Looking for the best cryptocurrencies to buy in December 2025 and beyond? With thousands of digital coins available, choosing the right ones can feel overwhelming. We’ve analyzed the latest market data to bring you the top 6 cryptocurrencies by market capitalization, combining established leaders with innovative projects. Whether you’re a seasoned investor or just starting out, this guide provides clear insights to help you navigate the fast-moving crypto market — and prepare your portfolio for 2026.

Buy Crypto Safely with Guardarian

Guardarian is a trusted platform that makes buying, selling, and swapping cryptocurrencies simple, secure, and fast. It supports major coins such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), XRP, Binance Coin (BNB), and Solana (SOL), offering a seamless experience for both beginners and experienced investors. Guardarian prioritizes security, regulatory compliance, and quick transactions, giving you confidence while entering the crypto market.

How to Buy Crypto on Guardarian:

-

- Go to the Guardarian.

- Choose your crypto — Bitcoin, Solana, or another supported asset.

- Enter the amount and select your currency.

- Select a payment method: Google Pay, Apple Pay, card, SEPA, Pix, or SPEI.

- Confirm your transaction and follow any verification prompts if required.

- Receive your crypto in your wallet.

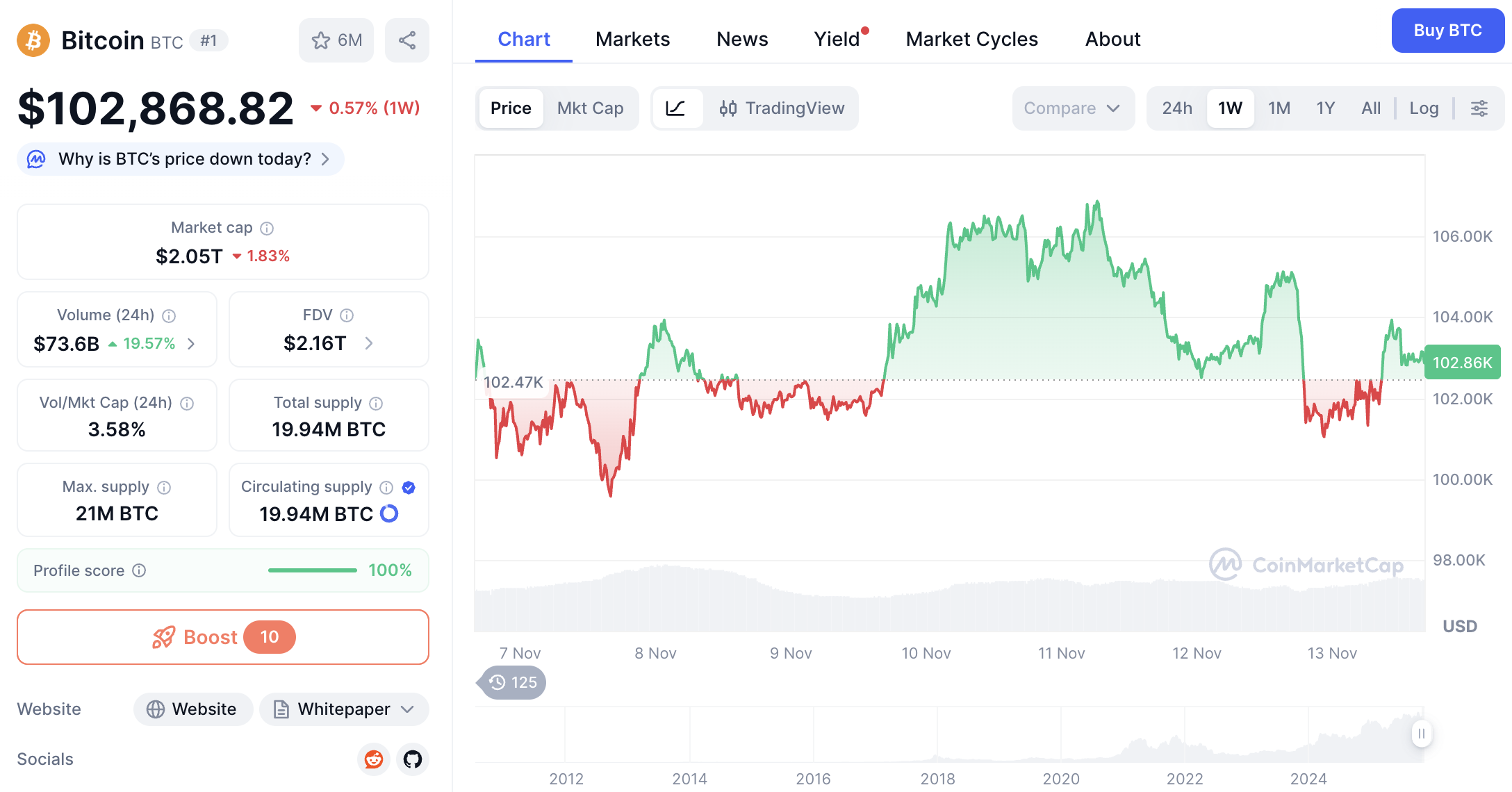

1. Bitcoin (BTC) – The Digital Gold Standard

Market Cap: ~$2.05 trillion

Current Price: $102,909.92 (0.12% change in 1W)

Why Buy BTC: Bitcoin, launched in 2009 by Satoshi Nakamoto, remains the most recognized cryptocurrency. With a capped supply of 21 million coins, it is a hedge against inflation and a trusted store of value for institutions and retail investors alike.

BTC Price chart. Source: CoinMarketCap.

Bitcoin recently slipped below $103K amid spot ETF outflows totaling $278M, led by Fidelity and Ark Invest. Despite broader positive macro news, including the U.S. government reopening, market sentiment remains in extreme fear, reflected by a Crypto Fear & Greed Index of 25/100.Technically, BTC trades below key moving averages (10-, 20-, 50-, 100-, and 200-day EMAs/SMAs), with indicators signaling weakening momentum: RSI at 42, Momentum (10) at –3,525, and MACD (12,26) at –2,486. This suggests short-term downward pressure, although whale accumulation of 45,000 BTC this week hints at long-term holder confidence. Analysts are divided: some predict potential short-term corrections, while macro investors remain bullish, forecasting BTC could reach $180,000 later in the cycle. With Bitcoin remaining the cornerstone of any crypto portfolio, December 2025 could offer strategic entry points for long-term investors seeking exposure to digital gold.

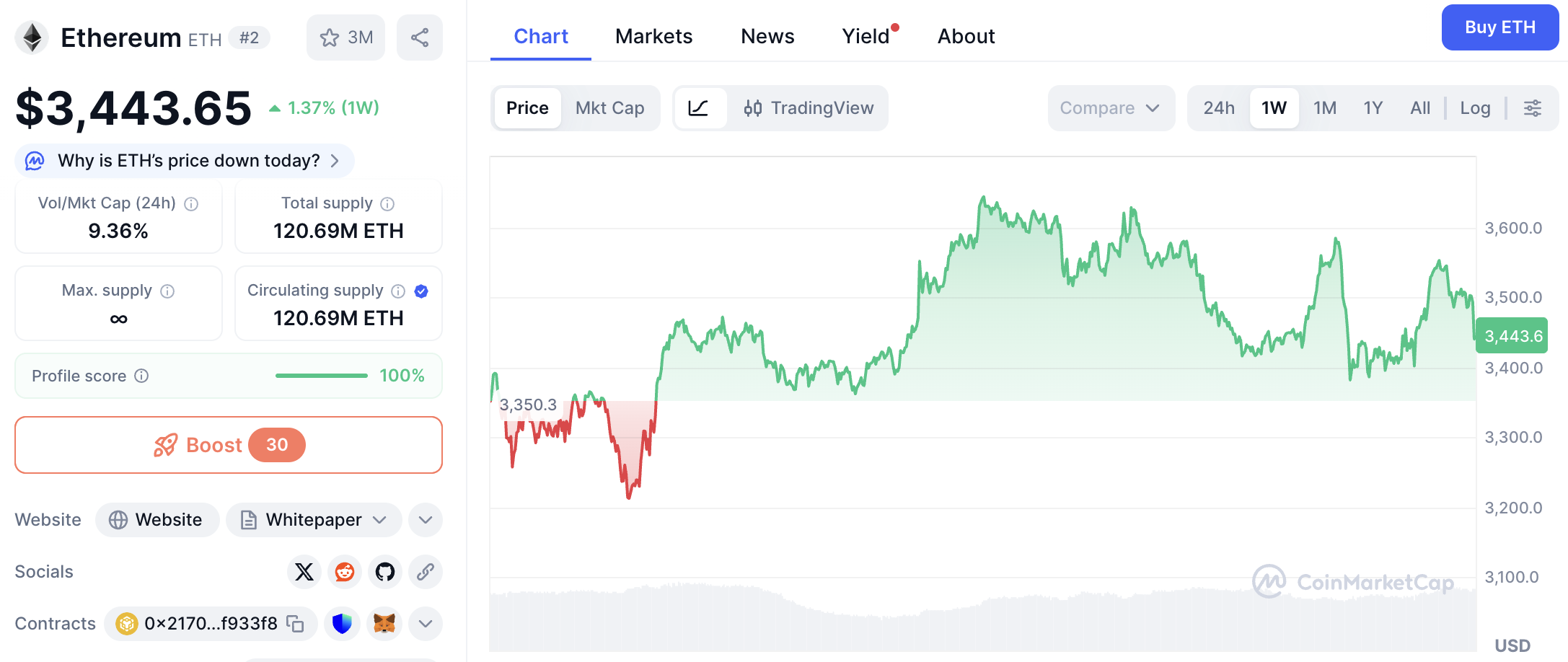

2. Ethereum (ETH) – The Smart Contract Pioneer

Market Cap: ~$415.18 billion

Current Price: $3,439.87 (1.51% change in 1W)

Why Buy ETH: Ethereum powers decentralized applications (dApps), DeFi, and NFTs, making it the backbone of the smart contract ecosystem. Its network activity remains strong, with high transaction volumes and steady demand for gas fees, reflecting solid user engagement despite broader market fear.

ETH Price chart. Source: CoinMarketCap.

Ethereum has seen a recent recovery, rising 3.18% in a single day and outperforming Bitcoin and the broader market. While ETH experienced a monthly decline of 12.43%, it still gained 12.78% year-over-year, highlighting its resilience. Market sentiment is currently bearish (Fear & Greed Index at 15), but long-term investors are quietly accumulating during low-price periods.

Technically, Ethereum shows mixed signals: it trades above its 50-day SMA, suggesting near-term support, but remains below the 200-day SMA, indicating longer-term caution. Key support levels are $3,333, $3,253, and $3,126, while resistance levels are $3,539, $3,666, and $3,746. RSI at 39.74 signals neutral momentum, while low volatility (6.66%) points to cautious but deliberate market movements.

Analysts predict a potential 10.37% rise in the near term, with ETH possibly reaching $3,815 if bullish momentum continues. For investors preparing for December, this suggests a strategic window to accumulate Ethereum at current levels, balancing short-term risk with long-term growth potential.

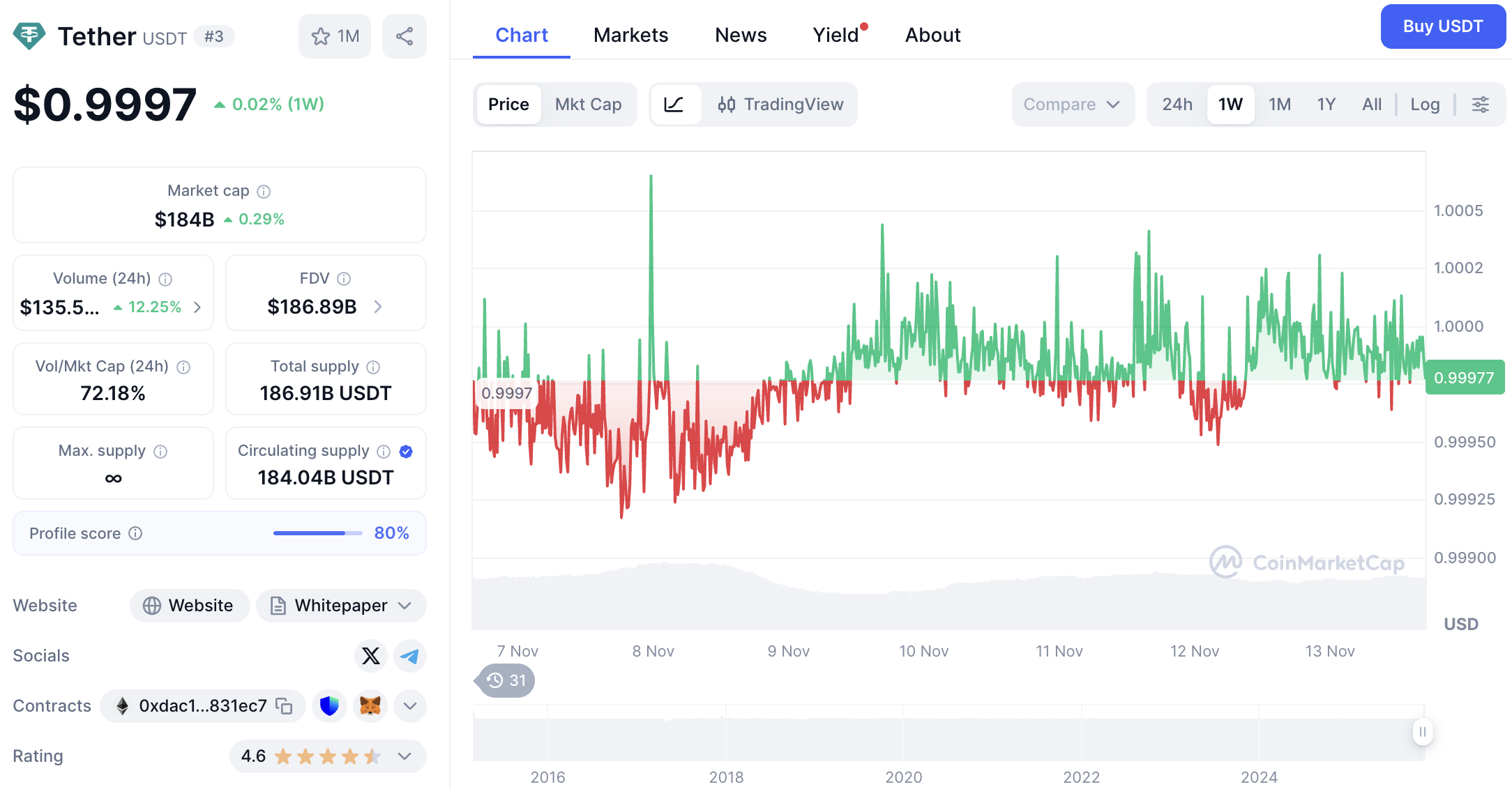

3. Tether (USDT) – The Stablecoin Anchor

Market Cap: ~$184.03 billion

Current Price: $0.9999 (0.03% change in 1W)

Why Buy USDT: Tether is a USD-pegged stablecoin that provides stability in the volatile crypto market. Its wide adoption across exchanges and DeFi platforms makes it a key tool for trading, hedging, and cross-chain transfers.

USDT Price chart. Source: CoinMarketCap.

As cryptocurrencies become increasingly regulated—especially in Europe with frameworks like MiCA — demand for reliable and compliant stablecoins like USDT is growing. Investors and institutions are turning to USDT for secure liquidity, smooth trading, and minimal price fluctuation exposure.

With a circulating supply of 184.04B USDT and daily trading volumes exceeding $132B, Tether continues to demonstrate its essential role in the crypto ecosystem. Its stability makes it an ideal choice for managing risk during volatile periods and for strategically entering other crypto positions in December.

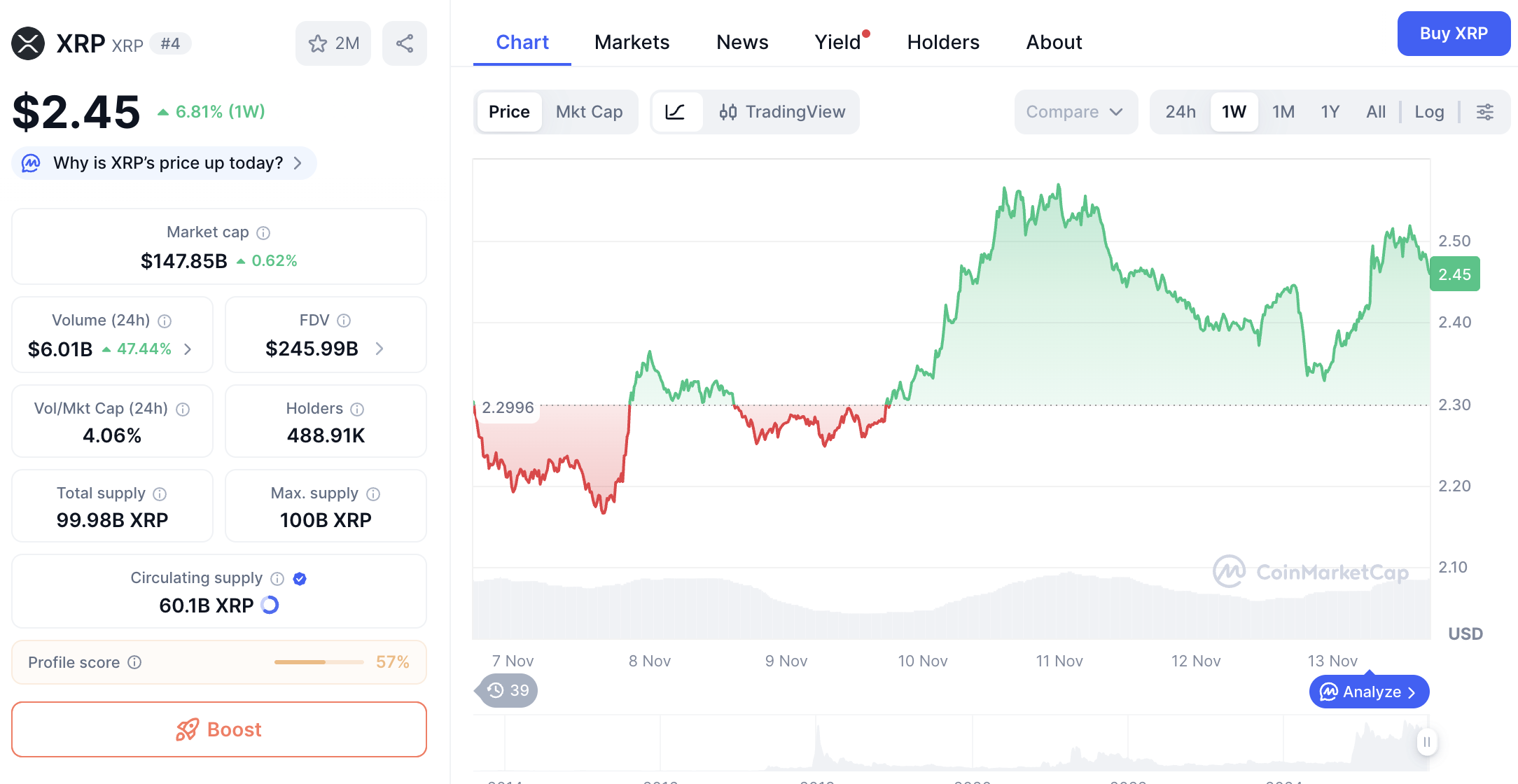

4. XRP – The Cross-Border Payment Solution

Market Cap: ~$147.82 billion

Current Price: $2.45 (6.79% change in 1W)

Why Buy XRP: XRP, powered by Ripple, enables fast and low-cost cross-border payments. Its adoption by banks and payment networks makes it one of the most practical cryptocurrencies for real-world use.

XRP Price chart. Source: CoinMarketCap.

XRP has recently traded near $2.50, gaining 13.3% over the past week. Buying pressure has supported the $2.20 level, while futures open interest reached $3.91B, and derivatives and options volumes surged 68% and 63%, respectively. Technical patterns, like the tightening triangle, suggest a potential breakout if momentum continues.

With a circulating supply of 60.1B XRP and strong institutional interest, XRP remains a compelling choice for investors looking for both utility and growth. Its efficient payment protocol, combined with rising trading volumes, makes December a potentially strategic window to accumulate XRP before the next bullish cycle.

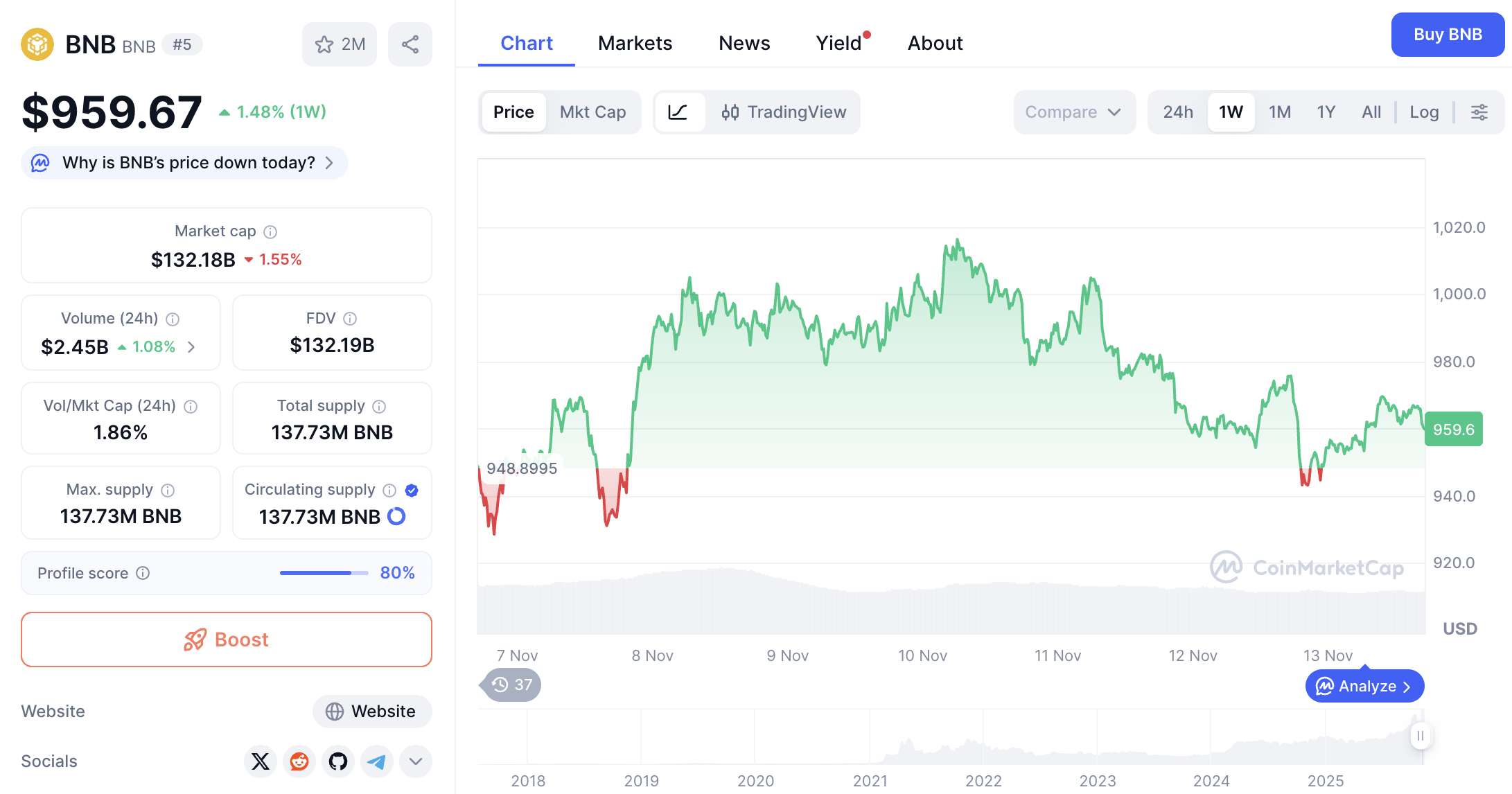

5. Binance Coin (BNB) – The Exchange Powerhouse

Market Cap: ~$132.12 billion

Current Price: $959.25 (1.24% change in 1W)

Why Buy BNB: BNB fuels the Binance ecosystem, including the Binance Smart Chain, trading fee discounts, DeFi applications, and more. Its deep integration into Binance’s infrastructure makes it a core asset for both retail and institutional investors.

BNB Price chart. Source: CoinMarketCap.

BNB has recently traded just below the $1,000 mark, following a 10% rally over the past month. The token’s accessibility has improved with listings on platforms like Robinhood and Coinbase, while Binance Smart Chain now supports $8.54 billion in total value locked (TVL) across DeFi protocols.

Technical and market factors suggest that $900–$930 acts as immediate support, while a clean breakout above $975 could reignite bullish momentum. Analysts project long-term potential for BNB between $1,200 and $2,000 by 2030, driven by token burns, Web3 integrations, and growing adoption in DeFi, gaming, and NFTs.

For December, BNB offers investors a chance to participate in a blue-chip altcoin with strong ecosystem fundamentals, especially during periods of market consolidation or low volatility.

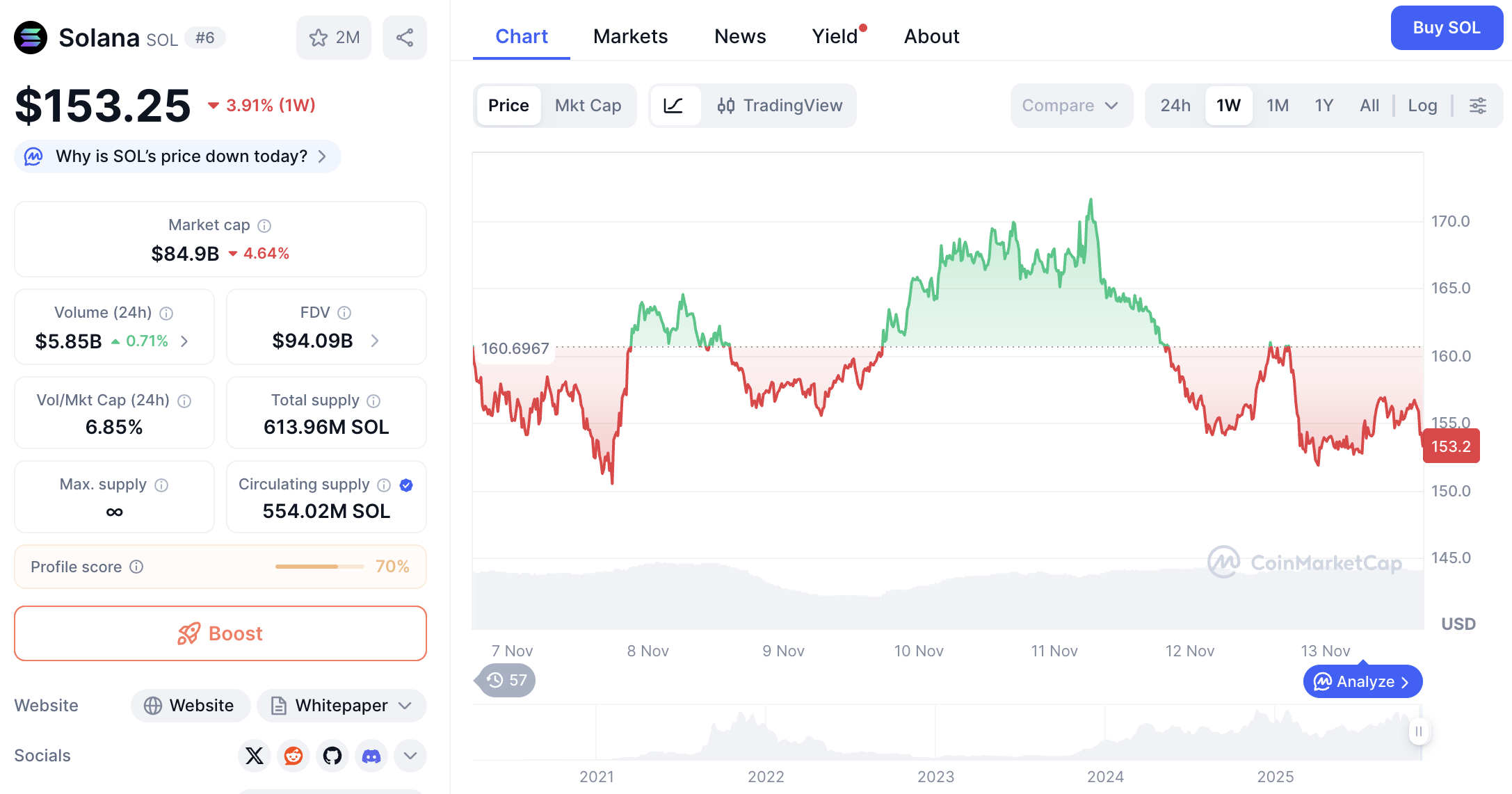

6. Solana (SOL) – The High-Speed Blockchain

Market Cap: ~$85.12 billion

Current Price: $153.64 (3.65% change in 1W)

Why Buy SOL: Solana is a third-generation Layer-1 blockchain known for its high throughput, low latency, and low transaction costs. It combines proof-of-stake with a unique proof-of-history system, allowing for fast transaction validation and sub-second finality, making it ideal for DeFi, NFTs, and gaming applications.

SOL Price chart. Source: CoinMarketCap.

Solana has demonstrated resilience despite past network outages and market volatility. In 2025, key catalysts include regulatory clarity and the approval of Solana ETFs in the U.S., opening institutional channels and increasing liquidity. On-chain activity remains strong, with over 656 dApps, $10.96B in total value locked (TVL), 3,860 active developers, and $6.4B in NFT sales. Around 67% of SOL is staked, showing strong community engagement.

Technically, SOL trades near $156, supported by network upgrades like zk-rollups and cross-chain bridges that improve scalability and reliability. Partnerships with oracles such as Chainlink enhance liquidity across DeFi and NFT venues. Analysts project potential highs of $157.57 for 2025, with long-term upside toward $234 by 2030.

For investors planning for December, Solana offers a high-speed, well-integrated blockchain with solid fundamentals and exposure to emerging DeFi and NFT markets. Its fast network and growing ecosystem make SOL a strong contender for strategic accumulation ahead of the winter months.

As 2025 comes to a close, market volatility, ETF developments, and ecosystem upgrades are reshaping the crypto landscape. Whether you’re focused on blue-chip assets like Bitcoin and Ethereum or high-performance blockchains like Solana, diversification remains key.

Guardarian makes it easy to take the next step — buy, sell, or swap your favorite cryptocurrencies securely and instantly. With low fees, fast transactions, and global payment options, it’s your reliable bridge between fiat and crypto. Start building your 2026 crypto portfolio today at Guardarian.com