The global stablecoin market is heating up, but regulators are increasingly stepping in. Recently, the Hong Kong Monetary Authority (HKMA) warned investors that no stablecoin issuers have been approved in Hong Kong, and marketing such products is considered illegal. This move is the first real test of Hong Kong’s new regulatory framework for stablecoins, which came into effect in August 2025. The rules impose strict licensing, capital, and governance requirements, making it difficult for new projects to enter the fast-growing digital asset market.

AnchorX Stablecoin Faces Regulatory Hurdles

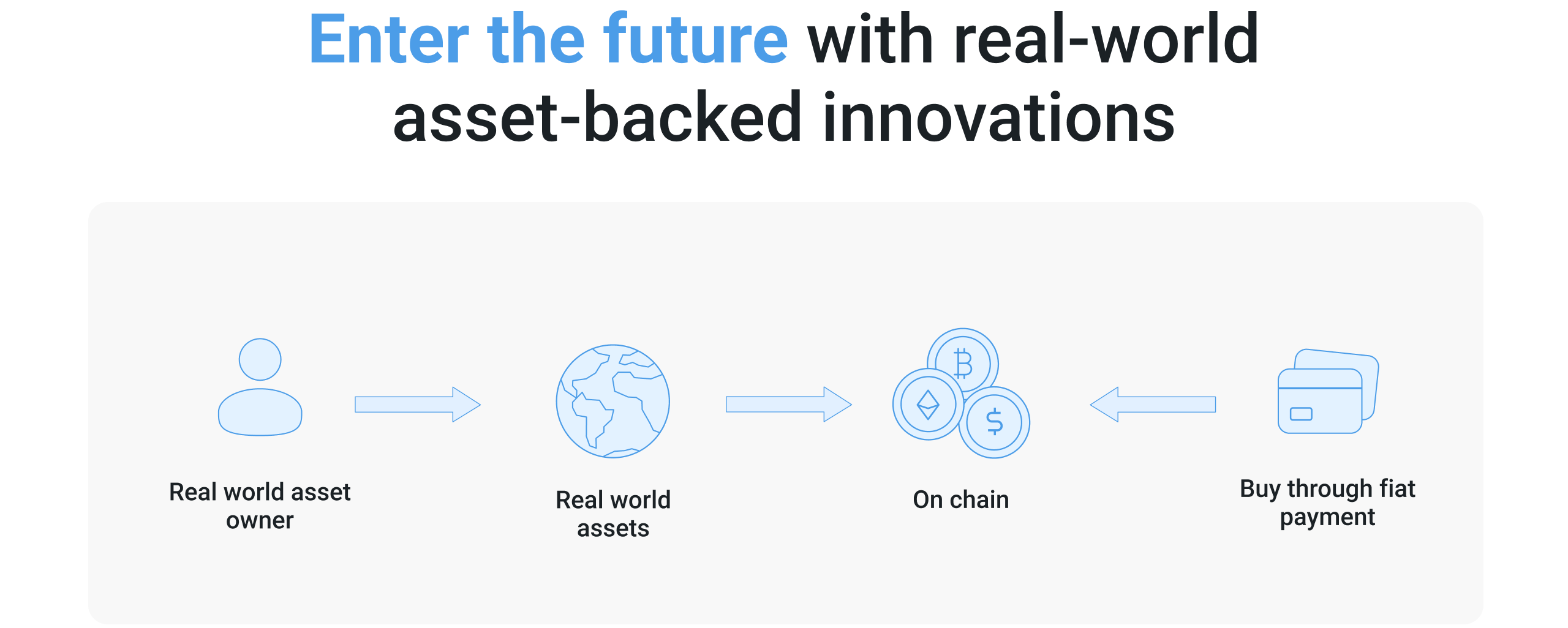

Hong Kong-based AnchorX recently launched an offshore yuan stablecoin, claiming a license from Kazakhstan’s Astana Financial Services Authority. The coin is intended to ease cross-border payments for Chinese companies and Belt and Road Initiative participants. AnchorX also plans to integrate its stablecoin into digital-asset trading and real-world asset (RWA) tokenization, allowing investors to buy RWA through tokenized platforms.

However, the China Securities Regulatory Commission (CSRC) instructed some Hong Kong brokerages to halt tokenization operations to improve risk management. Industry insiders, like Augustine Fan from SignalPlus, noted that efforts to merge crypto with traditional finance “pulled back” because many projects were rushed without proper infrastructure. Regulators are emphasizing real-world applications rather than projects that ride short-term trends.

USDT Remains the Leading Stablecoin

Globally, stablecoins continue to grow. On-chain data shows the market reached a new all-time high of $294.76 billion in the last 30 days, with 192 million holders. Tether’s USDT dominates with a $173 billion market cap, accounting for 59% of the sector. Circle’s USDC and USDe follow with $73.6 billion and $14.432 billion, respectively.

For investors entering the crypto space, the first step often involves stablecoins. Many traders start by choosing a reliable token to fund trades or store value. You can buy USDT on major exchanges to participate in crypto trading safely and take advantage of blockchain-based opportunities.

Europe’s Challenge to US Dominance

Europe is now taking steps to counter the US dominance in stablecoins. Nine banks, including ING and UniCredit, plan to launch a euro-denominated stablecoin via a new Amsterdam-based company. This initiative is designed to provide a regulated euro-backed alternative to USDT and USDC.

Although euro-denominated stablecoins currently account for just $620 million, this push shows Europe’s ambition to offer an alternative for investors who prefer euros. Once launched, it will provide another option for those looking to buy crypto in the eurozone without relying solely on US-backed stablecoins.

Key Takeaways

- Regulatory compliance is essential: Hong Kong’s crackdown shows why legality matters when choosing stablecoins.

- USDT is still the market leader: Ideal for liquidity, trading, and cross-border payments.

- Diversification is valuable: Europe’s euro-backed stablecoin and tokenized RWAs offer new opportunities.

- Practical steps for newcomers: Start by funding your account with stablecoins, such as USDT, explore blockchain-based projects to buy RWA, and diversify your portfolio by selecting other cryptocurrencies.