As crypto markets continue to evolve, stablecoins remain the safest bridge between digital assets and traditional finance. Whether you’re looking to lock in profits, move funds across exchanges, or simply hedge against volatility, this fall offers a great opportunity to buy stablecoins that combine liquidity, transparency, and reliability.

Here are the top 5 stablecoins to watch — and buy — in fall 2025.

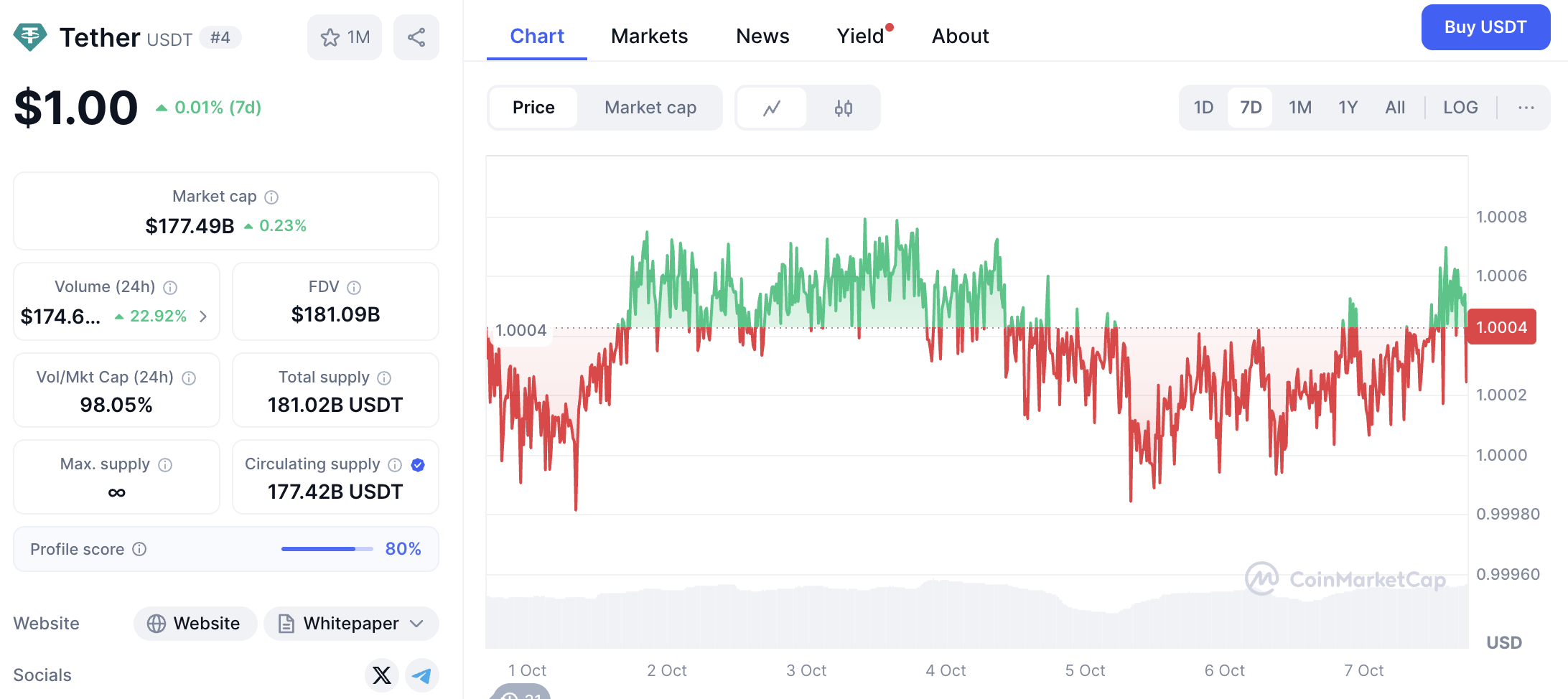

1. Tether (USDT)

USDT price chart. Source: CoinMarketCap.

Tether is still the world’s largest and most traded stablecoin, with a market cap surpassing $177 billion. It’s supported on nearly every major exchange and blockchain, making it the most accessible option for crypto users worldwide.

When investors need quick, secure liquidity, they buy USDT — simple as that.

Why it stands out:

-

The most liquid stablecoin globally.

-

Available across multiple blockchains (Ethereum, Tron, Solana, and more).

-

Transparent attestations of reserves published regularly.

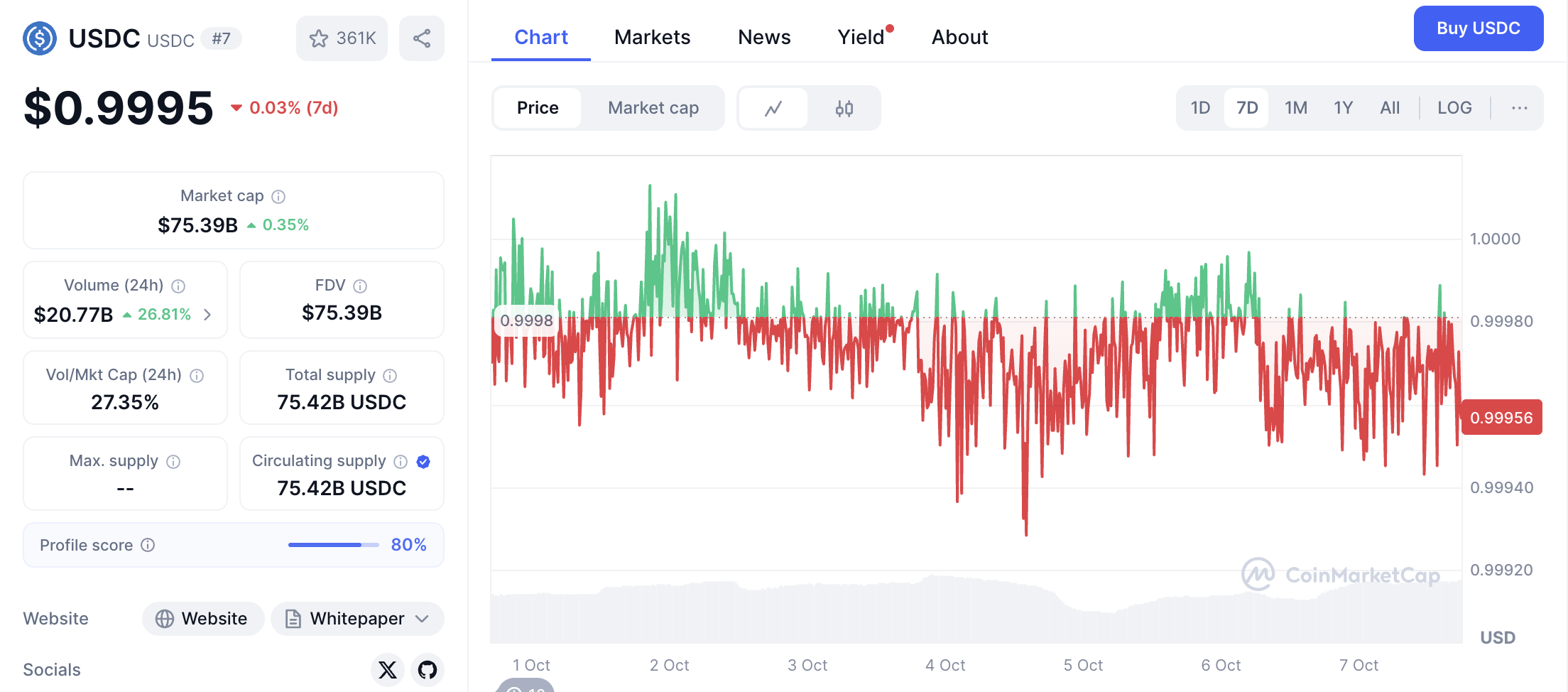

2. USD Coin (USDC)

USDC price chart. Source: CoinMarketCap

USDC, issued by Circle, has become a key player for institutions and compliant DeFi ecosystems. With over $75 billion in circulation, it offers transparency, regulatory alignment, and integration across multiple networks. You can check the latest stats on CoinMarketCap.

Why consider it:

-

Fully backed by cash and U.S. Treasuries.

-

Supported by Visa, Coinbase, and global fintechs.

-

Strong regulatory framework in the U.S. and Europe.

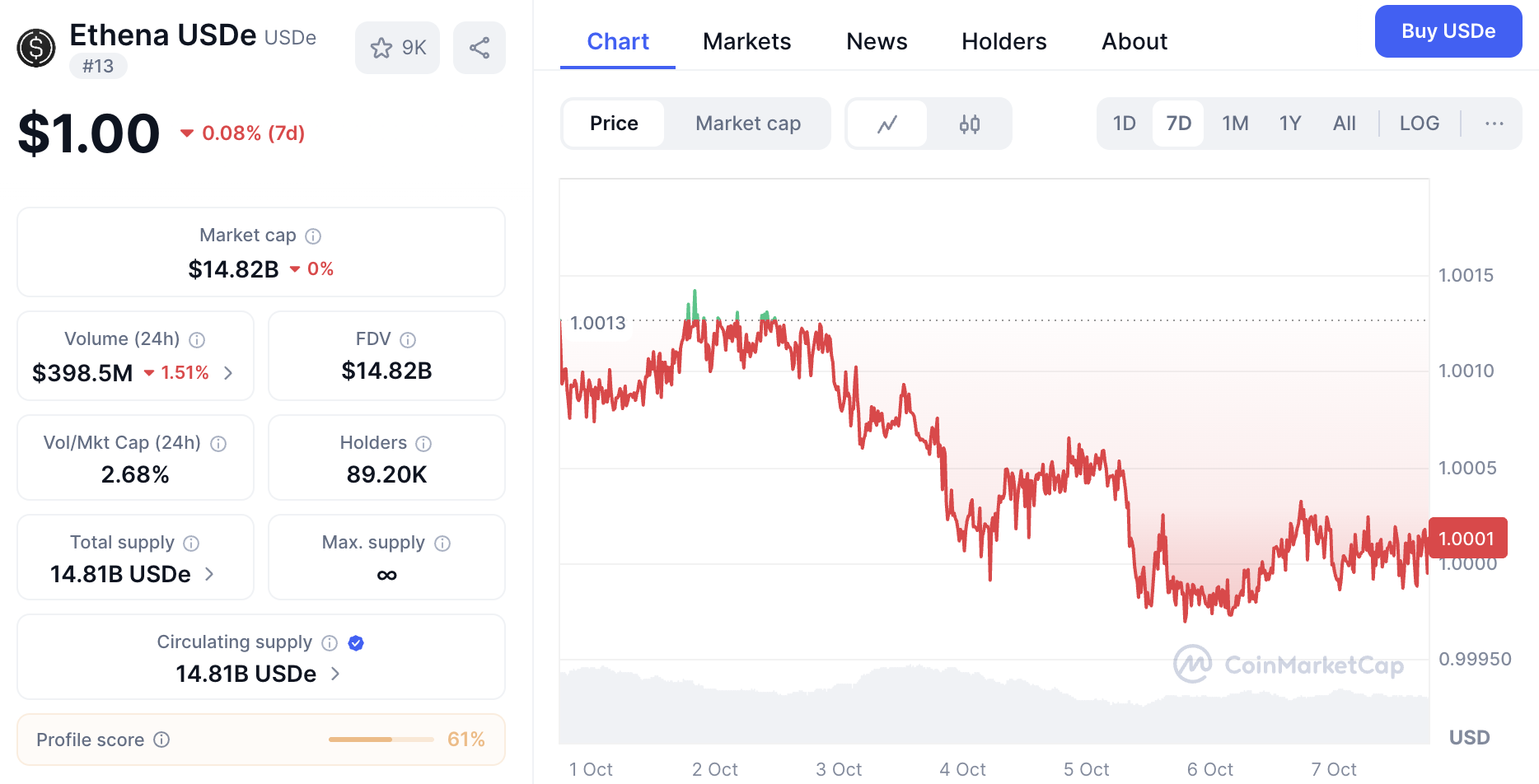

3. Ethena USDe (USDe)

USDe price chart. Source: CoinMarketCap

Ethena’s USDe has rapidly gained traction in 2025, surpassing $14 billion in market cap thanks to its innovative synthetic dollar model. Unlike traditional fiat-backed coins, USDe uses a combination of on-chain collateral and delta-neutral strategies to maintain its peg.

Key features:

-

Decentralized and crypto-native design.

-

Transparent on-chain backing and audits.

-

Growing adoption in DeFi protocols and yield markets.

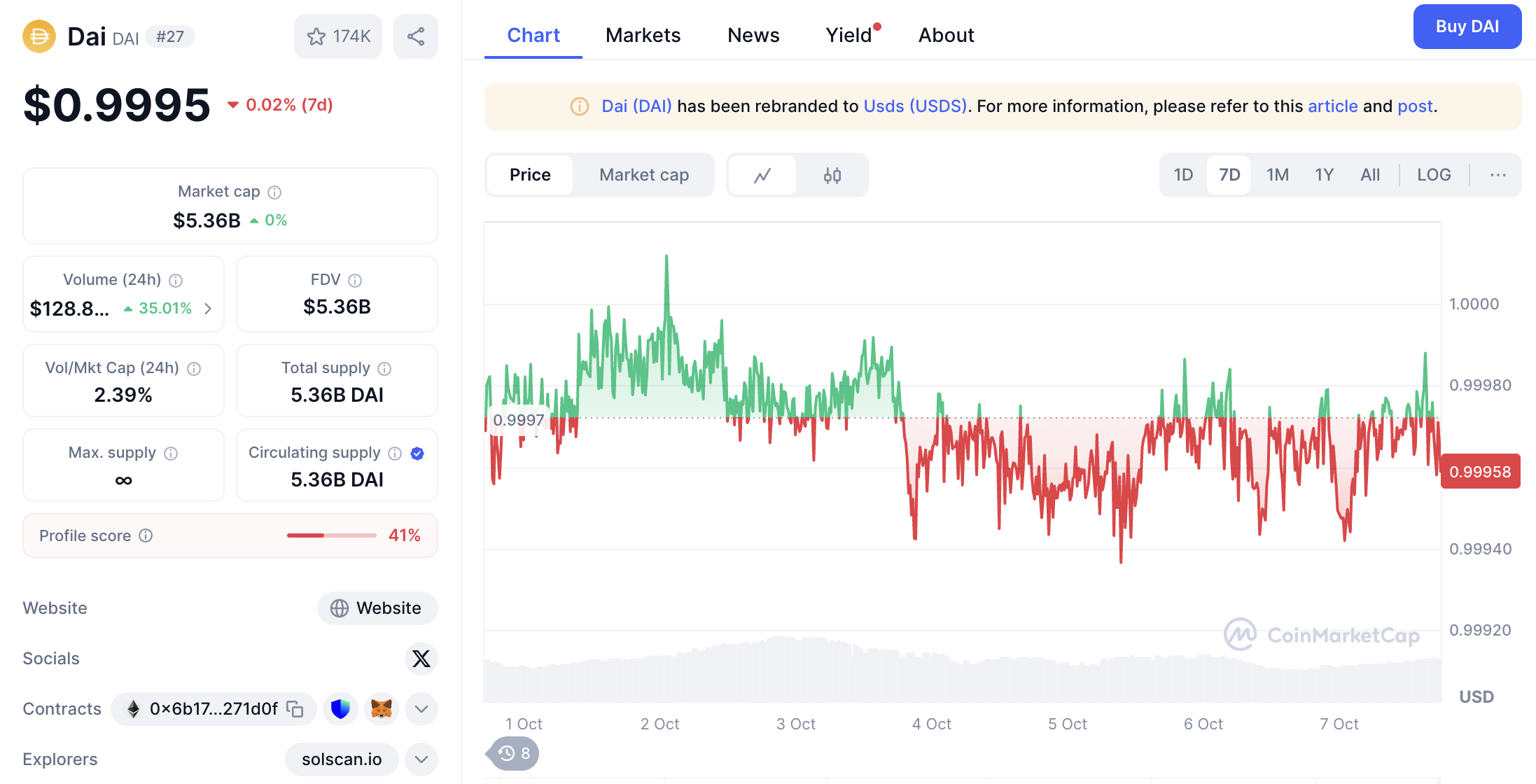

4. Dai (DAI)

USDe price chart. Source: CoinMarketCap

DAI remains a DeFi veteran — the original decentralized stablecoin governed by MakerDAO. It’s backed by over-collateralized crypto assets such as ETH and USDC, maintaining its dollar peg through smart contracts rather than banks.

Why it matters:

-

Fully decentralized and community-governed.

-

Backed by real on-chain collateral.

-

Ideal for users avoiding centralized custody.

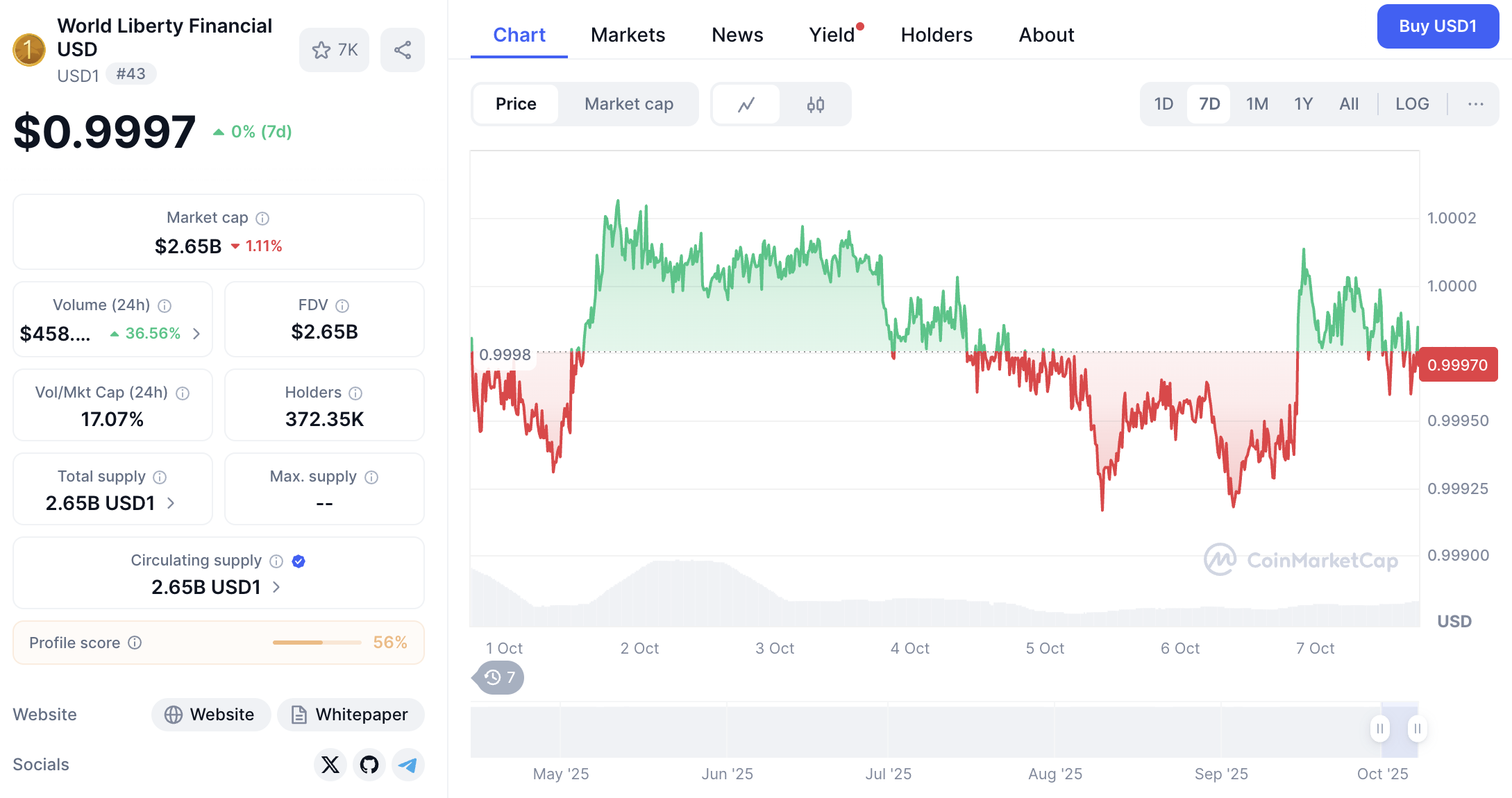

5. World Liberty Financial USD (USD1)

USDe price chart. Source: CoinMarketCap

The newest addition to the stablecoin market, USD1 by World Liberty Financial aims to combine institutional transparency with on-chain innovation. Although newer, it’s gaining recognition in 2025 for its focus on compliance and global accessibility.

Highlights:

-

Fully audited reserves.

-

Designed for institutional integrations.

-

Potential future listing on major exchanges.

As global markets continue to fluctuate, stablecoins remain the cornerstone of risk management in crypto portfolios. Whether you’re diversifying, transferring funds, or waiting for the next bull run, this fall could be the perfect time to buy stablecoins and secure your digital holdings.

And you can do it right here ⬇️

But before you buy stablecoins, always check:

- What assets back the coin (fiat, crypto, or algorithmic mechanisms)?

- Who issues and audits the reserves?

- Is it widely adopted and liquid on major exchanges?

Want to learn how to choose the safest and most reliable stablecoins? Read our full guide on how to pick the right one here.