Choosing a crypto-fiat bridge in 2026 is a high-stakes decision for any fintech project or e-commerce merchant. Your on-ramp is the first point of contact for your customers, and its efficiency directly impacts your conversion rates and brand reputation.

In the current market, businesses often find themselves comparing Guardarian, a high-agility gateway, and Vault (Vault.ist), a structural Digital Banking-as-a-Service (DigiBaaS) provider. While both facilitate value movement, they serve very different operational needs.

This breakdown provides a detailed comparison of Guardarian vs Vault to help you decide which infrastructure partner is best equipped to scale your project in 2026 with the lowest risk and highest efficiency.

Key Takeaways

- Asset Support: Guardarian leads the industry with support for over 1,000 cryptocurrencies, whereas Vault offers a more restricted selection of approximately 100 tokens.

- Time-to-Market: Guardarian integration is designed for speed, with a customizable widget that can be live in 10 minutes. Vault’s structural build typically requires 10 to 14 days.

- Upfront Costs: Guardarian operates on a zero setup fee model. Vault requires a significant capital investment, with onboarding fees ranging from $60,000 to $150,000.

- Maintenance: Guardarian is performance-based with no monthly minimums. Vault charges roughly $10,000 per month for platform maintenance.

- Service Model: Guardarian provides a boutique experience with a Dedicated Personal Account Manager for B2B partners, while Vault focuses on automated infrastructure support.

Guardarian vs Vault: Which on-ramp is better?

Determining which on-ramp is “better” depends entirely on your project’s scope. If your goal is to integrate a high-performance, low-friction payment bridge that supports a massive variety of assets with no financial risk, Guardarian is the superior choice. Its ability to go live in minutes with zero setup costs makes it the industry standard for agile Web3 projects that need immediate ROI.

Vault is designed for established enterprises that want to launch their own branded “neo-bank” and have the budget for high fixed costs. However, for the majority of businesses simply needing to move funds between fiat and crypto, Guardarian provides the versatility, asset depth, and time-saving features required to stay competitive in the fast-moving 2026 economy.

Guardarian overview

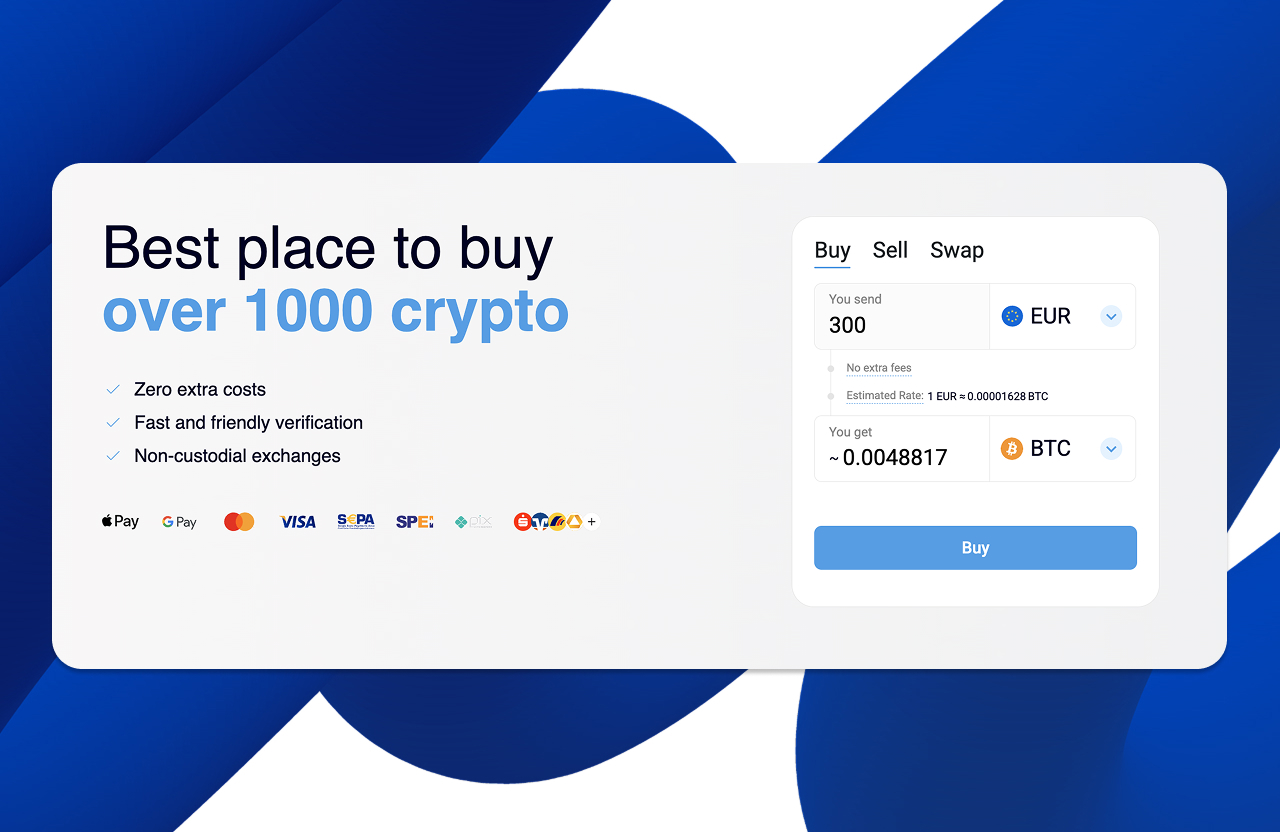

Guardarian is a premier, licensed crypto-fiat bridge founded in 2017. It is built on a non-custodial architecture, meaning it facilitates the immediate transfer of assets into the user’s private wallet without holding funds on the platform. This model significantly reduces platform risk and aligns with the decentralized ethos of modern crypto users. Trusted by major industry players like Ledger and Trust Wallet, Guardarian has expanded its suite to include institutional OTC desks, e-commerce payment rails (G-Payments), and specialized tokenization support for Real-World Assets (G-RWA).

Vault overview

Vault is a structural Digital Banking-as-a-Service (DigiBaaS) provider. It allows companies to launch their own branded financial ecosystems, utilizing middleware to connect banking rails with digital assets. Vault functions as a custodial middleware provider, storing user funds in segregated accounts with global banking partners. Since pivoting to a dedicated DigiBaaS model in 2023, Vault has focused on providing a “bank-in-a-box” solution for clients who wish to own the entire user financial journey rather than just a high-speed payment bridge.

What are Guardarian and Vault: Crypto payment solutions

Both Guardarian and Vault serve as essential bridges between traditional banking and the digital asset economy, but their business models represent opposite ends of the efficiency spectrum:

| Comparison Point | Guardarian | Vault |

|---|---|---|

| Primary Service | High-Agility Crypto Gateway | White-Label Infrastructure Host |

| Setup Fees | €0 (Zero upfront costs) | $60,000 – $150,000 |

| Monthly Maintenance | None (Performance-based) | ~$10,000 / month |

| Launch Timeline | ~10 Minutes (Widget) | 10 – 14 Days (Minimum) |

| Crypto Asset Count | 1,000+ Tokens | ~100 Tokens |

| Custody Model | Non-Custodial (User control) | Custodial (Segregated accounts) |

| Support Model | Dedicated Personal Manager | General Infrastructure Support |

| Business Clients | 400+ Active B2B Partners | 40+ White Label Clients |

| Financial Risk | Zero (Pay-as-you-grow) | High (Heavy CAPEX required) |

Business features breakdown: Guardarian vs Vault

Integration & Settlement

Guardarian is the industry benchmark for rapid deployment. Its “Plug & Play” widget can be integrated into any website via an iframe in about 10 minutes, requiring zero technical expertise. For native app experiences, Guardarian offers a robust REST API with developer-friendly documentation. Transactions are settled rapidly, with crypto delivered to the user’s wallet typically in 5 to 20 minutes.

Vault’s integration is more structural. While they claim a “rapid” deployment of 10 to 14 days, this involves a deep setup of banking rails and compliance middleware. Because Vault involves custodial accounts and traditional banking partnerships, the settlement process can be subject to the operational hours and compliance speeds of traditional partner banks like HSBC.

Fees & Final rate transparency

Guardarian utilizes a highly transparent “all-in” rate model. The final price shown to the user already includes all network, processing, and service fees. This eliminates “sticker shock” at the final checkout step, which is the primary cause of cart abandonment. For the business partner, Guardarian is free to integrate, with no setup or monthly maintenance fees.

Vault.ist operates on an enterprise SaaS model. Businesses face a high entry barrier with onboarding fees between $60,000 and $150,000, plus $10,000 monthly maintenance. While Vault allows partners to set their own fees for end-users, the high fixed costs require significant transaction volume to reach a positive ROI.

Experts use the following formulas to evaluate integration efficiency:

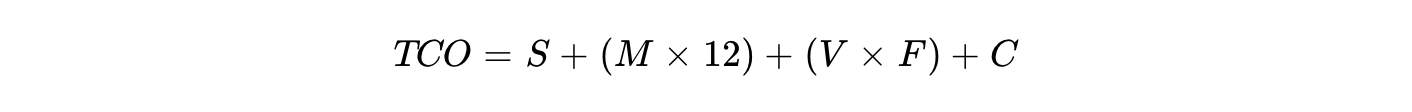

1. Total Cost of Ownership (TCO) for Year 1:

Where:

- S — Setup Fee.

- M — Monthly Maintenance.

- V — Annual Transaction Volume.

- F — Transaction Fee.

- C — Indirect costs (Compliance, Support).

For Guardarian, S and M are 0, making TCO linearly dependent on turnover.

For Vault, S and M create a heavy fixed load that only decreases in proportion at ultra-high volumes.

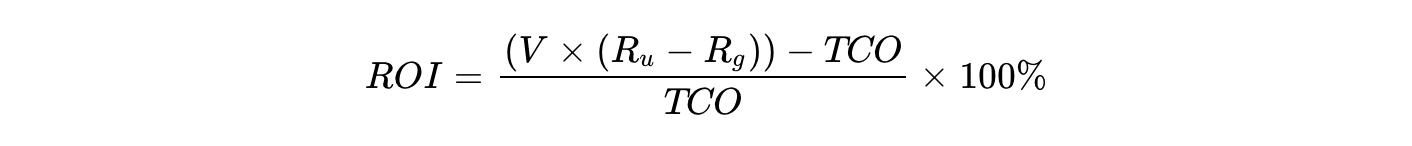

2. Partner Return on Investment (ROI):

Where:

- Ru — Rate charged to the end-user.

- Rg — Base gateway rate (All-in rate).

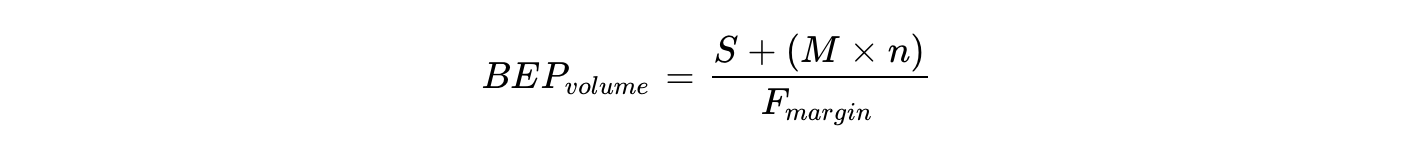

3. Break-even Point (BEP) for Vault:

Where n is the number of months in operation and Fmargin is the partner’s net margin.

Payment methods

- Guardarian excels in regional localization, supporting over 20 major payment methods. These include global standards (Visa, Mastercard, Apple Pay, Google Pay) and high-growth regional rails like PIX for Brazil, SPEI for Mexico, and Open Banking for Europe.

- Vault’s payment options are centered on its banking core. It provides multicurrency IBANs for SEPA and SWIFT transfers and allows for the issuance of virtual and physical card products. While comprehensive for “neo-banking,” Vault is less agile than Guardarian at integrating new regional alternative payment methods quickly.

Supported countries & Fiat currencies

- Guardarian has a massive global footprint, operating in over 170 countries and supporting 30+ fiat currencies (expanding to 50+ in its G-Payments suite). This makes it a powerful partner for businesses with a truly global user base.

- Vault claims coverage in 200 countries and supports 40+ fiat currencies. However, because Vault’s services are custodial and bank-dependent, actual availability is often restricted by the risk appetite and regulatory constraints of its underlying partner banks.

KYC & Compliance

Both platforms are strictly regulated.

- Guardarian is an licensed Virtual Asset Service Provider (VASP). Its KYC process is optimized to be “fast and friendly,” often completing in seconds for new users. Guardarian also offers simplified KYC flows for smaller transactions, reducing friction for new crypto buyers.

- Vault handles full bank-grade compliance, including KYC, KYB (Know Your Business), and KYT (Know Your Transaction). Because Vault is essentially launching a bank for its clients, the compliance burden is more rigorous and time-consuming than Guardarian’s agile gateway approach.

Supported crypto assets & Networks

- This is a clear area of Guardarian dominance. Guardarian supports over 1,000 cryptocurrencies across dozens of networks, including advanced Layer-2 solutions like Arbitrum, Polygon, and Optimism, and allows partners to integrate their own brand tokens.

- Vault focuses on a curated list of approximately 100 major assets. While Vault also allows integration of brand tokens, it lacks the massive “token supermarket” that Guardarian provides, which is essential for businesses serving a diverse Web3 audience.

| Asset Category | Popular 2026 Tokens | Guardarian | Vault.ist |

|---|---|---|---|

| Political/Meme Tokens | OFFICIAL TRUMP (TRUMP), KISHU | Yes | No |

| ISO 20022 Standards | XDC, HBAR, QNT, ALGO | Yes | Partial |

| Ecosystem Tokens | TON, Pulse (PLS), Kaspa (KAS) | Yes | No |

| Infrastructure L2s | ARB, OP, MATIC | Yes | Majors only |

| DeFi Blue Chips | NEXO, 1INCH, AAVE | Yes | Selective |

| Next-Gen Stablecoins | PYUSD, USDE, EURC | Yes | Yes |

| Utility Tokens | TIPSY, BTT, LUNC | Yes | No |

UX & Ease of use

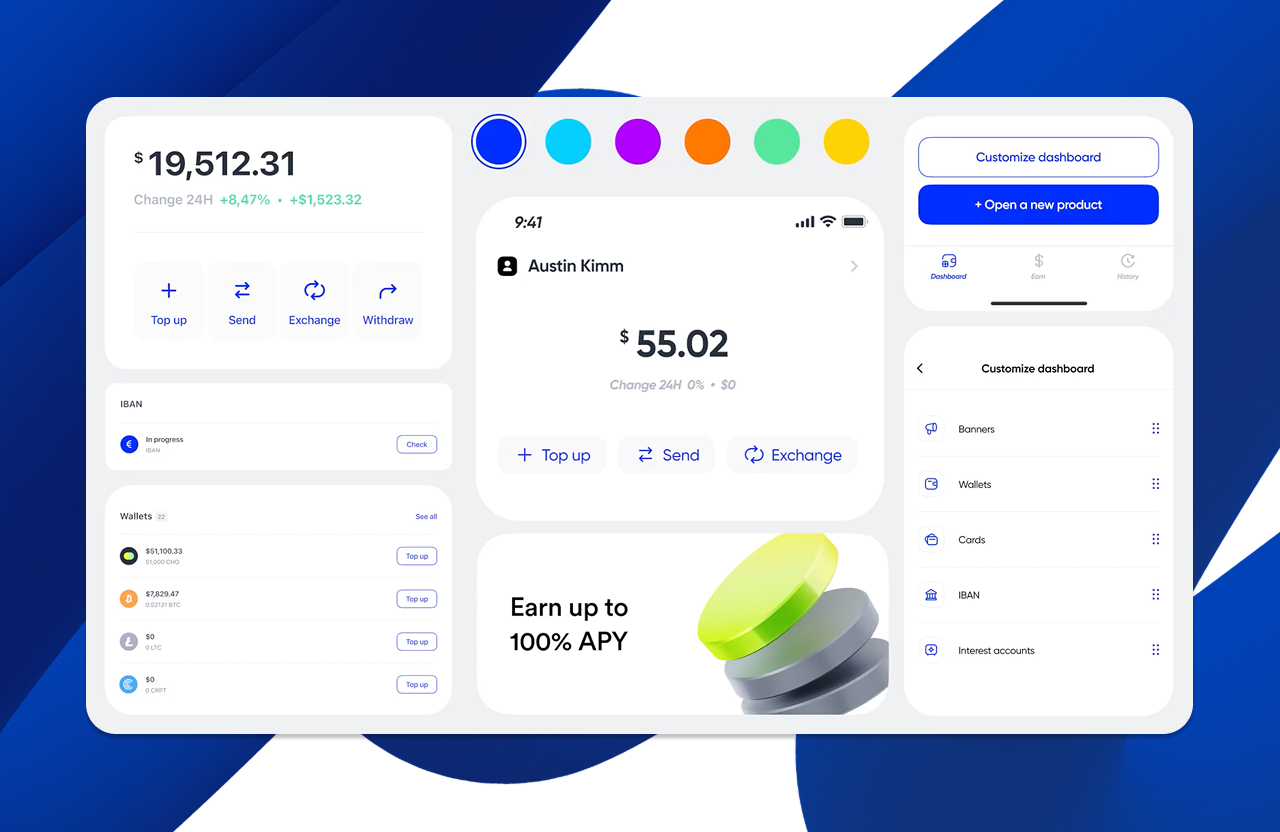

- Guardarian is built for speed and simplicity. The user journey is typically a three-step process: pick a coin, enter a wallet address, and pay. This “fast-exchange” feel is preferred by users who want to acquire crypto without the friction of a complex banking app.

- Vault provides a structured fintech experience. Its UX is that of a professional banking app, which is excellent for trust but involves more steps and mandatory account registration. For businesses looking for the highest possible conversion rate, Guardarian’s streamlined flow is generally more effective.

Delivery & Speed

- Guardarian is engineered for high-velocity delivery, aiming for completion in 5 to 20 minutes. Most card and instant bank transfers result in immediate crypto acquisition.

- Vault’s speed is variable. While internal transfers between Vault users are instant, external transactions using traditional banking rails (SWIFT/SEPA) can take longer, especially for first-time purchases or large amounts.

Refunds, chargebacks & Disputes

- Guardarian protects its partners with 3DS security for card payments and matched-name bank transfer requirements, resulting in a near-zero chargeback risk. As the regulated exchange of record, Guardarian assumes the operational risk of fraud, allowing its partners to focus on their core product.

- Vault, as a white-label infrastructure provider, often places more of the monitoring responsibility on the business partner. While Vault provides compliance tools, the business owner is more involved in managing the financial behavior of their user base.

Partner support

- The “Guardarian Advantage” is its boutique service model. Every B2B partner is assigned a Dedicated Personal Account Manager. This provides a direct human line for resolving technical or compliance issues instantly, which is a massive upgrade over ticket-only systems.

- Vault offers 24/7 customer support, but this is typically aimed at the end-users of the white-label platform. For the business partner, the relationship is often more automated and focused on technical maintenance.

Security measures & Trust

- Guardarian is non-custodial, which is the gold standard for crypto security. It never stores user assets; funds go directly to the user’s private wallet. This architecture eliminates the risk of platform hacks affecting user balances. Guardarian is licensed and adheres to the highest data encryption standards.

- Vault uses a custodial “segregated account” model, where funds are stored in partnership with major banks like HSBC. While Vault meets high security standards (OWASP), the custodial nature of the service requires users to place their full trust in Vault’s internal controls and bank-dependent infrastructure.

Real user opinions: What the community says

Reviews of Guardarian

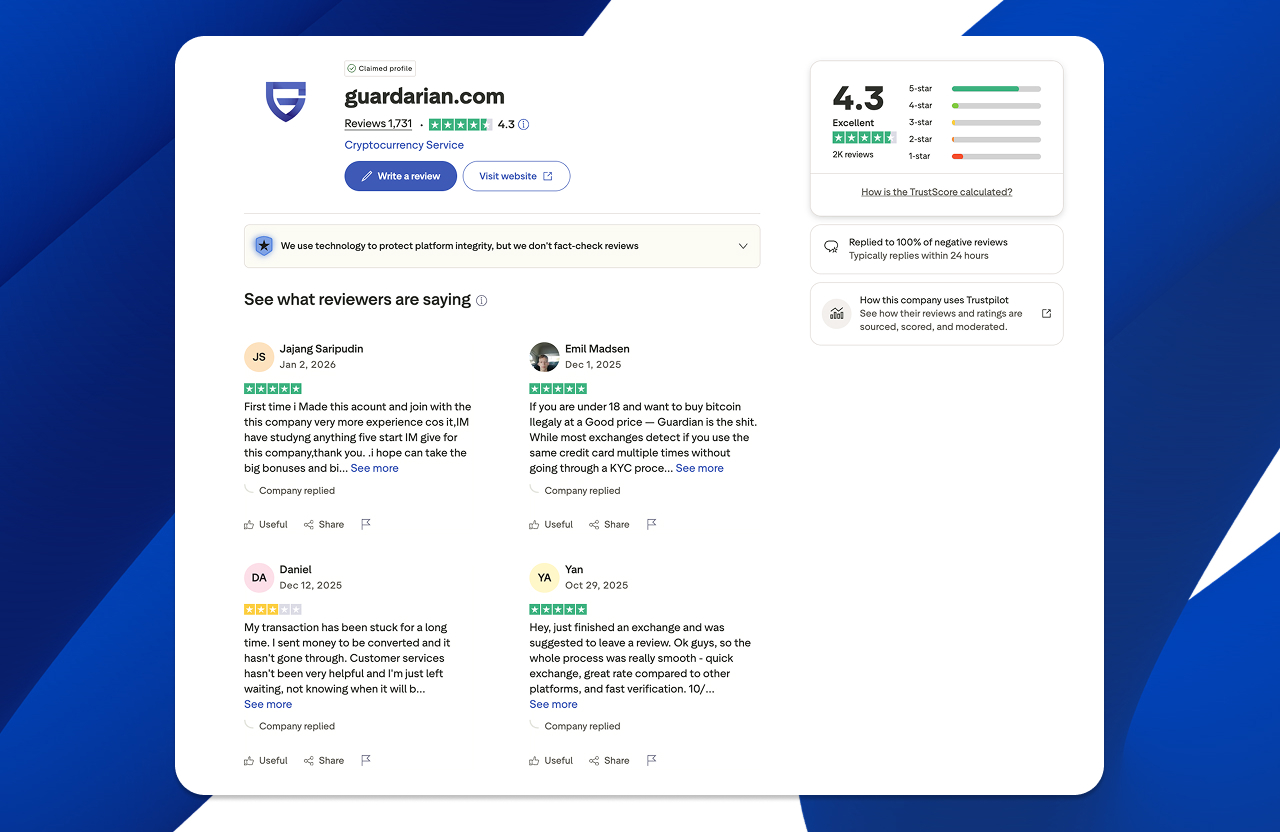

Guardarian maintains a strong Trustpilot score, with users frequently praising the platform’s transaction speed and ease of use. Reviewers like Louis T. and Jan B. have highlighted the “smooth process” and “fast execution” as key benefits. The platform is widely recognized as a “legit” and trustworthy bridge for instant crypto acquisition.

Reviews of Vault

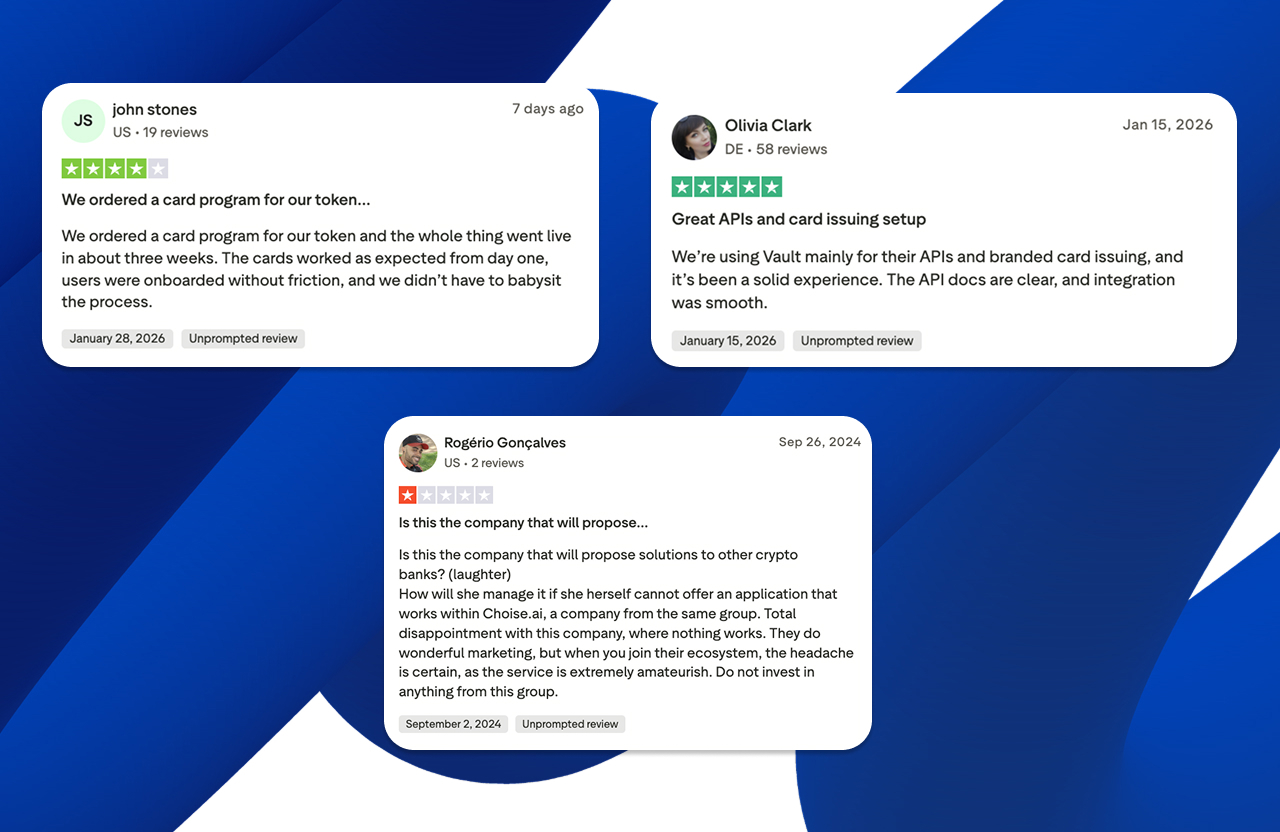

Vault (Vault.ist) has a lower Trustpilot score, based on a smaller sample size. Positive reviews mention the speed of launching a card program (within three weeks) and API documentation quality. However, some critical reviews have pointed to challenges in ecosystem integration and professional maturity compared to more established gateways.

Pros & Cons summary

Guardarian — Pros & Cons

| Pros | Cons |

|---|---|

| 1,000+ Assets (Unrivaled variety) | No physical card issuing (Gateway focus) |

| €0 Setup Costs and 10-min integration | Minimalist dashboard for some power users |

| Dedicated B2B Personal Manager | KYC triggers can vary by region |

| Transparent “All-in” rates (Zero gaps) |

Vault — Pros & Cons

| Pros | Cons |

|---|---|

| Full White-Label ecosystem | High Entry Cost ($60k-$150k) |

| Custom card issuance options | $10k/mo maintenance fees |

| Multicurrency banking middleware | Limited asset selection (~100 tokens) |

| 24/7 branded end-user support | Long structural integration cycle |

Which should you choose?

Choose Guardarian if…

- You need to support a vast range of niche tokens or multiple L2 networks (1,000+ assets).

- You want a launch-ready solution that takes 10 minutes to integrate with zero setup costs.

- You value personal service and want a dedicated manager for your account.

- You want to maximize conversion by showing users a simple, all-in price.

Choose Vault if…

- You are an enterprise that needs a full white-label bank host under your own brand.

- Your business model specifically requires issuing branded cards to your users.

- You have the budget for high fixed costs and CAPEX.

- You need to provide your users with segregated custodial accounts.

FAQ

How we compared Guardarian vs Vault

To provide an objective perspective, we analyzed the official documentation, technical specifications, and fee schedules of both providers as of 2026. We prioritized metrics critical to business operations, including time-to-market, cost of ownership, asset diversity, and regulatory licensing. Furthermore, we cross-referenced official claims with verified user feedback on Trustpilot and industry-wide case studies from partners like Ledger and Trust Wallet to ensure a professional and factual comparison.

- B2B Crypto Exchange & Fiat-to-Crypto Services | Guardarian for …, accessed February 11, 2026, https://guardarian.com/business

- Comparisons & Partnerships – | Guardarian, accessed February 11, 2026, https://guardarian.com/blog/category/comparisons-and-partnerships/

- Best Crypto Payment Gateways in 2025: Features, Fees, and Compliance Compared, accessed February 11, 2026, https://microblink.com/resources/blog/crypto-payment-gateway/

- Vault.ist | Everything Under One Roof – Cards. Banking. Crypto., accessed February 11, 2026, https://vault.ist/

- Targeting $180M in Revenue, Vault Aims to Lead the $50B Digital Crypto Banking Market, accessed February 11, 2026, https://fintech-alliance.com/news-insights/article/targeting-180m-in-revenue-vault-aims-to-lead-the-50b-digital-crypto-banking-market

- White Label Fintech Platform – Vault.ist, accessed February 11, 2026, https://vault.ist/white-label-fintech-platform

- Vault.ist Reviews | Read Customer Service Reviews of vault.ist, accessed February 11, 2026, https://www.trustpilot.com/review/vault.ist

- Buy, Sell, and Swap crypto on Guardarian | Fiat On/Off Ramp & Best …, accessed February 11, 2026, https://guardarian.com/

- Top 10 Crypto-Friendly Jurisdictions in 2026 – Global Overview, accessed February 11, 2026, https://gofaizen-sherle.com/blog/top-crypto-friendly-jurisdictions

- Vault.ist – Circle Alliance Directory, accessed February 11, 2026, https://partners.circle.com/partner/vaultist

- Guardarian vs MoonPay (2026): Fees, KYC, Limits & Speed, accessed February 11, 2026, https://guardarian.com/blog/guardarian-vs-moonpay/

- Guardarian – BitcoinWiki, accessed February 11, 2026, https://bitcoinwiki.org/wiki/guardarian

- Guardarian vs Overpay: Which Business solution is better?, accessed February 11, 2026, https://guardarian.com/blog/guardarian-vs-overpay/

- Guardarian Reviews – 2026 – Slashdot, accessed February 11, 2026, https://slashdot.org/software/p/Guardarian/

- Guardarian vs Simplex: On-ramp for Business review, accessed February 11, 2026, https://guardarian.com/blog/guardarian-vs-simplex/

- Read Customer Service Reviews of guardarian.com – Trustpilot, accessed February 11, 2026, https://www.trustpilot.com/review/guardarian.com