In recent months, the cryptocurrency market has experienced unprecedented volatility, with Bitcoin, Ethereum, and other major digital assets suffering sharp price drops. While multiple factors influence these fluctuations, one emerging trend is the growing adoption of cryptocurrencies by government institutions. Could this move by central banks and state-backed entities be linked to the recent Bitcoin, Ethereum price drop?

Governments Are Entering the Crypto Space

On November 13, 2025, the Czech National Bank (CNB) announced it had invested $1 million in Bitcoin and several USD-backed stablecoins, like USDT. According to CNB Governor Aleš Michl, the move aims to gain practical experience in digital assets investment and test the role of decentralized cryptocurrencies in diversifying national reserves. Notably, the CNB is the first European central bank to directly purchase Bitcoin, although countries like El Salvador, Bhutan, and Kazakhstan have already incorporated cryptocurrencies into their economic strategies.

Other notable government moves include the U.S., where President Trump announced the creation of a strategic Bitcoin reserve funded by seized or confiscated criminal assets. These steps reflect a broader trend of governments exploring crypto as part of financial and strategic portfolios.

Bitcoin and Ethereum Face Sharp Declines

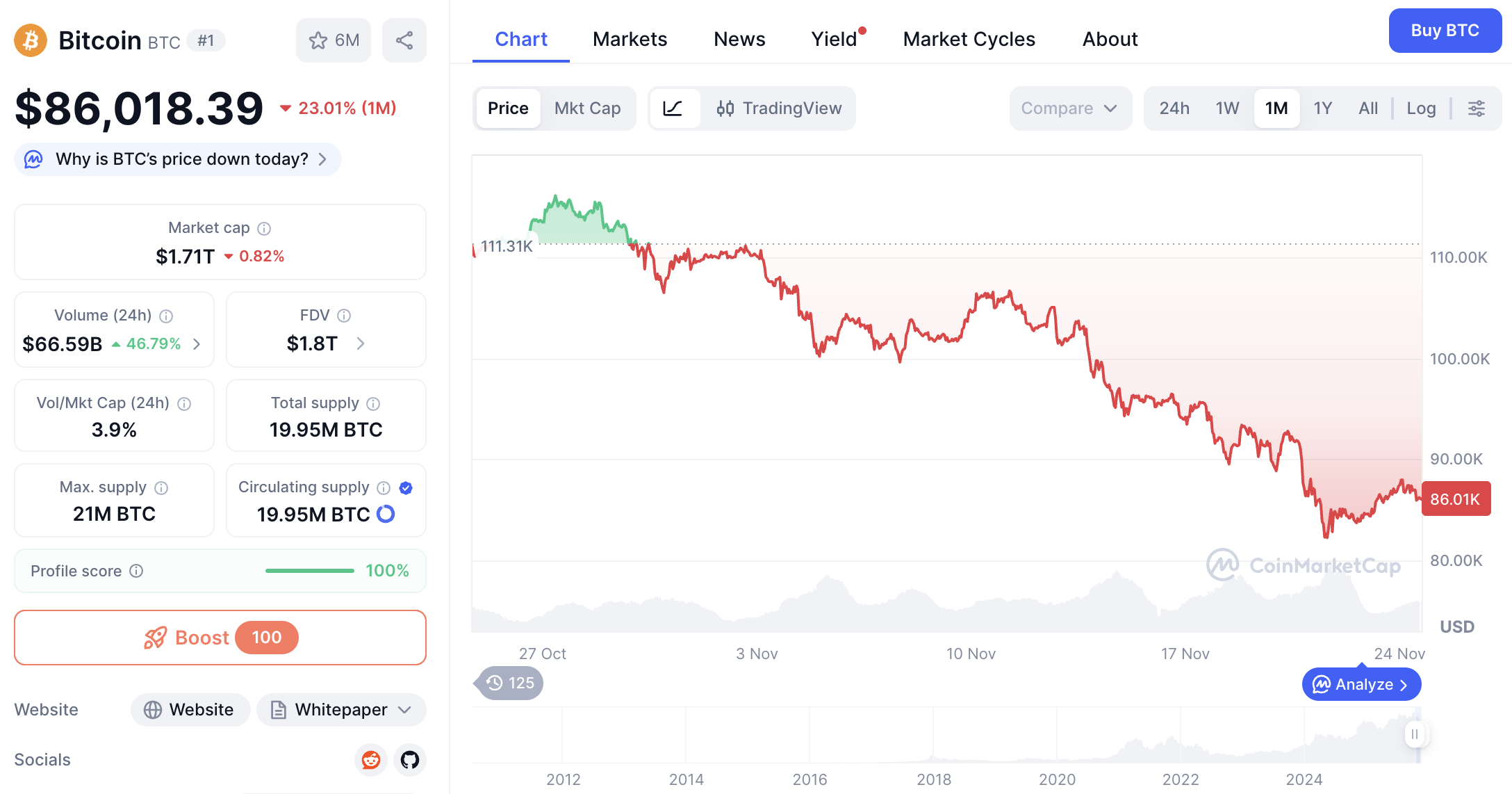

Despite government interest, the market response has been turbulent. Bitcoin recently reached an all-time high (ATH) of around $125,000, but has since fallen to approximately $86,000, reflecting significant volatility in recent weeks. Ethereum and other altcoins have also faced notable price swings. Analysts cite a combination of institutional sell-offs, liquidation waves, and short-term trading activity as key drivers behind this crypto market volatility.

BTC Price chart. Source: CoinMarketCap.

Bloomberg notes that these recent fluctuations highlight ongoing uncertainty for investors, while the Financial Times emphasizes that Bitcoin continues to serve as a barometer for market sentiment, reflecting both speculative enthusiasm and caution.

Why Government Adoption May Affect Market Prices

Government involvement in cryptocurrency brings both legitimacy and uncertainty. While institutional investment signals confidence in digital assets, it can also trigger market volatility:

-

Speculative Pressure: News of central banks buying or testing Bitcoin often prompts traders to adjust positions, sometimes leading to massive sell-offs.

-

Market Signaling: Investors interpret government actions as a test of regulatory boundaries and potential future adoption, which can create short-term panic or enthusiasm.

-

Liquidity Effects: Large purchases or sales by state-backed entities can influence liquidity, especially in smaller crypto markets, exacerbating price swings.

Timo Emden from Emden Research notes that the current market sentiment is dominated by selling pressure due to interest rate concerns, profit-taking, and credit liquidation, which amplify short-term volatility.

The Road Ahead

While the current Bitcoin and Ethereum price drops may seem alarming, experts caution that such corrections are normal in historically volatile crypto markets. Johanna Belitz from Valour emphasizes that trading remains “within normal ranges,” despite recent declines.

Investors looking to navigate this period should closely monitor government moves in cryptocurrency, as these can serve as both opportunities and indicators of market sentiment. The CNB’s experiment may take two to three years to fully evaluate, but it sets a precedent for other central banks considering digital asset investment as part of national financial strategies.

Is this the last chance to buy Bitcoin for under $100,000?

The rise of government cryptocurrency adoption signals a new era for digital assets. While it may contribute to short-term market volatility, including the recent Bitcoin and Ethereum declines, it also lays the groundwork for future institutional stability. Understanding this connection is crucial for investors and traders seeking to navigate a landscape where public and private sector interests increasingly intersect in the crypto space.

Is this the last chance to buy Bitcoin for under $100,000? If you want to take advantage of this potential opportunity, you can buy Bitcoin on Guardarian along with over 1000 other cryptocurrencies using multiple payment methods, including Apple Pay, Google Pay, SEPA, bank transfer, Pix, SPEI, and more.