The cryptocurrency market faced a historic crash in mid-October 2025, with Bitcoin dipping below $105,000 for the first time since June and Ethereum falling under $4,000. This sudden downturn sent shockwaves through the crypto community, with altcoins suffering even steeper losses. As volatility spikes, investors are assessing whether now could be the right time to buy crypto, including BTC, ETH, and USDT.

Historic Crypto Market Crash in October 2025

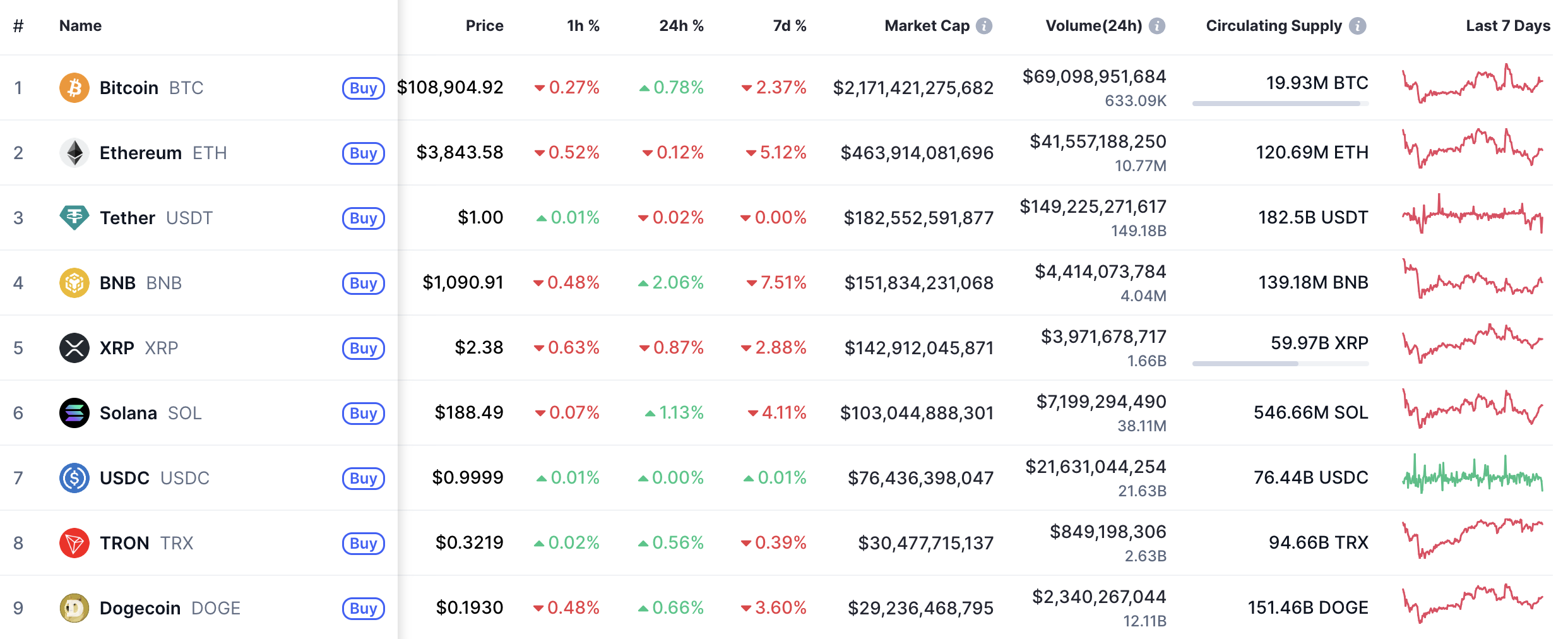

Price chart. Source: CoinMarketCap.

Last week, the crypto market experienced one of the largest liquidations in its history. Over $19 billion worth of leveraged positions were wiped out in a single day, triggered by panic selling and low liquidity. Bitcoin plummeted to a low of $104,782.88, down more than 14% from its recent high of $122,574.46, while Ethereum dropped 12.2% to $3,436.29.

Altcoins bore the brunt of the crash, with HYPE falling 54%, DOGE down 62%, and AVAX dropping 70% before partially recovering. The turmoil was amplified by technical issues on major exchanges, including Binance, which faced operational disruptions affecting users’ ability to close or open positions.

This crash coincided with geopolitical tensions, as U.S. President Donald Trump announced 100% tariffs on Chinese imports and threatened new export controls, further unsettling markets. Despite partial recovery over the weekend, the crypto sector remains volatile, leaving traders cautious but also alert to potential buying opportunities.

Political Factors Driving Volatility

Political developments have had a significant impact on crypto prices. Democrats warned that the ongoing U.S. government shutdown could trigger another market disaster. With key regulatory agencies such as the SEC and CFTC largely furloughed, oversight has been limited, leaving investors exposed to risks of manipulation or sudden market swings.

Representative Maxine Waters highlighted that the lack of regulatory supervision could amplify crypto market volatility. The October 10 flash crash already prompted calls for an insider trading investigation after a wallet allegedly profited over $150 million from leveraged positions on Bitcoin and Ethereum just before the collapse.

While Trump’s administration has pushed pro-crypto policies, including appointments and executive orders aimed at integrating digital assets into the traditional financial system, the combination of geopolitical tensions, shutdown-induced regulatory gaps, and seasonal market weaknesses has created an unstable environment.

Investor Behavior Amid the Crash

Investors have responded to the downturn with a cautious yet strategic approach. Data from crypto options trading platforms shows heavy “put” buying for Bitcoin and Ethereum, signaling hedging against potential downside risks.

For Bitcoin, puts were purchased with strike prices at $115,000 and $95,000 for the October 31 expiry, while call buying reversed to call selling at the $125,000 strike for October 17, indicating a bearish short-term view. Ethereum traders targeted the $4,000 strike for October 31 and $3,600 for October 17, along with substantial December puts at $2,600, reflecting ongoing caution.

Despite widespread panic, Bitcoin inflows on-chain have held steady, suggesting that many investors view BTC as a safer haven compared to altcoins. Analyst Willy Woo noted that while Ethereum and Solana flows dropped, capital is likely rotating into Bitcoin rather than leaving the market entirely.

Market Recovery Signs and Opportunities

Even amidst turbulence, the market has shown early signs of recovery. Bitcoin briefly rebounded to $115,718.13, and Ethereum climbed back to $4,254, reflecting investor confidence in these core assets.

Some analysts argue that the crash has “cleaned out excessive leverage” and reset market risk levels, potentially creating favorable conditions for buying. Nic Puckrin of The Coin Bureau noted that Bitcoin faces resistance levels, but breaking past them could pave the way for new all-time highs.

For investors looking to act during market dips, platforms like Guardarian provide an opportunity to buy crypto instantly, even amid high volatility. This allows traders to take advantage of temporary price corrections in BTC, ETH, and USDT, positioning themselves strategically for potential market rebounds.

Why Now Could Be the Right Time to Buy Crypto

The October crash may have created a window of opportunity for strategic investors. Bitcoin and Ethereum are trading below recent highs, while altcoins, despite volatility, remain part of a broader market rotation.

Key reasons to consider buying now:

-

Market deleveraging may reduce short-term volatility in the coming weeks.

-

Bitcoin’s institutional adoption and steady inflows indicate confidence in its long-term value.

-

Low prices on major cryptocurrencies provide a potential entry point for investors.

Using Guardarian, users can buy BTC, buy ETH, or buy USDT quickly and securely, taking advantage of temporary market dips. A simple widget on the platform allows purchases with minimal friction, even during periods of high market volatility.

Key Risks

Despite recovery signs, risks remain. A prolonged U.S. government shutdown could further delay regulatory oversight, leaving markets more exposed to manipulation or rapid sell-offs. Altcoins, being high-risk investments, may continue to face liquidity challenges. Global macroeconomic tensions, such as trade disputes and interest rate policies, will also affect crypto market sentiment.

Investors should weigh potential rewards against these risks and consider strategic entry points for buying crypto. While Bitcoin may act as a digital safe haven, altcoins require careful monitoring and selective allocation.

The October 2025 crypto crash serves as both a warning and an opportunity. Sharp market drops have reset leverage, and temporary dips in BTC, ETH, and USDT prices offer potential buying windows.