Cryptocurrencies are known to be some of the most volatile assets you can invest in. You can never be sure if the price of your asset will not skyrocket or plunge the next day.

This, of course, has turned many merchants and regular people away from investing into and using cryptocurrencies.

To counter this volatility, stablecoins were created. These currencies, pegged to the price of some real-world asset are meant to offer protection from crypto market volatility to investors.

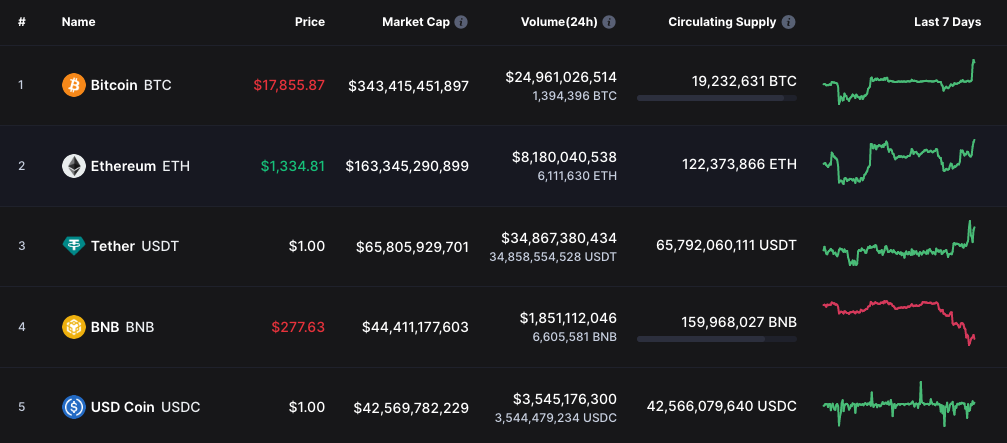

USDT and USDC are the two most prominent stablecoins, both holding their solid spots in Coinmarketcap’s top 5.

But what is the difference between these two? And why someone may choose one over the other? That’s what we will discuss in this article. So, let’s get right into it! 👇

What is Stablecoin?

Stablecoins are a particular kind of cryptocurrency linked to a reliable asset, such as the US dollar. This mitigates the frequent volatility that cryptocurrencies tend to have, stabilizing the price. That’s why stablecoins appeal to consumers who wish to deal in digital currency but are wary of price volatility.

Stablecoins come in various forms, each with its advantages and disadvantages. While some stablecoins are directly tied to the value of a particular fiat currency, like the US dollar, others are correlated to the value of a commodity, like the price of gold or silver.

Tether, for instance, is a popular stablecoin pegged to the US dollar. Tether’s value remains stable through USD reserves.

Algorithmic stablecoin is another subset of stablecoins that employs algorithmic stabilization methods to hold their value stable, often by using Ethereum smart contracts.

MakerDAO’s DAI is an example of an algorithmic stablecoin. It is not backed by any centralized entity and is instead soft-pegged against the US Dollar through Ethereum- backed assets deposited by MakerDAO’s users.

Now that you have a basic understanding of what stablecoins are, let’s look at their main positive and negative aspects.

Advantages and Disadvantages of StableCoins:

Let’s go through some advantages as well as disadvantages that stablecoins offer compared to regular cryptocurrencies.

Advantages of Stablecoins

- Trustworthy as a means of exchange – having the potential to reduce risk during exchanges and help marketplaces deal with FIAT currency regulation

- Good for everyday payments – Stablecoins make a great everyday currency for online purchases as well as buying yourself a cup of coffee.

- Safe from cryptocurrency crashes – unlike other crypto assets, stablecoins show almost no fluctuation, which is useful for securing your investments during crashes.

Disadvantages of Stablecoins

- They are centralized – most stablecoins are centralized, usually working with a single third party. This makes them unable to provide the same level of decentralization and is overall against the blockchain nature.

- Reduced trust – since stablecoins are usually centralized, all users have to put trust into a singular entity or organization which increases the risk of being deceived.

- Regulations – since stablecoins are backed by fiat currencies, they depend on the regulations these currencies use, discouraging investor adoption.

With all this in mind, let’s address our main topic – the difference between the two biggest stablecoins on the market today, starting with…

What is USDC?

USDC is a stablecoin tied to the US dollar’s value. It is the second most popular stablecoin among crypto users. Each USDC is worth one US dollar, and reserves of US dollars back the currency. Centre Consortium, a partnership of Circle and Coinbase, is responsible for issuing USDC.

A primary goal of USDC is to be a trustworthy cryptocurrency that users can use for various transactions and investments. Its peg to the US dollar ensures its value will be stable, making it a more convenient currency for day-to-day transactions. Because of this, USDC may appeal to shops and customers interested in accepting digital currencies for payments but afraid of the volatility of some of the more popular options.

USDC’s additional advantages over other cryptocurrencies include excellent stability and privacy. Its runs on the Ethereum blockchain, which makes it highly portable and open to integration into a wide range of services and applications. This can make USDC a flexible medium for international trade and P2P money transfers.

Most major cryptocurrency exchanges offer USDC. Like USDT, you can transfer and receive the US Dollar Coin (USDC) using any ERC-20 (Ethereum) compliant wallet or business, as well as many other blockchains, including Algorand, Stellar, Binance Smart Chain, Hedera, Tron, Solana, and more.

USDC is a preferable stablecoin choice among crypto users due to its company policy and standards. (Image: Circle)

USDC is a significant step forward for stablecoins since it provides a trusted and secure medium of exchange and investment in the cryptocurrency market. USDC can expand cryptocurrency’s utility and use by offering a more stable and interoperable digital currency alternative.

What is USDT?

With a market worth of more than $65 billion (as of 13 Dec ‘22), Tether USD is the most widely used stablecoin. USDT is commonly known as the first stablecoin.

Hong Kong’s Tether Limited issued USDT in 2014 to help level the playing field between cryptocurrencies and fiat currencies. Tether introduced the world to a platform-independent, blockchain-based US Dollar with all the technological benefits of cryptocurrencies like Bitcoin and Ethereum but none of the inherent risk of price fluctuations.

Tether claims to be the world’s first stablecoin. (Source: Tether)

Tether combines the best features of both worlds to enable instant, transparent, and cheap crypto-dollar transfers between parties. This expands the applications of cryptocurrencies beyond only online purchases to include monetary transfers between people.

Anyone may use USDT to make instant, low-cost transactions on blockchain-based financial networks and earn interest in the process. It also allows businesses to accept cryptocurrency payments in fiat money without taking on the market risk of doing so with more volatile cryptocurrencies.

You may use the USDT tokens on various blockchains, including Bitcoin, Ethereum, EOS, Algorand, Tron, and many more. On cryptocurrency exchanges, you may use USDT to purchase or make trades involving hundreds of different cryptocurrencies.

Although USDT has been the subject of debate due to questions about its reserve management and degree of decentralization, it continues to be one of the most popular stablecoins due to its vast support throughout the market.

USDC vs USDT: Differences

USD Coin and Tether USD are almost identical digital currencies in that they are both pegged to the US dollar and can be generated on various blockchains like Ethereum and Solana. Nevertheless, they do have differences. In a duel between USDC and USDT, which currency would prevail?

The following are some of the main distinctions between these two stablecoins that may aid in our decision-making:

- Backing – USDC is entirely backed by US Dollar, while USDT also uses other digital currencies, loans, bonds as collateral. Because of this, USDC is often considered a safer investment, though USDT has made steps to make its backing more transparent and trustworthy.

- Blockchain – Initially, USDT and USDC were built on Bitcoin and Ethereum blockchains respectively. Now they have expanded to other blockchains. USDC lives natively on Ethereum, Solana, Avalanche, TRON, Algorand, Stellar, Flow, and Hedera networks. USDT can be used on Algorand, Avalanche, Bitcoin Cash’s Simple Ledger Protocol (SLP), Ethereum, EOS, Liquid Network, Omni, Polygon, Tezos, Tron, Solana and Statemine.

In summary, USDC and USDT are stablecoins tied to the US dollar’s value. However, they vary regarding how they are issued and supported and the blockchain technology they are based on.

USDC vs USDT: Similarities

USDC and USDT are the two most popular USD-pegged stablecoins that share many common characteristics:

- Both USDC and USDT are backed 1:1 to the price of US Dollar

- They both provide a secure and trusted cryptocurrency exchange and investment alternative – their key identifying feature. They are more convenient for day-to-day transactions due to their stable value fixed to the US dollar.

- They are very portable and adaptable to new environments because of their foundation in blockchain technology. This may make them an effective tool for various financial applications, including peer-to-peer payments and cross-border transactions.

USDC and USDT represent significant steps forward in the evolution of stablecoins, providing consumers and investors with two proven methods of transacting and protecting their digital currency holdings.

Which Stablecoin is Better? (USDC vs USDT)

It is tough to choose between USDT and USDC as the best stablecoin since it may differ depending on the demands and preferences of the individual. Both stablecoins provide a secure and trusted means of making cryptocurrency-related purchases and investments, and each has pros and cons.

USDT can provide greater liquidity and is more widely accepted, simply due to its popularity and big volumes. But it is not necessarily considered a better choice by experts simply due to its wider spread.

The fact that USDC is completely collateralized, backed by US Dollar gives it a potential edge over USDT. This may give people more faith that the value of USDC is supported by something real and that it won’t fluctuate as much.

When it comes to making transactions or putting money into the cryptocurrency market, both USDT and USDC are good bets. Collateralization and the blockchain on which they’re built will play a role in one’s decision between these stablecoins.

How to buy USDC and USDT?

If you are planning to invest into either of the two stablecoins, you are lucky – practically every exchange out there offers options to buy these.

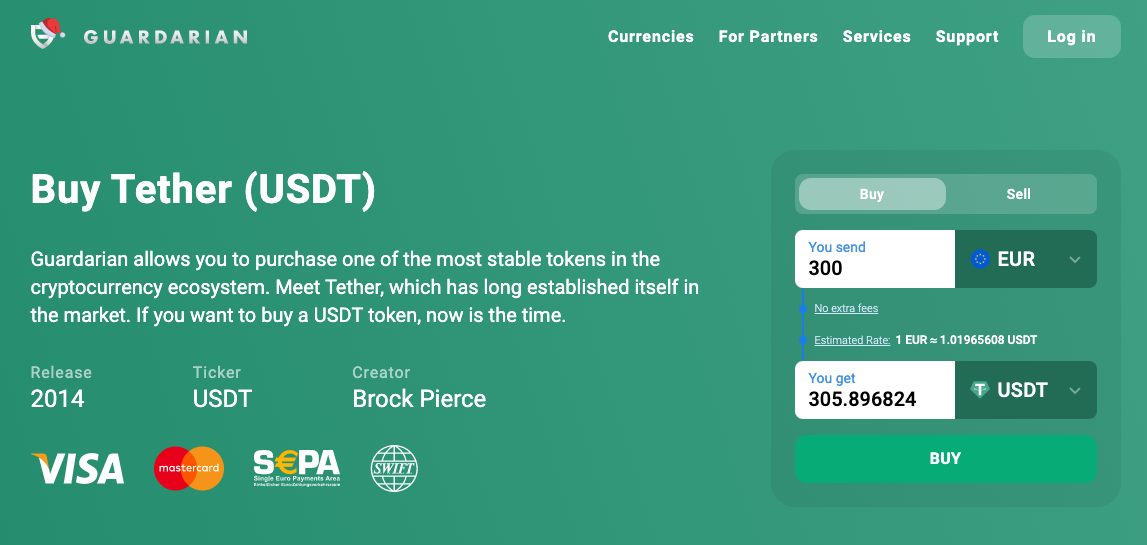

But if you would like to buy USDC or USDT instantly, safely and easily – we recommend using Guardarian.

Best rates on the market, instant transactions and no registration – we are happy to be able to provide these benefits to all of our customers.

The Takeaway

Even though all stablecoins are pegged to the dollar, they are not exactly equal.

In the USDC vs USDT comparison, Tether is somewhat of a better known stablecoins; USDT is less appealing to some investors due to the company’s business practices and ambiguous ties with exchanges.

On the other hand, USDC provides the same advantages as Tether without being implicated in any questionable dealings or governmental probes.

While USDT remains the most popular stablecoin, time will show if it will remain the leader or if the tide will turn towards something else in the future.