In the US alone, inflation has reached a 40-year high, with prices skyrocketing faster than wages, causing a lot of people to look for alternative assets to use as inflation hedges. And cryptocurrencies are often said to be such an inflation hedge nowadays.

But what many people don’t realize is the fact that Bitcoin itself is also an inflationary asset, and not only that but Ether, the native cryptocurrency of Ethereum, is also considered to be inflationary.

In that case though, what is the difference between inflationary and deflationary cryptos, and more importantly, which is better? Let’s find out together:

What does inflation mean?

The term “inflation” simply refers to the rate of increase in prices over a certain period of time. It is in itself just a broad measure which calculates the overall price or cost of living increase in a country.

In its lowest form, inflation is not that bad – it encourages people to spend which in turn stimulates economic growth.

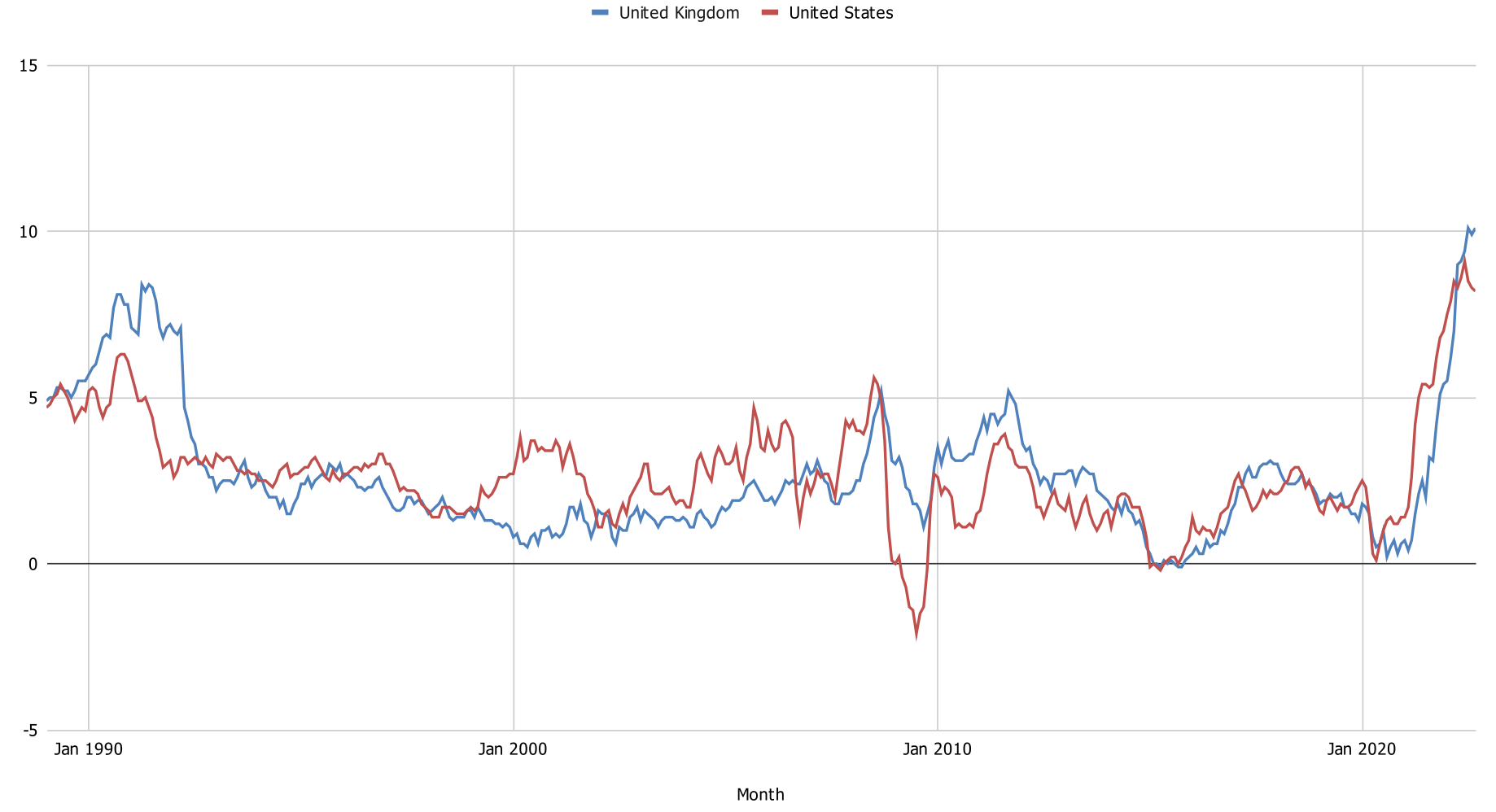

Inflation rates in the US and UK 1989-2022

But if wages can’t keep up with inflation, the masses can end up suffering exponentially as they can’t afford to spend money as much as they used to.

The US Federal Reserve is currently fighting to keep the inflation of fiat currencies around the 2% mark, but this does not apply to cryptocurrencies since they are decentralized.

What is an Inflationary Cryptocurrency?

An inflationary cryptocurrency is one that has an increasing number of tokens in its circulation.

In order to introduce new tokens on the market, these are mined by crypto miners, (like Bitcoin), or issued through staking validators (like Ethereum). And the reason for inflation in cryptocurrency is the same as with FIAT – to encourage participation.

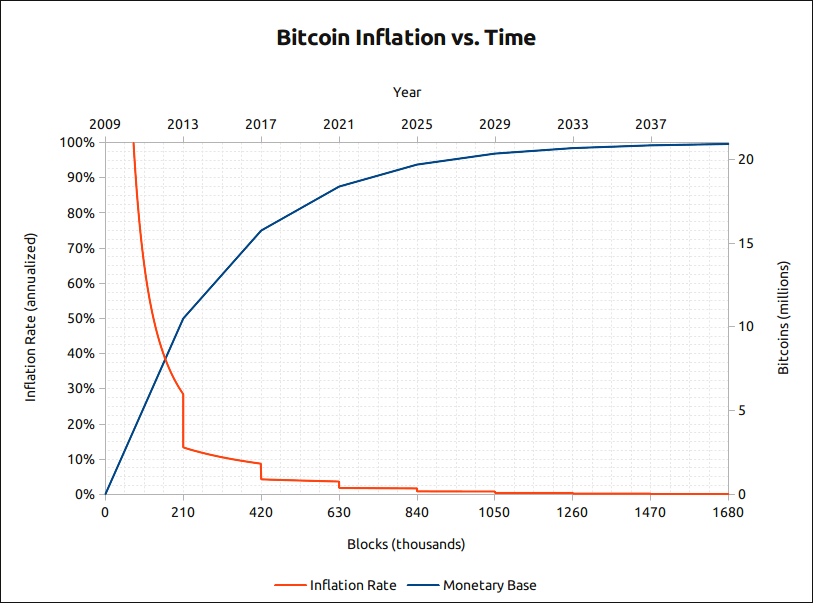

Bitcoin’s inflation rate

Many cryptocurrencies have fixed issuances, for example the Bitcoin protocol decreases the issuance of new coins at a fixed rate, as once the cap of 21 million bitcoins is mined, the minting will stop altogether.

On the other hand, Dogecoin has an unlimited supply of tokens, which means that new tokens can be produced infinitely. If the supply of Dogecoin outpaces the demand for it, the value of the currency will decrease over time.

Examples of Inflationary Cryptocurrencies:

Many popular cryptos are inflationary in nature. Here are just some examples of these:

- Bitcoin (BTC) – Bitcoin is an inflationary cryptocurrency with a supply hard cap of 21 million coins.

- Dogecoin (DOGE) – Dogecoin has a fixed issuance rate of 5 billion coins a year, which means that every time the issuance is reduced compared to the total suppply.

- Ethereum (ETHER) Ethereum has a burning protocol implemented, however the minted supply outpaces the burning rate, making Ethereum an inflationary cryptocurrency.

- Polkadot (DOT) – an inflationary currency, it uses a mechanism called parachain auctions to combat excessive inflation

- Avalanche (AVAX) – Avalanche has an inflation rate of almost 40%, which is much higher than, for example, Bitcoin (1.8%).

- Cosmos (ATOM) – Cosmos’ inflation rate changes slowly and will stop completely when staking participation reaches 67%

What is a Deflationary Cryptocurrency?

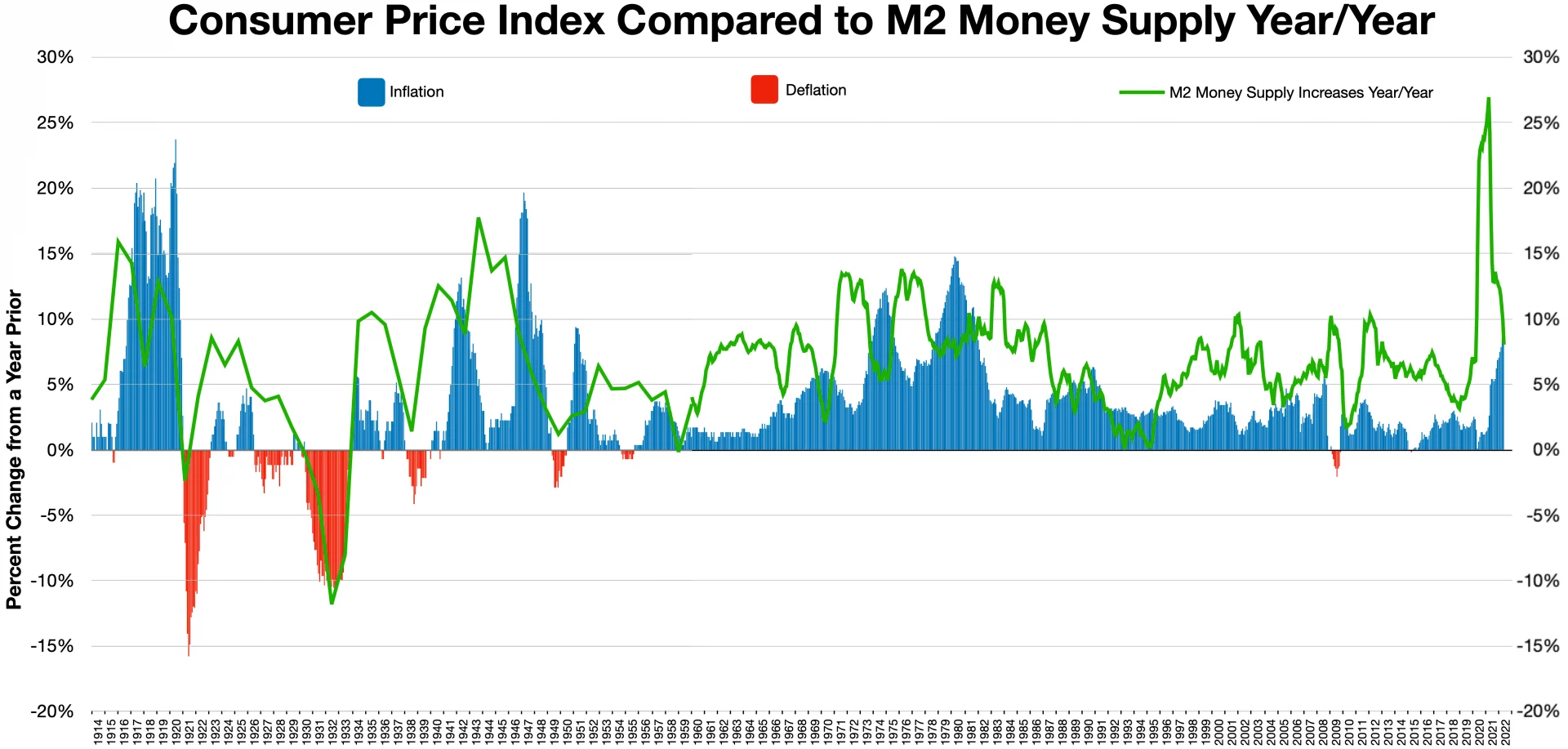

The term “deflation” refers to a period of time during which the prices of goods and services decrease across the economy, increasing the purchasing power of all consumers.

Periods of deflation shown in red

Deflationary cryptocurrencies are the tokens in which the supply decreases over time. Given that the demand for such a token stays the same, its value will do the opposite – increase over time.

Of course, the demand can vary due to many circumstances, so it is difficult to ensure it stays constant. Because of this, deflation mechanisms exist to reduce the number of tokens circulating.

“Burning”, which just means destroying some amount of currency in circulation is what many cryptos use as a deflation mechanism. 🔥

For example, Binance uses this to regulate the price of its BNB token. Every quarter, a certain number of BNB tokens are destroyed, which reduces the total supply of the coin and as such – increases its value.

Polygon is another example of this, burning some amount of MATIC every now and then.

Examples of deflationary cryptocurrencies:

And here are some examples of deflationary cryptocurrencies that you are likely to have encountered before:

- Binance Coin (BNB) – One of the world’s leading crypto exchanges, it repurchases BNBs from investors that walked away with a 20% profit from the previous quarter, sending them to a dead address, out of circulation

- Cronos (CRO) – The native token of Crypto.com, it is a non-minable cryptocurrency with well over 30 billion tokens on the market

- PancakeSwap (CAKE) – The native token of PancakeSwap, it has no real maximum supply, although it manages to avoid being an inflationary token by utilizing a coin burn mechanism.

- Litecoin (LTC) – Every four years or so, Litecoin goes through a halving process (which halves the block mining reward), which keeps it safe from inflation.

- Solana (SOL) – Solana is technically both inflationary and deflationary, as it lacks a cap on supply and distribution while also featuring a burn transaction fee which keeps it deflationary

Which One is Better?

Many investors tend to turn towards deflationary cryptocurrencies over inflationary crypto assets, because given that as the supply decreases, the value will keep going up.

But there are many inflationary cryptocurrencies that have great utility to support them and keep the demand high. On top of that, different methods of reducing inflation exist

At the end of the day, it entirely depends on the situation that you find yourself in. For example, inflationary cryptocurrencies can end up with situations in which demand overpowers supply, while at the same time being important for continuing the mining process.

While there is no single answer to which type of cryptocurrencies is better, there are some factors that we can use to compare them. Let’s have a brief look at each one.

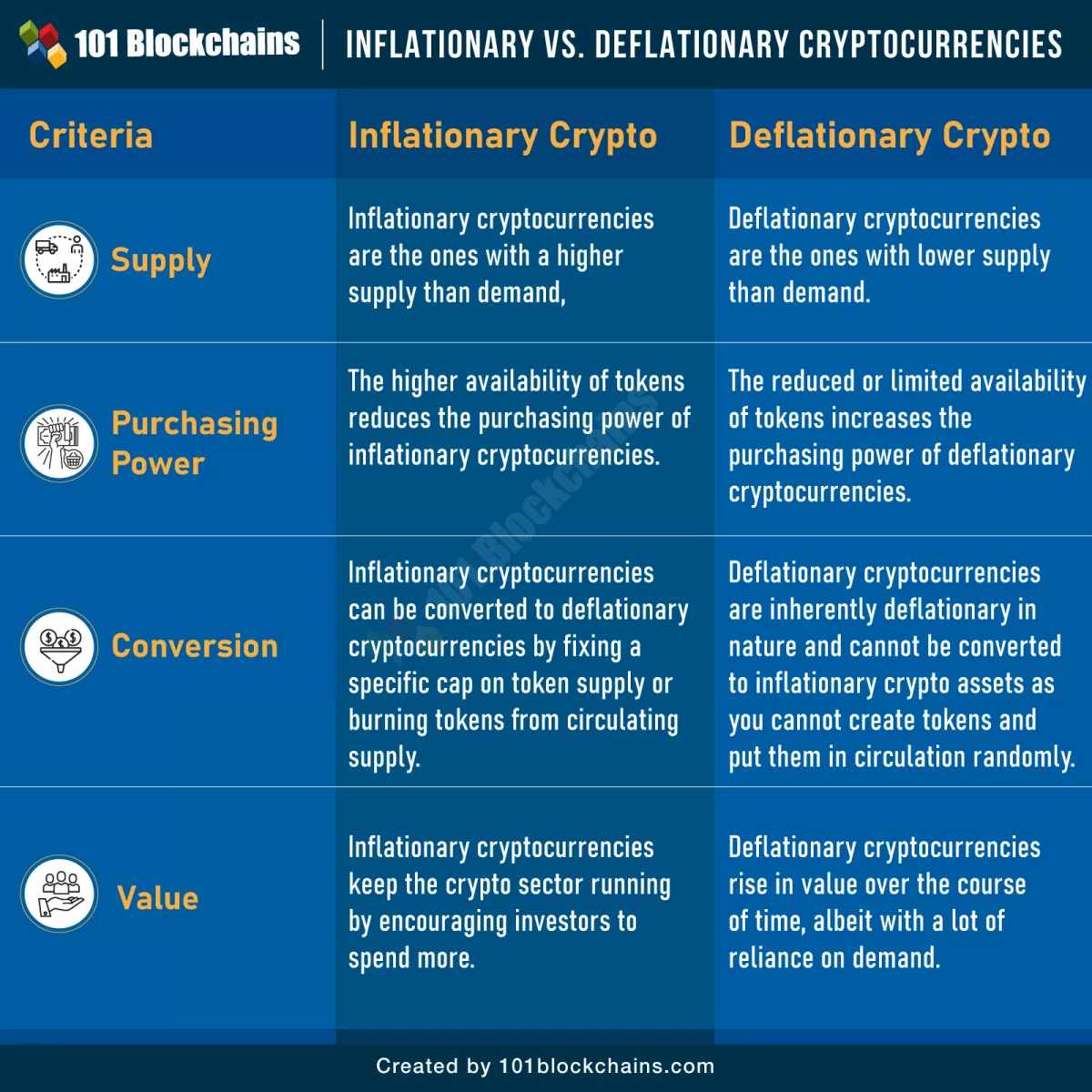

Inflationary vs Deflationary crypto comparison. Source: 101 Blockchains

Supply

As mentioned before, supply is the main difference between the inflationary and deflationary cryptos.

In case of inflationary cryptocurrencies, the supply increases over time, while with deflationary cryptocurrencies the supply offered is regularly reduced.

Purchasing power

It is widely known, that when the number of tokens in circulation is increased, the purchasing power of the inflationary cryptocurrencies goes down.

On the other hand, when deflationary cryptocurrency supply is reduced, the price of such crypto goes up, which increases the purchasing power as well.

Conversion

An important point to note is that inflationary currencies can temporarily be turned into deflationary currencies. For instance, Ethereum has burned different amounts of ETH tokens during times of high activity.

But deflationary cryptocurrencies are programmed to only support supply reduction. This means that these can not be created at will at any time, so they cannot utilize any benefits that inflationary currencies enjoy.

Value

The value of a deflationary cryptocurrencies goes up when the supply is reduced by destroying tokens in circulation, which makes them an attractive investment for many people.

However, different cryptocurrencies have different intrinsic value depending on what on their use cases and unique utilities. This can make a particular crypto project more popular in the future, making its value go up.

Conclusion

At the end of the day, both inflationary and deflationary currencies have their own place and their own use. We hope that now you have a better understanding of the difference between the two, so you can make more informed decisions when investing into crypto in the future

And if you planning to invest into crypto any time soon, we recommend you check out Guardarian.

With us you can buy and sell 300+ different cryptocurrencies with no registration and no hidden fees!

Just choose the asset you want to buy and how you want to pay – and your crypto will be on its way in no time!

So come give us a try at www.guardarian.com and as always – good luck and safe investing! ✨