As the world increasingly adopts blockchain technology, the competition among blockchain networks to provide the most efficient, scalable, and secure infrastructure is fiercer today than ever.

Polygon and Polkadot are blockchain platforms that both address the issues of scalability and interoperability, but they differ in their approaches to achieving these goals.

This article will explore the differences between Polygon and Polkadot and how they compare in terms of technology, governance, consensus mechanisms, and their use cases. We will also look closely at the native tokens of these platforms, MATIC and DOT, and their price predictions for the next year.

So, let’s get right into it, starting with… 👇

What is Polygon (MATIC)?

Polygon is a blockchain platform that facilitates better communication between different Ethereum-based applications. It is a Layer-2 blockchain built on top of the Ethereum network that allows developers to create decentralized applications (dApps) that are faster, cheaper and more efficient.

Polygon aims to organize the growing market of Ethereum applications, enabling developers to help drive Ethereum adoption and create a more efficient blockchain economy. Ultimately, it envisions becoming the “internet of blockchains”, extending its support to other blockchain networks.

MATIC is Polygon’s native currency that is used for paying network fees, staking, as well as governing the Polygon protocol. It takes its name from Polygon’s initial name – Magic Network, which was changed to Polygon in 2021.

What is Polkadot (DOT)?

Polkadot is a blockchain network that enables different blockchains to communicate and interact with each other. For instance, it can be used to create a flow of data between Ethereum and Bitcoin blockchains.

Polkadot can be used to create sub-blockchains called “parachains” that are used to handle transaction processing. This ensures that the main network is fast and scalable, allowing for an efficient cross-blockchain communication.

DOT is Polkadot’s native token that is used for validating network transactions through staking as well as governing the Polkadot protocol.

How does Polygon Work?

Polygon is a Layer 2 blockchain that addresses the scalability issues of the Ethereum network. It is a sidechain operating in parallel with the Ethereum mainnet and offering faster and cheaper transactions.

Polygon uses a modified version of the Plasma framework to create highly optimized sidechains for processing transactions on. Each sidechain has a specific use case, such as handling exchanges, gaming or NFT-related transactions. Each sidechain also has a set of validators that ensure all transactions are secure and accurate.

It also employs a Layer 3 solution called commit chains – a set of transaction networks operating adjacent to the Ethereum network. Commit chains accumulate sets of transactions, which are then confirmed and returned to the underlying network. This solution ensures higher transaction security as well as helps improve transaction speed.

In summary, Polygon’s layering solution uses multiple layers, with Ethereum mainnet as its base layer, sidechains as the second layer and commit chains as the third layer. It uses Plasma technology to create scalable and secure sidechains. Polygon also uses commit chains as a way to improve the transaction speed of the network.

It is important to mention that though Polygon is currently used as a scaling solution for Ethereum, there are plans to expand its support to other blockchains. The ultimate goal is to create an “Internet of blockchains” that would provide interoperability between different decentralized protocols.

How does Polkadot Work?

Polkadot is a multi-chain platform that addresses interoperability and scalability issues present in other blockchains.

It is a sharded network consisting of multiple chains that operate in parallel to each other. These chains, known as “parachains”, communicate with each other using Polkadot’s Relay Chain, which acts as the network’s central hub.

Polkadot uses a special consensus mechanism called “Nominated Proof-of-Stake”, NPos for short, which offers improved security as well as high scalability. Token holders nominate validators in order to confirm transactions and secure the network. NPoS offers these validators incentives to make sure they act in the network’s favor. It can also remove validators if they show signs of malicious activity.

Polkadot’s Bridge chain is one of its most unique features. It is a parachain that enables cross-chain interoperability, connecting Polkadot with other blockchain networks like Ethereum or Bitcoin. Bridge chain can be used to transfer data from external blockchains onto the Polkadot network, after which it can be used by other parachains on the network.

Additionally, Polkadot uses a unique governance mechanism involving a process called “referenda”. In it, token holders vote on proposals submitted by the members of the community or the core development team.

To summarize, Polkadot is a sharded multi-chain network consisting of multiple chains called parachains. It uses the Nominated Proof-of-Stake consensus mechanism to ensure network security and offers cross-chain connectivity through the bridge chain.

Polygon vs. Polkadot: Technical Comparison

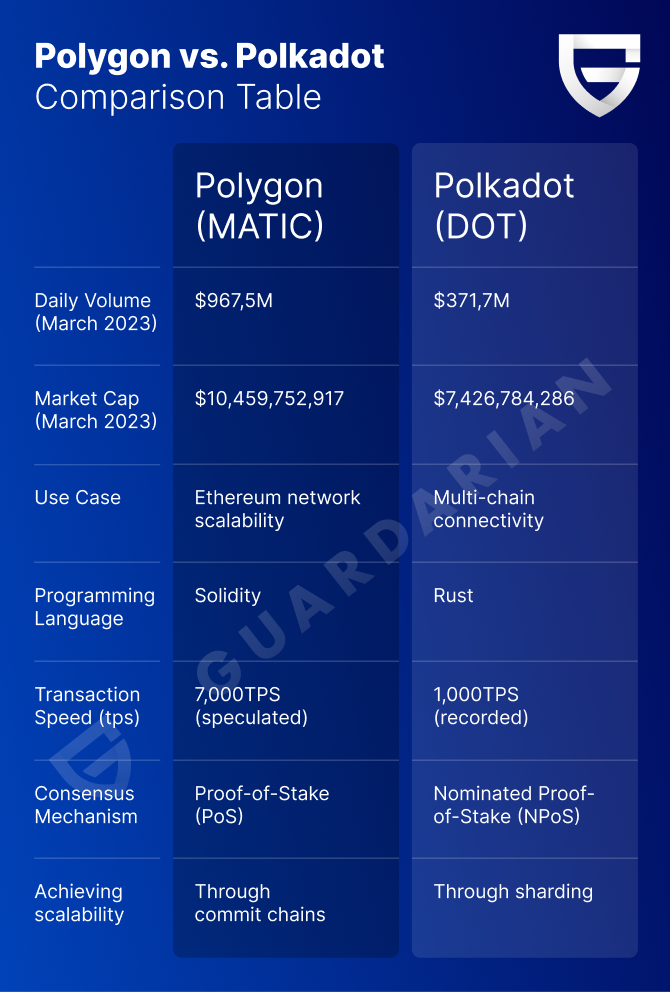

We will go over the different technical aspects of both tokens below, but if you want a quick overview, here is a table with a summary of each one:

Polygon & Polkadot Comparison Table

Polygon vs. Polkadot: Consensus mechanism

Polygon and Polkadot utilize different consensus mechanisms to secure their networks.

- Polygon uses a Proof-of-Stake (PoS) consensus algorithm, which allows token holders to become validators and earn rewards for validating transactions.

- Polkadot, on the other hand, uses its Nominated Proof-of-Stake (NPoS) algorithm that combines Proof-of-Stake (PoS) with a variant of Practical Byzantine Fault Tolerance (PBFT).

Polygon vs. Polkadot: Programming Language

Both Polygon and Polkadot support multiple programming languages, but there are some differences.

- Polygon primarily uses Solidity, which is the same programming language used by Ethereum.

- Polkadot, on the other hand, was developed using the Rust programming language, more precisely – using its Substrate framework.

Polygon vs. Polkadot: Use Case

While both Polygon and Polkadot are designed to address scalability issues in blockchain networks, they have different use cases.

- Polygon is primarily focused on improving the scalability and usability of Ethereum through Layer 2 scaling solutions.

- Polkadot, on the other hand, is designed to be a multi-chain network that enables interoperability between different blockchain networks.

Polygon vs. Polkadot: Transaction Speed

Transaction speed is an important consideration for both Polygon and Polkadot.

- Currently, Polygon can process up to 7,000 transactions per second using its Ethereum scaling solution.

- Polkadot can process up to 1,000 transactions per second with the help of sharding – dividing the network into multiple parallel chains

Polygon vs. Polkadot: Scalability

Scalability is a major focus for both Polygon and Polkadot, but they have different approaches to it.

- Polygon uses commit chains to offload transactions from the Ethereum mainnet and improve overall network performance.

- Polkadot, on the other hand, uses sharding to divide the network into multiple parallel chains, which can each process transactions independently.

Both approaches offer scalability benefits, but they have different tradeoffs in terms of security, decentralization, and network architecture.

MATIC vs. DOT: Price Predictions

As we mentioned before, MATIC and DOT are Polygon’s and Polkadot’s native tokens, respectively. And as we know, platform tokens are only as successful as the projects they are used in.

And though it is difficult to predict how a particular cryptocurrency will perform in the future, let’s look at what experts have to say about the future outlook for MATIC and DOT.

Polygon (MATIC) price prediction

MATIC price chart. Source: Coinmarketcap

Polygon experienced a rapid decline in value at the end of 2021. Still, in the spring and summer of 2022, it partnered with multinational companies like Coca-Cola and Disney, which helped it attain stability. Some analysts think MATIC is primed for rapid growth, while others dismiss it as a low-yield asset destined to remain stagnant.

MATIC Price Prediction by WalletInvestor

According to WalletInvestor, a free forecasting platform, the MATIC token will cost between $1.217 and $1.659 by the end of 2023.

MATIC Price Prediction by Government Capital

Government Capital predicts that MATIC will reach the price point of $2.28 a year from now. This would turn an investment of 100$ today (14 March, 2023) into 185$ in a year, according to their data.

Polkadot (DOT) price prediction

DOT price chart. Source: Coinmarketcap

Polkadot has gained popularity among investors due to its ability to respond positively to market sentiments and remain stable during bullish trends. Although the DOT token experienced a decline in value during the November 2021 crypto market crash, many believe in its potential for future business adoption.

DOT Price Prediction by WalletInvestor

WalletInvestor predicts that by the end of 2023 DOT will cost anywhere between $0.557 and $1.835.

DOT Price Prediction by Government Capital

According to Government Capital, DOT will decrease in price and cost an average of $5.275 in March 2024. This would turn an investment of 100$ today (14 March, 2023) into 81$ dollar on the same day next year.

Conclusion

To sum everything up, both Polygon and Polkadot are popular blockchain projects with many promises for the crypto community. Polygon is more often than not considered a more speculative investment while Polkadot is often seen as a more stable one.

However, it is important that you do your own research and make your own conclusions before investing in either one of them. We hope that this article helped you get a better understanding of what MATIC and DOT are all about.

P.S.

And if you are thinking about investing in DOT, MATIC, or any other cryptocurrency, we recommend you check out Guardarian.

On our website, you can buy and sell over 400 different tokens and coins – fast, securely and without registration.

Simply choose what you want to buy and what you want to pay – and after a quick & intuitive checkout process your assets will reach your wallets in no time!

So come give us a try at www.guardarian.com and we wish you good luck and safe investing! ✨

The information provided in this article is the author’s opinion and not investment advice. There is always the risk of seeing your investment go down in value due to price fluctuations. Make sure your portfolio aligns with your investment objectives and risk tolerance by reviewing it regularly and investing only money you can afford to lose.