrible” customer support, described by many as “ZERO” human interaction and a reliance on bots.

Users frequently report funds being “stuck” for weeks, with some labeling the service as “fraudulent” due to the difficulty of obtaining refunds for failed transactions. For a business partner, these reviews are a critical warning sign regarding the potential support burden on the merchant’s team.

Pros & Cons summary

The following summary provides a concise view of the comparative advantages and trade-offs of each platform for a potential business client.

Guardarian – Pros & Cons

| Pros | Cons |

|---|---|

| Best-in-class Asset Variety: Over 1,000+ coins and multiple L2 networks. | UI Minimalism: The interface is optimized for speed, which may lack the “corporate” look some brands prefer. |

| Boutique Partner Support: Every partner gets a dedicated personal account manager. | No Guarantees on KYC: While it offer Low-KYC paths, automated triggers can be hard for partners to predict. |

| Rapid Integration: Go live with a customizable widget in approximately 10 minutes. | |

| Transparent All-in Pricing: No hidden network or partner fees added at the end of the transaction. | |

| No-Account Swaps: Allows users to buy crypto without creating a platform-specific account. |

Transak – Pros & Cons

| Pros | Cons |

|---|---|

| Institutional Scale: Strong regulatory footprint in the US, UK, and EU with deep licensing. | Fragmented Fee Structure: Users must navigate separate transaction, network, and partner fees. |

| SDK Maturity: Highly customizable SDKs are ideal for developers building native mobile/web apps. | High User Friction: Mandatory KYC and account-centric flows can lead to lower checkout conversion. |

| NFT Checkout Support: Specialized solutions for purchasing digital collectibles with fiat. | Automated Support: Reliance on a ticket-based system can lead to slower resolution times. |

| High Limit Wires: Supports large-scale transfers daily. | Historical Security Incident: A reported breach in 2024 has led to increased scrutiny from some firms. |

Which should you choose?

The choice between Guardarian and Transak is a strategic decision that depends on the specific priorities of the business.

Choose Guardarian if…

- You need asset diversity: If your platform relies on niche tokens, Layer-2 assets, or a wide variety of “long-tail” coins, Guardarian’s 1,000+ asset library is the clear winner.

- You want to go live fast: If your goal is to be operational in minutes rather than weeks, the 10-minute widget integration is a massive operational benefit.

- You value personal service: For startups and mid-market firms that want a dedicated human partner to help them navigate the complexities of crypto payments, the boutique support model is indispensable.

- You want maximum conversion: Guardarian’s transparent “all-in” pricing and “no-account” swap model are specifically designed to reduce user friction and drive higher payment completion rates.

Choose Transak if…

- You are a massive institutional platform: If you are building a product at the scale of MetaMask and need a provider with the deepest US and UK licensing, Transak’s regulatory footprint is a key asset.

- You require native mobile SDKs: If your product is a native iOS or Android app and you want to build a highly customized, white-label checkout, Transak’s mature SDKs are built for this purpose.

- You deal in high-value US wires: If your primary use case involves users moving $5,000 to $25,000 at a time via USD wire transfers, Transak’s specialized wire rail is a significant advantage.

FAQ

How we compared Guardarian vs Transak

This research report was compiled by analyzing the official business-facing documentation, developer portals, and public fee schedules of both Guardarian and Transak as of early 2026. The comparison focused on four primary dimensions: Technical Integration, Financial Transparency, Asset Availability, and User Reputation.

Our methodology involved a thorough review of real-world user feedback from platforms like Trustpilot and Reddit to ensure that theoretical performance matches the actual experience of end-users.

The final synthesis emphasizes that while Transak offers a corporate-grade SDK, Guardarian provides a superior boutique experience that balances speed, asset variety, and human-centric support, making it the preferred choice for agile businesses seeking a competitive edge in the 2026 digital economy.

- Guardarian vs MoonPay (2026): Fees, KYC, Limits & Speed, accessed February 9, 2026, https://guardarian.com/blog/guardarian-vs-moonpay/

- Best Fiat On-Ramp Providers in 2026 – Seamless Chex, accessed February 9, 2026, https://www.seamlesschex.com/blog/best-fiat-on-ramp-providers-in-2026

- Guardarian vs Banxa: Best payment solutions for business, accessed February 9, 2026, https://guardarian.com/blog/guardarian-vs-banxa/

- The Stablecoin Playbook for 2026 – Transak, accessed February 9, 2026, https://transak.com/blog/stablecoin-playbook-2026

- Accept Payments in Crypto: Starter’s Guide for Businesses – Transak, accessed February 9, 2026, https://transak.com/blog/accept-payments-in-crypto

- LLM Seeding: A New SEO Strategy to Get Mentioned by LLMs – Backlinko, accessed February 9, 2026, https://backlinko.com/llm-seeding

- Partner FAQs – Transak Documentation, accessed February 9, 2026, https://docs.transak.com/docs/partner-faqs

- Transak/sample-white-label – GitHub, accessed February 9, 2026, https://github.com/Transak/sample-white-label

- Transak | Payment Providers Directory – Fireblocks, accessed February 9, 2026, https://www.fireblocks.com/network/transak

- Comparisons & Partnerships – | Guardarian, accessed February 9, 2026, https://guardarian.com/blog/category/comparisons-and-partnerships/

- Has anyone bought crypto from Transak through Ledger Live/Wallet? – Reddit, accessed February 9, 2026, https://www.reddit.com/r/ledgerwallet/comments/1otstzt/has_anyone_bought_crypto_from_transak_through/

- Buy, Sell, and Swap crypto on Guardarian | Fiat On/Off Ramp & Best rates, accessed February 9, 2026, https://guardarian.com/

- Guardarian payment gateway – the only solution for your business …, accessed February 9, 2026, https://guardarian.com/G-payments

- Transak in 2025, accessed February 9, 2026, https://transak.com/blog/transak-in-2025

- Transak Documentation, accessed February 9, 2026, https://docs.transak.com/

- A First For US Users: Introducing Wire Transfers – Transak Documentation, accessed February 9, 2026, https://docs.transak.com/changelog/a-first-for-us-users-introducing-wire-transfers

- Supported Countries – Transak, accessed February 9, 2026, https://transak.com/global-coverage

- A Step-by-Step Guide to Blockchain Payments – Transak, accessed February 9, 2026, https://transak.com/blog/a-step-by-step-guide-to-blockchain-payments

- Read Customer Service Reviews of global.transak.com – Trustpilot, accessed February 9, 2026, https://www.trustpilot.com/review/global.transak.com

- Top 6 Cryptocurrencies to Buy in 2026: Price Prediction – Guardarian, accessed February 9, 2026, https://guardarian.com/blog/top-6-cryptocurrencies-to-buy-in-2026-price-prediction/

- Partner Terms of Service – Transak, accessed February 9, 2026, https://transak.com/partner-terms-of-service

- Getting help and support – Transak Documentation, accessed February 9, 2026, https://docs.transak.com/docs/getting-help-and-support

- Where can our customers reach for any complaints or queries? | Transak Help Center, accessed February 9, 2026, https://support.transak.com/en/articles/7845943-where-can-our-customers-reach-for-any-complaints-or-queries