In 2026, cryptocurrency is globally recognized as property or a digital asset, meaning every sale, trade, or “spend” is a taxable event. The primary focus for the 2026 filing season is the implementation of Form 1099-DA in the US and the CARF framework globally, which provides tax authorities with automated transaction data from exchanges.

United States: The Era of Form 1099-DA and the “OBBB”

The US tax landscape is currently shaped by two major forces: the full integration of Form 1099-DA (Digital Asset Proceeds From Broker Transactions) and the tax relief provisions of the One Big Beautiful Bill (OBBB) signed in 2025.

Form 1099-DA means the IRS now receives a direct copy of your trading activity from brokers like Coinbase and Kraken. For the 2026 tax year, brokers must report both gross proceeds and cost basis for assets acquired after January 1, 2025.

The US landscape is defined by the permanent 37% top rate under the OBBB and the transition to mandatory broker reporting.

Tax Formula (Short-Term Gains):

Practical Example (USA):

An investor sells 1 BTC in 2025 (filed in 2026) that was held for 6 months.

- Proceeds: $60,000

- Cost Basis: $40,000

- Ordinary Income Rate: 24% (based on income bracket)

- Calculation: ($60,000 – $40,000) x 0.24 = $4,800 Tax Due

US Crypto Tax Rates and Deadlines 2026

| Provision | Details for 2026 |

| Short-Term Capital Gains | Assets held ≤ 1 year; taxed as ordinary income (10% to 37%). |

| Long-Term Capital Gains | Assets held > 1 year; taxed at 0%, 15%, or 20% based on income. |

| 0% Long-Term Rate Threshold | Taxable income up to $48,350 (Single) / $96,700 (Married). |

| Wash Sale Rule | Currently does not apply to spot crypto; the loophole remains open as of Feb 2026. |

| Form 1099-DA Receipt | Expected by Jan 30, 2026 (Coinbase/Kraken delays may extend to March 17). |

| Filing Deadline | April 15, 2026. |

Guardarian Edge: Be aware of the “Basis Gap”. If you transferred Bitcoin from a hardware wallet to an exchange to sell, your 1099-DA might show a $0 cost basis. Guardarian provides downloadable, timestamped purchase receipts that allow you to manually reconcile this on Form 8949, ensuring you only pay tax on your actual gains, not the full sale price.

Europe: MiCA Regulation and Global Transparency (CARF)

Europe has become the world leader in regulatory clarity thanks to the Markets in Crypto-Assets (MiCA) regulation and the DAC8 directive. Starting January 1, 2026, 48 jurisdictions (including most of the EU and the UK) began active data collection under the OECD’s Crypto-Asset Reporting Framework (CARF).

Tax Formula (United Kingdom):

Practical Example (United Kingdom):

An investor sells ETH with a total gain of £13,000 in the 2025/26 tax year.

- Total Gain: £13,000

- Allowance: £3,000

- Taxable Gain: £10,000

- CGT Rate: 24% (Higher rate taxpayer)

- Calculation: £10,000 x 0.24 = £2,400 Tax Due

Europe Regional Crypto Tax Summary 2026

| Country | Capital Gains Tax Rate | Key Rule for 2026 |

| United Kingdom | 18% or 24% | CGT allowance for 2026 is fixed at £3,000. |

| Germany | 0% (after 1 year) | “HODL” for 365 days, and the entire gain is tax-free. |

| Portugal | 28% (under 1 year) | Assets held > 1 year are tax-free; crypto-to-crypto trades are tax-free. |

| France | 30% (Flat Tax) | Occupied with a single fixed levy (PFU) for occasional investors. |

| Italy | 33% | Substitute tax on crypto gains recently increased from 26%. |

Asia: Strategic Pivots in Japan and India

Asia is currently a tale of two extremes. Japan is actively moving toward a more friendly 20% flat tax to encourage domestic innovation, while India maintains one of the strictest regimes in the world.

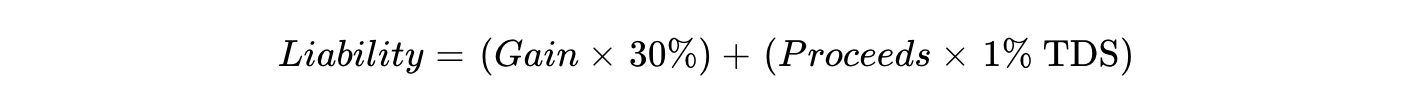

Tax Formula (India):

(Note: Losses cannot be offset against gains in India).

Practical Example (India):

An investor buys 1 BTC for ₹35,00,000 and sells it for ₹50,00,000.

- Gain: ₹15,00,000

- Flat Tax (30%): ₹4,50,000

- TDS (1% of proceeds): ₹50,000 (deducted by exchange at sale)

- Calculation: ₹4,50,000 (Total Tax) – ₹50,000 (Prepaid TDS) = ₹4,00,000

Asia Regional Crypto Tax Summary 2026

| Country | Tax Treatment | Recent Updates for 2026 |

| Japan | 20% (Proposed Flat Tax) | Transitioning away from “Miscellaneous Income” rates of up to 55%. |

| India | 30% Flat Tax + 1% TDS | No loss offsetting allowed; 1% Tax Deducted at Source on all trades. |

| Singapore | 0% (Individuals) | No capital gains tax for individuals; 9% GST on some services. |

| Thailand | Progressive (5% to 35%) | 10% excise duty on exchange fees replaced the old 3% volume tax. |

| UAE (Dubai) | 0% | Continues to be a global tax haven for individual crypto investors. |

Africa: New Regimes in Nigeria and Kenya

African nations are rapidly integrating crypto into their formal financial systems to boost revenue and improve crypto tax reporting obligations. Nigeria recently overhauled its entire tax structure, and Kenya has pivoted to a more balanced fee-based tax.

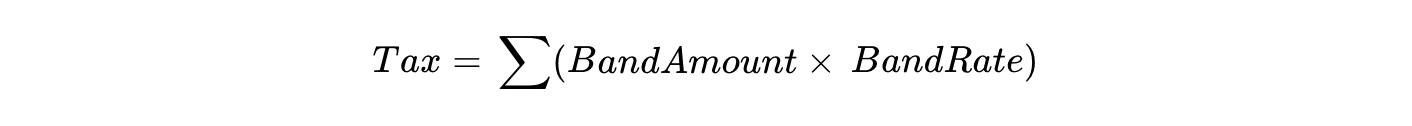

Tax Formula (Nigeria – Progressive):

Practical Example (Nigeria):

An investor realizes a total annual crypto gain of ₦3,000,000.

- Band 1: First ₦800,000 at 0% = ₦0

- Band 2: Remaining ₦2,200,000 at 15% = ₦330,000

- Calculation: ₦0 + ₦330,000 = ₦330,000 Total Tax

Africa Regional Crypto Tax Summary 2026

| Country | Individual Tax Rate | Implementation Detail |

| Nigeria | 15% to 25% | Gains are now added to regular income; threshold for 0% is ₦800,000. |

| Kenya | 10% Excise Duty | Applied only to fees charged by exchanges (VASPs), not the trade volume. |

| South Africa | Progressive (18% to 45%) | SARS is implementing CARF rules for full visibility by March 1, 2026. |

Advanced 2026 Tax Optimization Strategies

Despite the tighter net, the 2026 landscape still offers legal pathways to minimize your liability.

- Strategic Tax-Loss Harvesting: Since the wash sale rule does not apply to spot crypto in the US, you can sell a losing position on Dec 31 and repurchase it on Jan 1 to lock in a deduction.

- Philanthropy: Donating appreciated crypto to a 501(c)(3) charity allows you to bypass capital gains tax entirely while claiming a deduction for the Fair Market Value (FMV).

- Specific Lot Identification: Moving away from FIFO (First-In, First-Out) toward HIFO (Highest-In, First-Out) can significantly lower your capital gains, but requires the “wallet-by-wallet” tracking now mandated by the IRS.

- Optimization with Guardarian: Successful HIFO tracking requires “wallet-by-wallet” precision. Guardarian’s platform is designed for the modern investor, offering easy data exports that integrate seamlessly with enterprise-ready tax apps. This ensures your cost basis data is accurate, whether you are harvesting losses or optimizing via HIFO.

Disclaimer: Accurate Reporting and Verification

Leverage Modern Calculators for Precise Tracking

In the complex world of digital assets, manual spreadsheets are a relic of the past. To accurately manage your crypto capital gains tax, you must utilize a professional crypto tax calculator or dedicated crypto tax software. These tools streamline the aggregation of thousands of trades, ensuring you don’t miss any taxable events during the 2026 filing season.Verify and Validate via Official Sources

While software simplifies the process, the final word on your obligations always rests with official authorities. The IRS new tax rule, digital income guidelines, and global frameworks like CARF mean that your reporting must be audit-ready. Always verify your specific crypto tax reporting requirements on primary government portals.

Conclusion: Use the Right Tools

In 2026, manual spreadsheets will no longer sufficient. Compliance is a prerequisite for participating in the global digital economy. By staying informed on federal crypto tax reporting requirements and choosing a reliable partner like Guardarian, you can protect your portfolio and ensure your financial longevity.

Compliance is no longer a choice—it is a prerequisite for participating in the global digital economy. By staying informed on the IRS new tax rule, digital income, and regional shifts like Japan’s 20% pivot, you can protect your portfolio and ensure your financial longevity.

FAQ

- “Crypto Tax Loss Harvesting for US Expats in 2026 (2025 filing).” Online Taxman, onlinetaxman.com.

- “Crypto Taxes: The Complete Guide (2026).” CoinLedger, coinledger.io/guides/crypto-tax.

- “Cryptocurrency Tax Guide 2025.” Kelly+Partners Accountants Burbank, neumeistercpa.com/cryptocurrency-tax-guide-2025.

- “Cryptocurrency Taxes: The Complete 2025-2026 Guide for Investors and Business Owners.” Beancount, 16 Jan. 2026, beancount.io/blog/2026/01/16/cryptocurrency-tax-guide-what-you-need-to-know.

- “Don’t Miss This New Crypto Tax Form Before You File Your Tax Return in 2026.” CNET, cnet.com/tech/services-and-software/crypto-new-tax-form-rules.

- “Form 1099-DA: IRS Guidance for Digital Asset Brokers.” Sovos, sovos.com/blog/trr/what-is-form-1099-da-and-how-does-it-impact-crypto-transactions.

- “Form 1099-DA: What Crypto Investors Need to Know for 2026.” Kugelman Law, kugelmanlaw.com/blog/form-1099-da-delays-crypto-tax-reporting.

- “Google E-E-A-T: What Is It & How To Demonstrate It For SEO.” Search Engine Journal, searchenginejournal.com/google-e-e-a-t-how-to-demonstrate-first-hand-experience/474446.

- Internal Revenue Service. “Instructions for Form 1099-DA (2025).” IRS.gov, irs.gov/instructions/i1099da.

- —. “Understanding your Form 1099-DA.” IRS.gov, irs.gov/businesses/understanding-your-form-1099-da.

- “IRS Form 1099-DA.” Coinbase Help, help.coinbase.com/coinbase/taxes/forms-reports/1099da.

- “Overview of Federal Crypto Tax Reporting Requirements: Business Law and Litigation Defense Services.” Plunkett Cooney, plunkettcooney.com/tax-law-estate-plans-probate-business-succession/crypto-tax-reporting-requirements.

- “The 2026 Tax Filing Season: What to Know.” Bipartisan Policy Center, bipartisanpolicy.org/issue-brief/the-2026-tax-filing-season-what-to-know.

- “Wash Sale Rule: 2026 IRS Rules.” TokenTax, tokentax.co/blog/wash-sale-trading-in-crypto.