Let’s be honest: in 2026, liquidity is the plumbing of your business. If the pipes are too small, your growth leaks away through slippage and high fees. For companies scaling in the digital asset space, standard exchanges often feel like trying to run a factory on a garden hose. That is where Crypto OTC (Over-the-Counter) trading comes in.

In this guide, we’ll break down what “OTC in crypto” means for your bottom line and why choosing a boutique partner like Guardarian provides the agility that Wall Street giants simply can’t match.

Key Takeaways

- Minimize Costs: Lock in fixed rates to avoid price impact and slippage on all high-volume crypto otc deals.

- Low Entry Barrier: Scale with flexible B2B minimums of $10,000–$15,000 instead of rigid institutional gates.

- Technical Security: Verify your workflow with test transactions as low as $5,000–$10,000 before scaling.

- Direct Support: Skip the queues with a Personal Account Manager to handle MiCA compliance in real-time.

- Market Depth: Trade over 1,000 cryptocurrencies, including emerging niche tokens and Layer-2 assets.

- Rapid Settlement: Utilize SEPA Instant for smaller non-OTC trades with bank confirmations in under 10 seconds.

What is OTC in Crypto and Why Does Your Business Need It?

Crypto OTC trading is the private execution of large-volume digital asset trades outside of public order books. Unlike retail exchanges, where a large “buy” order can spike the price against you, OTC desks facilitate peer-to-peer transactions at a fixed, pre-agreed rate.

The bottom line? For any transaction exceeding $10,000, using a crypto OTC desk isn’t just a luxury—it’s a risk management necessity. It ensures:

- Zero Price Impact: Your trades don’t move the market.

- Deep Privacy: High-volume moves stay off public trackers until settlement.

- Tailored Liquidity: Access to assets that might lack depth on standard platforms.

The Math of Market Impact: Why OTC Wins the Execution Game

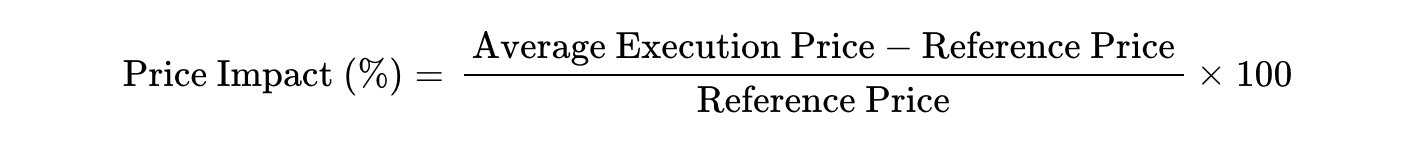

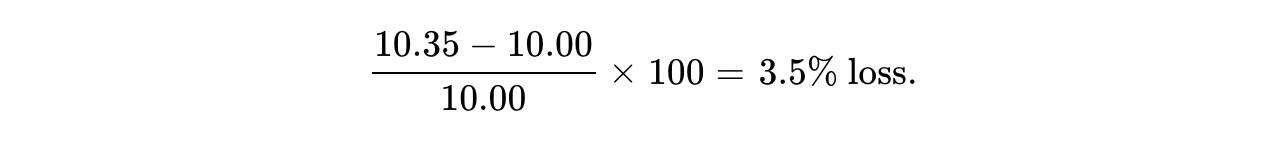

To understand why Institution treasurers prefer OTC in crypto, you have to look at Price Impact. On a standard exchange, a large order walks the book, eating through various price levels. The formula to calculate this execution efficiency is:

A Concrete Example: The $500,000 Buy Order

Imagine your company needs to acquire $500,000 worth of a mid-cap token for a project inventory.

- On a Standard Exchange (CEX): The “Reference Price” is $10.00. However, there is only $100,000 worth of liquidity at that price. To fill your order, the matching engine buys at $10.10, $10.25, and finally $10.50.

- Your Average Execution Price ends up being $10.35.

- Using the formula:

- Total Hidden Cost: Your $500,000 purchase just cost you an extra $17,500 in slippage alone.

- With Guardarian OTC: You submit a request to your manager. We tap into our private network and provide a single, fixed quote of $10.05 “all-in.”

- Price Impact: 0%. Your rate is locked.

- Net Savings: You save $15,000 and eliminate the risk of a sudden spike during execution.

Guardarian vs Others: A Boutique Crypto OTC experience

When searching for the best OTC crypto exchange, names like Cumberland and Kraken often appear. While these are reputable firms, their “institutional-first” models create barriers for many modern businesses.

The Entry Barrier

Giants like Cumberland often require discretionary investments of $10,000,000 or rigid $100,000 minimum trades. Guardarian is built for growth, offering standard entry points from $10,000 to $15,000. To ensure total peace of mind, we even facilitate test transactions as low as $5,000 to $10,000 so you can verify the “rails” before scaling up.

Guardarian’s Advantage: We provide a “boutique” experience. We offer institutional-grade security, but with the flexibility to handle a wider range of business volumes without the $10M gatekeeping.

Asset Diversity

Kraken OTC and B2C2 focus primarily on “Blue Chip” assets. While B2C2 excels in stablecoin swaps, its asset list is often narrower. By prioritizing top-tier tokens, these desks frequently bypass the high-growth mid-cap tokens

and emerging Layer-2 ecosystems where many innovative B2B projects are actually being built.

Guardarian’s Advantage: We support over 1,000+ cryptocurrencies across multiple networks, including Arbitrum and Polygon. If your business needs exposure to niche tokens, we provide the gateway that larger desks ignore.

Support and Onboarding

Most industry giants, including providers like Banxa or Simplex, operate through automated ticket-based portals. While this works for retail users, it creates a dangerous bottleneck for B2B partners.

Guardarian’s Advantage: Every business partner at Guardarian is assigned a Personal Account Manager. Whether you’re navigating in US, EU or Dubai, you have a human expert to call.

The G-Series: A Full-Stack Ecosystem for Your Treasury

Guardarian provides an integrated suite of tools called the G-Series, designed to make crypto “invisible” in your daily operations.

- G-OTC: High-limit trading with preferential rates and VIP support.

- G-Payments: An all-in-one gateway supporting 50+ fiat currencies and 1,000+ tokens.

- G-OnePay: A permanent deposit address that automatically converts crypto to fiat and hits your bank account in seconds.

- G-Custody: Bank-grade “cold wallet” storage with REST API integration for compliant asset management.

- G-RWA: Your bridge to tokenized Real World Assets, from treasuries to commodities.

Try Crypto OTC for Business with Guardarian!

The next decade of finance won’t be decided by the price of Bitcoin, but by the “plumbing”—the infrastructure that allows capital to move without friction. Choosing Guardarian means choosing a partner that provides the asset diversity, personal support, and clarity your business deserves.

FAQ

- Guardarian Ecosystem: guardarian.com/business

- Cumberland DRW Requirements: cumberland.io/requirements

- Kraken OTC & Pro: kraken.com

- MiCA Compliance Tracker: lw.com

- Price Impact & Slippage Dynamics: cube.exchange and sei.io

- Stablecoin Settlement Efficiency: binance.com/square

- B2C2 Stablecoin Interview: thepaypers.com