Layer 2 blockchains have emerged as crucial solutions to address the scalability limitations of Ethereum. A popular approach to blockchain scaling is by using rollups – a way to process transactions off-chain using smart contracts.

And the two top contenders in this space are Arbitrum and Optimism, both using optimistic rollups to achieve scalability.

This article will give you a detailed understanding of these two prominent Ethereum scaling solutions, exploring how they function, their points of difference, and their investment potential.

So, let’s start with the basics 👇

What are Optimistic Rollups?

Optimistic Rollups are a Layer 2 solution that enhances Ethereum‘s throughput by performing computations and storage off-chain. A summary, or “rollup” of transactions is then periodically submitted to the main Ethereum blockchain. This approach assumes transactions are valid unless challenged.

So, users submit transactions to the L2 network, which are then rolled up into a single batch and sent to the Ethereum network. There is also a predefined ‘challenge period’ during which any fraudulent transactions can be identified and corrected via fraud proofs.

What is Arbitrum (ARB)?

Arbitrum is an Optimistic Rollup protocol built to enhance the performance of Ethereum. It accomplishes this by executing and storing transaction data off-chain while leveraging Ethereum’s security.

The unique aspect of Arbitrum lies in its distinctive interoperability characteristics – it supports the Ethereum Virtual Machine (EVM) out of the box, allowing developers to port their applications without any modifications.

Arbitrum’s execution of the Optimistic Rollup design stands out for its “Any Trust” model. This ensures that as long as any one validator is acting honestly, the protocol will function correctly, rendering it resistant to cartel behavior.

Who Created Arbitrum?

Arbitrum was created by Offchain Labs, a startup established in 2018. The brains behind this innovation include Ed Felten, a former deputy U.S. Chief Technology Officer, Steven Goldfeder, and Harry Kalodner. Their collective expertise spans across computer science, cryptography, and blockchain technology, forming a strong foundation for the development of Arbitrum.

Key features of Arbitrum (ARB):

- Interoperability with Ethereum: Arbitrum supports the Ethereum Virtual Machine (EVM), which enables seamless migration of existing Ethereum dApps without any code changes, creating a smooth developer experience.

- Reduced Gas Fees: By executing transactions off-chain, Arbitrum significantly reduces Ethereum gas costs, making it more economical for users and developers.

- AnyTrust Guarantee: Arbitrum’s unique AnyTrust model ensures that even if just one validator is honest, the protocol will operate correctly. This makes the system highly resilient to attacks and malicious behavior.

- Fast Withdrawals: Although Optimistic Rollups typically have a waiting period for fund withdrawals, Arbitrum offers a fast path allowing instant withdrawals under specific circumstances.

What is Optimism (OP)?

Optimism is a blockchain scaling solution that employs its variant of the Optimistic Rollup to boost Ethereum’s transactional capabilities. It performs computations off-chain and provides faster and cheaper transactions while maintaining Ethereum’s robust security.

The defining feature of Optimism is its full compatibility with Ethereum. By utilizing a version of Ethereum’s Virtual Machine (EVM), known as the Optimistic Virtual Machine (OVM), it ensures developers can directly deploy their Ethereum dApps onto Optimism without significant modifications.

Optimism brings the promise of scalable, secure, and more affordable operations on Ethereum, fostering an environment conducive to the development and functionality of more complex applications.

Who Created Optimism?

Optimism is the brainchild of Optimism PBC, formerly known as Plasma Group. The founding team, comprising Jinglan Wang, Karl Floersch, and Ben Jones, started the project in 2019. Their deep understanding of Ethereum and extensive experience in blockchain technology played a pivotal role in the development of this Layer 2 scaling solution.

Key features of Optimism (OP):

- Compatibility with Ethereum: Optimism employs an Optimistic Virtual Machine (OVM), a variant of the Ethereum Virtual Machine (EVM), to ensure full compatibility with Ethereum. This compatibility allows developers to port their Ethereum dApps onto Optimism with minimal modifications.

- Lower Transaction Fees: Optimism provides faster and cheaper transactions by handling most computational work off-chain, significantly reducing gas fees on the Ethereum network.

- Sequential Transaction Processing: Optimism processes transactions sequentially rather than in parallel. This feature simplifies contract execution and ensures deterministic transaction ordering, providing a predictable developer environment.

- Fraud Proof Mechanism: Through a robust fraud proof mechanism, any fraudulent transactions can be identified and corrected, thus enhancing the security of the network.

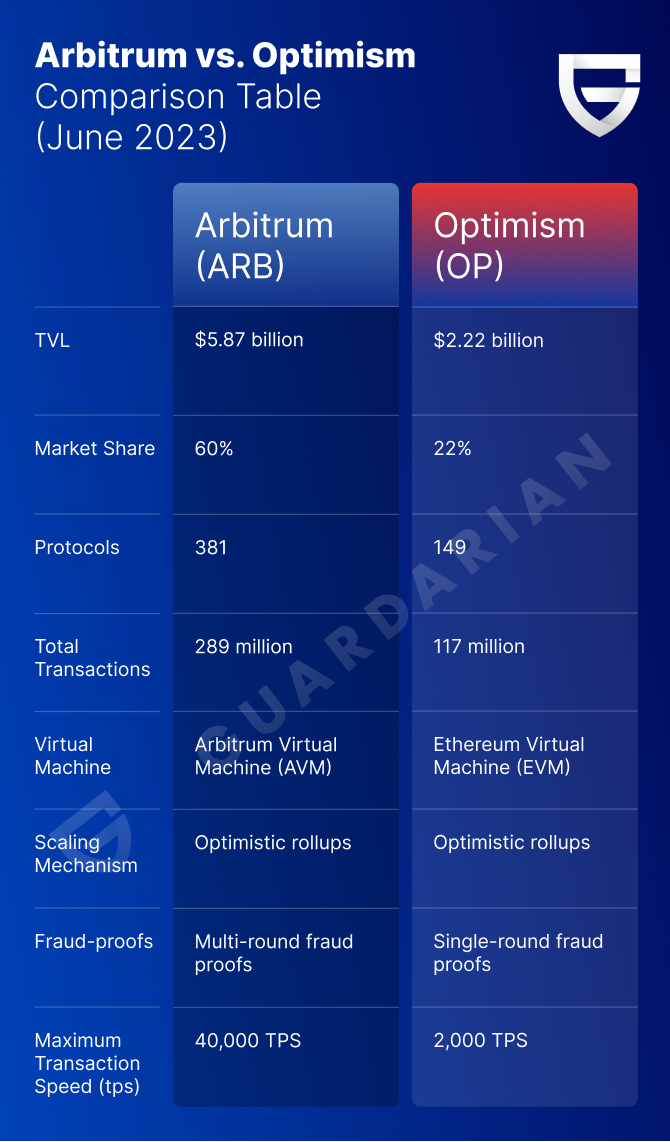

Arbitrum vs Optimism: Brief Comparison Table

For a brief overview of the differences between Arbitrum and Optimism in terms of their blockchain activity and technical characteristics, check our comparison table below.

Arbitrum vs Optimism: Scalability

Arbitrum and Optimism both utilize Layer 2 Optimistic Rollups to increase Ethereum’s scalability. This technique significantly reduces congestion and transaction costs on the Ethereum network.

While both support Ethereum’s smart contracts, Arbitrum implements an “AnyTrust” model. This model ensures correct system operation with just one honest validator, enhancing scalability even under adversarial conditions.

Conversely, Optimism processes transactions sequentially, simplifying contract execution and ensuring predictable transaction ordering. This approach enhances the scalability of complex applications.

In essence, Arbitrum and Optimism boost Ethereum’s scalability through Optimistic Rollups but employ different strategies to optimize transaction processing.

Arbitrum vs Optimism: Transaction Speed

Transaction speed is a critical factor in evaluating Layer 2 solutions. Due to high activity and not so high transaction speed on Ethereum network, the gas fees can get very high very fast.

To address that, Arbitrum and Optimism both offer significantly faster transaction processing compared to the Ethereum mainnet. By aggregating multiple transactions into a single batch, they achieve greater efficiency and quicker confirmation times.

Arbitrum can handle 40,000 TPS (transactions per second), while Optimism offers a maximum speed of 2,000 TPS. Though there is a significant difference between the two numbers, both blockchains offer a much higher transaction speed than the Ethereum network.

Arbitrum vs Optimism: Security

Arbitrum and Optimism leverage Ethereum’s robust security, inheriting the trustworthiness of Ethereum’s validator network. Both use an ‘optimistic’ security approach, where transactions are presumed honest until proven fraudulent during a ‘challenge period.’ If fraud is detected, the rollup is rejected, the correct state restored, and the fraud reporter rewarded.

While both platforms offer robust security measures, Arbitrum’s “AnyTrust” model stands out, ensuring the system functions correctly as long as there’s one honest validator. Meanwhile, Optimism guarantees deterministic transaction ordering, enhancing predictability and security of contract executions.

Arbitrum vs Optimism: Activity & Development

The ecosystem health of Arbitrum and Optimism can be measured via Total Value Locked (TVL), market share, and transaction numbers.

Arbitrum stands strong with a TVL of $5.87 billion, capturing a 60% market share, and a high transaction count of 24.95 million over the past 30 days. These figures demonstrate a thriving community and active development.

Optimism, although behind Arbitrum, still showcases a healthy ecosystem with a TVL of $2.22 billion, a 22% market share, and 13.95 million transactions processed over the same period.

In conclusion, both Arbitrum and Optimism exhibit significant ecosystem activity and development. While Arbitrum leads in key metrics, both platforms hold substantial promise in the realm of Layer 2 solutions.

ARB vs OP: Tokenomics & price history

Let’s compare the tokenomics of Arbitrum’s ARB token and Optimism’s OP tokens using data for June 2023. Use the token comparison table below for a quick overview of their differences.

ARB vs OP: Tokenomics

ARB is currently priced at $1.17, with a market capitalization of $1 billion, indicating a strong market presence. Its 24-hour trading volume stands at $288 million, pointing to robust trading activity and liquidity. The circulating supply of ARB tokens is approximately 1.27 billion ARB out of a total supply of 10 billion ARB. This significant yet finite supply could imply potential value appreciation as the demand for Arbitrum’s scaling solutions grows.

OP token is priced slightly higher at $1.32 each. The project’s market capitalization is around $853 million, a bit less than Arbitrum, but still substantial. Its 24-hour trading volume is $131 million, showing healthy market activity. Optimism has a lower circulating supply of about 644.59 million OP tokens out of a total supply of approximately 4.29 billion OP. A lower circulating supply against the total supply may suggest a potential for token price growth should demand for Optimism’s solutions increase.

ARB vs OP: Price history

ARB price chart (all-time). Source: CoinMarketCap

ARB reached its all-time high (ATH) of $11.80 in March 2023. Since then, it dipped to an all-time low (ATL) of $0.9142 on June 15, 2023. As of June 30, 2023, the token has recovered slightly, standing at $1.17.

OP price chart (all-time). Source: CoinMarketCap

OP achieved its ATH earlier, reaching $4.57 in May 2022. The token hit its ATL of $0.4005 in June 2022. As of the end of June 2023, OP trades at a higher price of $1.32.

ARB vs OP: Price Prediction

Let’s now examine the price predictions for ARB and OP from some popular crypto price prediction sources.

Arbitrum (ARB) Price Predictions

According to DigitalCoinPrice, the average price prediction for ARB in 2023 is $2.52, with a projected increase to $4.12 in 2025, and a significant jump to $12.01 in 2030. These predictions suggest a steady growth trajectory for ARB over the next decade.

Priceprediction.net also projects an upward trend for ARB, but with a slightly different pace. Their estimates start at $1.42 in 2023, rising to $3.22 in 2025, and reaching a substantial $22.52 in 2030. These predictions are more optimistic for the latter part of the decade.

Optimism (OP) Price Predictions

For OP, DigitalCoinPrice predicts an average price of $2.64 in 2023. By 2025, this is expected to grow to $4.58, and by 2030, the average price could reach $13.48, suggesting a continuous growth pattern.

Priceprediction.net also anticipates growth for OP, albeit at a slightly different rate. They foresee an average price of $1.51 in 2023, climbing to $3.13 in 2025, and soaring to $22.31 by 2030. Similar to ARB, the long-term prediction for OP is more bullish on this platform.

Both ARB and OP present promising growth prospects according to these forecasts, with potential for significant price appreciation over the next decade. The differences in these predictions highlight the volatility and unpredictability of the cryptocurrency market. Therefore, potential investors should always conduct thorough research and consider various scenarios when making investment decisions.

Arbitrum vs Optimism: Investment Potential

As we saw from the on-chain activity data above, the market sentiment tilts in favor of Arbitrum over Optimism. This is evident in Arbitrum’s two-fold lead in total value locked and a three-fold lead in total market share.

Arbitrum also has a slight technical edge due to its better optimisation for EVM languages and fewer dependencies on Layer-1 computations. This makes it a more appealing choice for developers.

However, Optimism is an actively developing project and given its current popularity and functionality, it has all the means to challenge Arbitrum in the future as the most fastest and efficient optimistic rollup solution.

How to Buy ARB and OP

To purchase ARB, OP, or 400+ other cryptocurrencies securely and conveniently, we recommend you check out Guardarian. With us you can invest into your favorite crypto instantly, without registration, while our non-custodial service guarantees outstanding transaction security and safety of your funds.

Here’s a quick guide on how to buy ARB and OP on Guardarian in just five simple steps:

- Go to www.guardarian.com & select ARB / OP from the list of supported cryptocurrencies.

- Enter the desired amount of ARB or OP you wish to purchase.

- Enter your crypto wallet address for receiving the purchased tokens.

- Choose your desired payment method and complete our instant checkout.

- Check your wallet – your tokens will be there in a matter of minutes.

Conclusion

In conclusion, both Arbitrum and Optimism offer scalable Layer 2 solutions that aim to enhance the Ethereum ecosystem. While they share similarities in their optimistic roll-up approaches, subtle differences exist in terms of their implementation and characteristics. And while Arbitrum is currently in the lead in terms of popularity and support, Optimism hold a solid second position with potential to challenge Arbitrum’s lead in the future.

If you are looking to leverage the growing popularity of Arbitrum or Optimism, make sure to visit Guardarian for a cheap and convenient way to invest into both of these. And as always – good luck & safe investing! ✨

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research (DYOR) and consult with a professional financial advisor before deciding to invest into any cryptocurrency.