As the cryptocurrency market evolves in 2025, investors face a key question: should you prioritize stability or growth? Stablecoins, pegged to the US dollar, provide predictable value for payments and trading, while Bitcoin thrives on scarcity and long-term appreciation. For anyone planning to buy crypto, understanding these differences is crucial.

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value by pegging to assets like the US dollar. Examples include USDT (Tether) and USDC. Their low volatility makes them ideal for payments, trading, and short-term storage of value.

Key Points:

-

Stability: Value remains predictable, minimizing risk.

-

Use Cases: Daily transactions, cross-border transfers, DeFi participation.

-

Management: Mostly centralized, relying on issuers or audits for trust.

What Is Bitcoin?

Bitcoin (BTC) is the first decentralized cryptocurrency. Its value is determined purely by supply and demand, leading to high volatility. Bitcoin is often considered “digital gold” and is used as a long-term investment or inflation hedge.

Key Points:

-

Finite Supply: Only 21 million BTC will ever exist.

-

Decentralization: No single authority controls issuance or ledger.

-

Returns: Potentially high, but comes with significant risk.

For long-term investors, buy BTC can provide portfolio growth and wealth preservation.

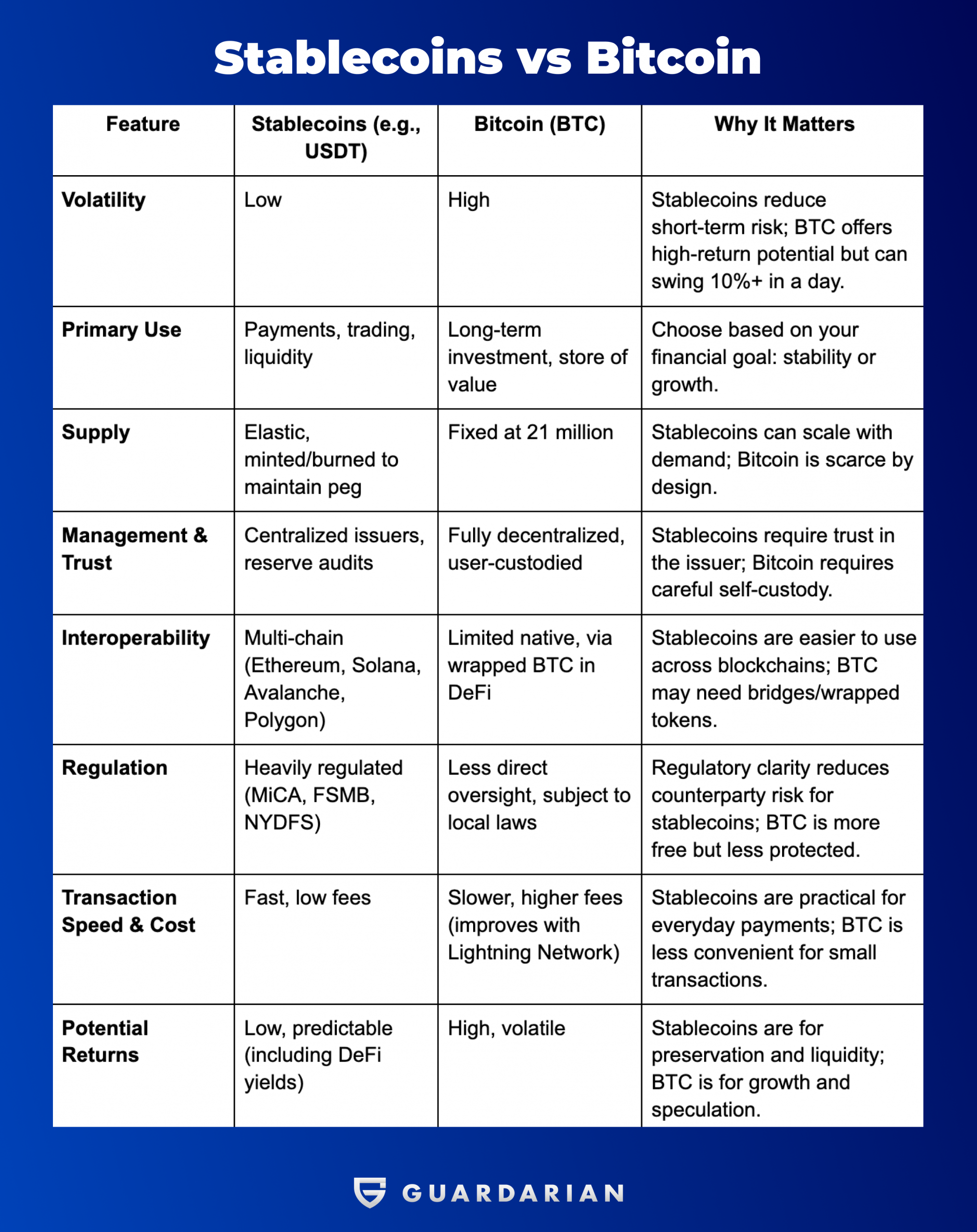

Stablecoins vs Bitcoin

How to Decide Between Stablecoins and Bitcoin?

-

Purpose: Need daily payments or looking for long-term growth?

-

Risk Tolerance: Low-risk stablecoins vs high-volatility Bitcoin.

-

Liquidity Needs: Stablecoins allow instant use; BTC may need conversion.

-

Regulatory Comfort: Stablecoins are more tightly regulated; BTC is decentralized.

A balanced approach works best: hold stablecoins for predictable value and liquidity, while allocating a portion of your portfolio to Bitcoin for growth.

Conclusion

In 2025, Stablecoins vs Bitcoin comes down to stability vs growth:

-

Stablecoins (e.g., USDT): Safer, low volatility, perfect for payments, trading, and capital preservation.

-

Bitcoin (BTC): High potential returns, long-term investment, but volatile and requires careful management.

Using trusted platforms, anyone can confidently buy crypto in USA and select the right combination of stablecoins and Bitcoin to match their goals.