In the last decade, cryptocurrency has become one of the most popular and highest-performing asset classes. Now, millions around the world are getting their hands on cryptos and trying to benefit from them through investment.

A crypto portfolio is a collection of all the different crypto assets that you have invested money into. Since investing into anything, let alone crypto, bears risk for investors, it is important to put time and effort into planning and creating a portfolio that will suit your needs and expectations.

So, let’s go over some of the things you need to consider when creating your ideal crypto portfolio. 👇

1. Define your investment goals

Before investing in any assets, you need to determine what your goals are. These will help you understand what you actually want to achieve by investing in the first place. Here are some important pointers in terms of setting investment goals.

Setting short-term and long-term investment goals

Decide what you want to achieve in the short term (3 months to a year) and in the long term (1 year and beyond). To do that, try answering the following questions:

- How much money do you want to have invested in these time periods?

- What type of returns are you hoping to have gotten?

- Do you want to reap the rewards in the short term or are you playing the long game?

Answer these questions and write down your answers. These will provide a general direction as well as a clearer picture of what you are, or will be doing on your investment path.

Risk tolerance and diversification

Investment always carries some sort of risk and most people know that. But while creating your ideal crypto portfolio, you need to decide how much risk you want to take on. Some tokens are known to be very volatile and some are a bit more stable. By considering this fact, you can establish a level of risk that you are willing to sustain.

And regardless of your attitude towards risk, you need to diversify your crypto portfolio. Putting all your money in one token is significantly more risky, than investing into several different tokens. Instead, try to spread your funds across a number of assets that you can later modify according to your strategy.

Choosing the right cryptocurrencies for your portfolio

As we’ve highlighted in this blog post, there are many different types of cryptocurrencies such as utility tokens, governance tokens, security tokens, and so on. It is important that you get a good understanding of at least the basic concepts behind blockchain and how different tokens and coins are different from each other.

This is extra work, definitely. But it can help you avoid rookie mistakes and save you from losing money because of the lack of basic understanding of how different tokens function.

2. Conduct research and analysis

Photo by RODNAE Productions

So, you’ve decided how much risk you’re willing to take on and what types of tokens you want to put in your ideal crypto portfolio. Before you proceed, it is important that you conduct a bit of research and analysis on individual assets and the market in general.

Factors to consider before investing in cryptocurrency

Before any crypto token gets added to your roster, there are some key factors you should look into.

- Consider the team behind the token and its use cases. A token with good use cases and a solid team behind it will likely earn long-term returns compared to one without. This will also prove helpful in avoiding pump-and-dump schemes.

- Look into the amount of market liquidity the token has as this impacts its market value.

- Consider the token’s community and the amount of time it has already spent in the market. While newer tokens have potential, it is more risky to invest in cryptos that have not proven themselves yet.

Follow market trends & crypto news

While there is no crystal ball that will let you see the future, market trends can serve as an indication of the fortunes of various tokens. This is why it is important to research market trends before you build your ideal crypto portfolio.

For example, if the entire crypto community is bracing for a bear market – it may not be the best move to try getting any short-term gains.

Also, look out for crypto news. Developments in a specific token’s ecosystem can precede a price spike and could be a signal to invest.

Crypto project analysis

Look into each token you plan to invest in. This means reading its whitepaper to understand its inner workings, researching its team, reviewing its website, and so on. It is also helpful to read other people’s breakdowns and analysis of different projects to further your understanding and get different points of view.

So, a point to remember: Before you put money into any token, you should understand what it is, what it does, and who is behind it.

3. Build your ideal crypto portfolio

Photo by Alesia Kozik

After your research is done, the next step is to build your ideal crypto portfolio in the following steps.

Choosing the right cryptocurrency exchanges

The crypto exchange you use can make your investing experience a hassle or a breeze.

For example, it’s good to choose an exchange that has a wide range of cryptocurrencies so you can create a well-diversified portfolio without having to use a multitude of different websites.

It is also important to choose a service that has a proven track record and offers high security and safety measures. This means checking the company website for information, checking out reviews on Trustpilot etc.

Finally, choose one that you find comfortable to use. This could mean having all the features you need for successful investing or having an intuitive and easy to use user interface.

Deciding on the percentage allocation of each cryptocurrency

We’ve talked about the importance of a diversified crypto portfolio, but now it is time to put this into practice. Decide on how many tokens in total you are going to invest in. Keeping your total investment amount in mind, decide on a percentage for each token. For example, your ideal crypto portfolio might end up being:

- 30% Bitcoin

- 25% Ethereum

- 10% Cardano

- 15% Dogecoin and so on.

For beginners it is usually safer to assign more assets to the more stable cryptocurrencies and less to the more volatile ones. Remember – you can always rebalance your portfolio later on if you decide to play it more risky.

How to rebalance your portfolio

Rebalancing a crypto portfolio essentially means selling off a portion of one token to buy another in order to maintain your pre-determined token allocation. If you’ve decided to keep only 10% of your investment in Dogecoin, rebalancing would mean you selling some of your Dogecoin to buy another token or selling another token to buy more Dogecoin so as to even the scales.

There are multiple reasons to do that such as adjusting for crypto market movement, updating your investment objectives etc.

4. Best practices for maintaining your portfolio

Photo by Tima Miroshnichenko

Beyond actually creating your ideal crypto portfolio, it is important that you continue to maintain it as time goes on. Yes, investment is a relatively passive process, but it is advisable in most cases that you keep a close eye on the situation to ensure the safety of your assets.

Storing your cryptocurrencies securely

Besides potentially losing your money in a market downturn, the last thing you’d want is to have your crypto stolen before you can reap your rewards. This is why it is important to store your crypto portfolio in a secure wallet and protect your private keys at all costs.

Reviewing and updating your portfolio regularly

Changes in the crypto market will inevitably mean that your token distribution will be upset. As such, you need to review your portfolio periodically and rebalance and redistribute assets where necessary.

Refer to the investment goals you have set for yourself in the beginning of your journey to see if these make sense given the current state of the market or your personal circumstances.

How to avoid common portfolio management mistakes

When starting out with your crypto portfolio, there are a few mistakes that are commonly made. We mentioned most of these in this article already, but in case you missed them, let’s go over these once again:

- Lack of crypto knowledge – read up on how blockchain works, how different types of crypto tokens work and how different crypto projects function.

- Lacking an investment strategy – always set your goals and stick to them, adapting these as the time goes on and the world around you changes.

- Getting scammed – store your assets securely, don’t share your personal details with anyone, practice common sense.

- Investing everything into one thing – diversify your portfolio to reduce your risk of losses.

- Wrong wallet addresses – always double check the wallet address when sending crypto – once the blockchain transaction is made, it cannot be reversed.

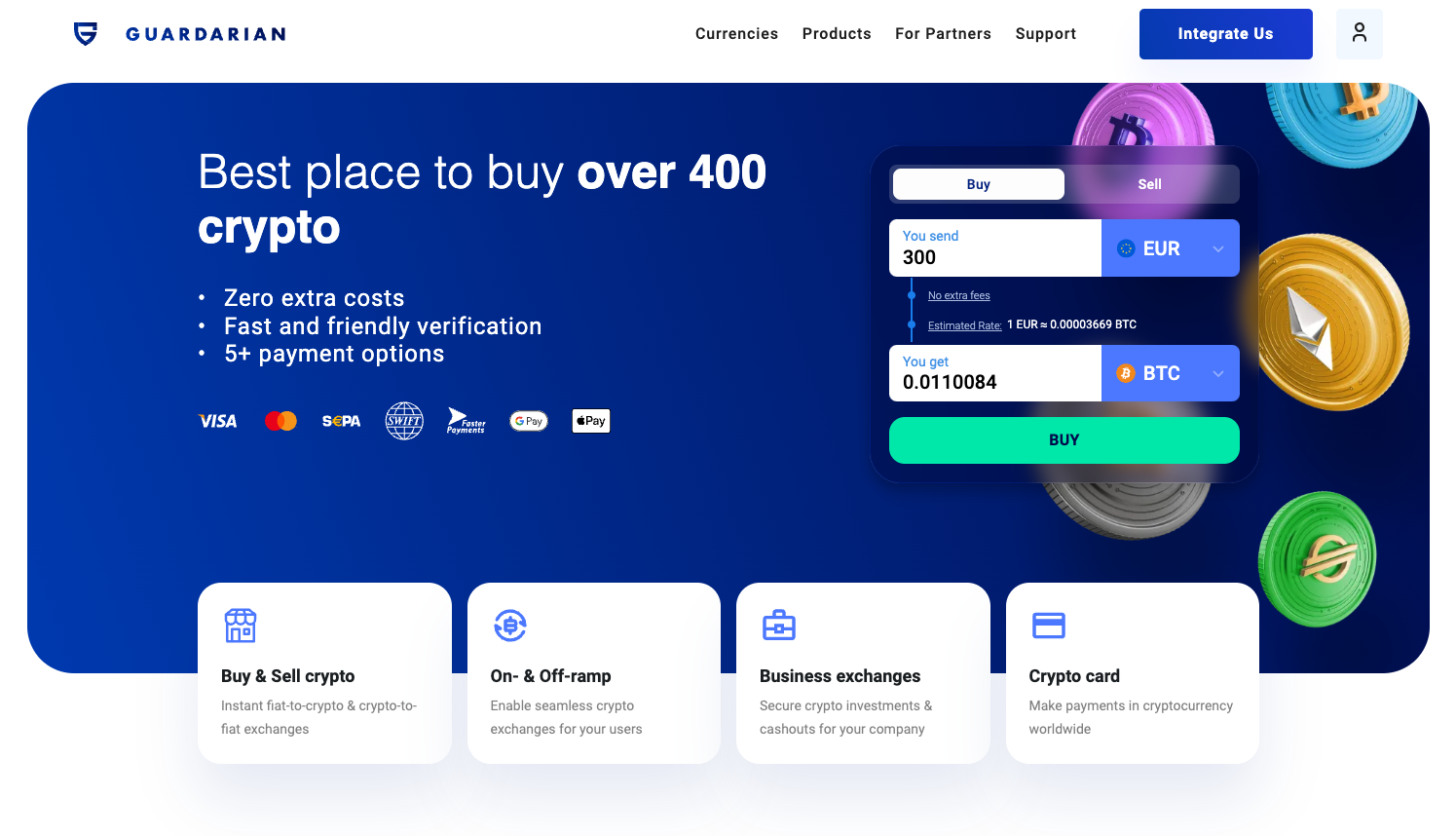

5. Invest in crypto easily with Guardarian

To create your ideal crypto portfolio, you will need a solid platform to buy and sell your tokens at. At Guardarian, we have streamlined all our features to support crypto investors at every level in developing their portfolios.

Instant crypto exchanges

With us you can instantly buy and sell over 400 cryptos using all the major payment methods (credit cards, debit cards, etc.). Not only do we operate with a high level of security but we are also non-custodial. This means that we don’t hold on to your assets, instead directing them straight to your address of choice.

Auto-invest in your favourite crypto

We also offer custom features to help you invest with as little effort as possible. For example, you can use our auto-investment feature that will periodically invest a certain amount of fiat currency into crypto assets of your choice, e.g. $100 worth of Bitcoin to be bought every month. You can begin auto-investing in your personal cabinet after making your first exchange.

Invest into crypto without registration

Here’s how you can invest into any crypto with us in 5 easy steps:

- Go to www.guardarian.com.

- Select what you want to buy, how you want to pay as well as the desired amount and click “Buy”.

- Enter your wallet address and choose your payment method.

- Complete our fast and intuitive checkout process. No registration required.

- Check your wallet and we hope to see you soon. 😉

It’s as easy as that. After the first exchange a personal cabinet will become available to you. You can use that to set up auto-investing, check your transaction history and more.

So come give us a try and we guarantee that you will not leave disappointed. 😌

Conclusion

In conclusion, creating an ideal crypto portfolio will take some time and research on your part but the potential rewards can definitely be worth the effort. As we’ve discussed in this article, you’ll need to:

- Define your investment goals, including your risk tolerance and the types of tokens you’re willing to invest in

- Conduct research and analysis on both blockchain technology and different crypto projects.

- Build your portfolio, dividing your investment among a number of tokens

- Engage in the best practices for maintaining your ideal crypto portfolio

- Check out Guardarian for the best possible rates, fast transactions and helpful investment tools.

Crypto investing cannot be learned through theory – it requires practice. And though some mistakes are unavoidable, we hope that the things mentioned in this article will help you not to fall for some rookie missteps and accelerate your learning as a crypto investor. ✨

Follow our socials to stay up to date with the latest crypto news and get other informative articles like this one.

Keep in mind, that there is always the risk of seeing your investment go down in value due to price fluctuations. The information in this article is not an investment advice. Make sure your portfolio aligns with your investment objectives and risk tolerance by reviewing it regularly and investing only money you can afford to lose.