Real World Assets (RWA) are becoming a hot topic in crypto, as they bring real-world value like real estate and commodities onto the blockchain. At Guardarian, we see RWAs as an important step in connecting traditional finance with the digital world. This article explains what RWAs are, how they differ from popular cryptocurrencies like Bitcoin and Ethereum, and why they matter for investors exploring the future of digital assets.

What Are Real World Assets (RWA)?

Real World Assets (RWA) are tokenized versions of tangible or traditional financial assets such as real estate, artwork, commodities, or bonds. Tokenization means converting these physical assets into digital tokens on a blockchain, enabling them to be traded like cryptocurrencies.

Source: CoinMarketCap

Unlike cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), which are purely digital and decentralized currencies or platforms, RWAs represent ownership or rights tied directly to real-world objects or financial instruments.

How Are RWAs Different from Bitcoin and Ethereum?

-

Physical Backing: RWAs represent digital ownership of real assets — buildings, precious items, or shares in commodities. Bitcoin and Ethereum exist solely as digital assets without direct ties to physical objects.

-

Purpose and Use: Bitcoin and Ethereum are mainly used as stores of value, means of payment, or platforms for decentralized applications, whereas RWAs aim to broaden investment opportunities by making real-world assets more accessible and liquid.

-

Volatility and Stability: RWAs may experience less price volatility because their value is often linked to the underlying real asset, while cryptocurrencies like BTC and ETH can be much more volatile.

Why Are RWAs Important?

RWAs open new doors for investors by providing access to high-value or traditionally illiquid assets through blockchain tokens. This allows for greater portfolio diversification by combining the transparency, security, and efficiency of blockchain technology with real-world value.

RWA Tokens vs. RWA Infrastructure: What’s the Difference?

As interest in Real World Assets (RWA) grows, it’s important to distinguish between two key categories in the space:

| Project | Category | Backed by Real Asset? | Role |

| PAXG | RWA Token | Yes (Gold) | Digital gold ownership |

| ONDO | RWA Token | Yes (Treasuries) | Tokenized yield-bearing assets |

| LINK | Infrastructure | No | Oracle data feeds for RWAs |

| HBAR | Infrastructure | No | RWA tokenization platform |

| ALGO | Infrastructure | No | Compliance-friendly RWA chain |

| AVAX | Infrastructure | No | Customizable RWA networks |

| INJ | Infrastructure | No | RWA trading and derivatives |

| XLM | Infrastructure | No | Cross-border RWA transfers |

RWA Tokens: These are tokens directly backed by real-world assets like gold, government bonds, or real estate. Holding these tokens means you have digital ownership or a claim on the underlying physical asset.

-

PAX Gold (PAXG) — backed 1:1 by physical gold stored in vaults.

-

Ondo (ONDO) — represents tokenized yield-bearing assets such as U.S. Treasuries.

RWA Infrastructure Projects: These blockchains or protocols provide the technical foundation for tokenizing, transferring, or trading RWAs — but their native tokens are not RWAs themselves. They support the ecosystem without being backed by any physical asset.

-

Hedera (HBAR): Known for its high-speed and secure distributed ledger technology, Hedera supports enterprise-level applications including RWA tokenization with fast finality and low fees.

-

Chainlink (LINK): As a decentralized oracle network, Chainlink provides reliable real-world data feeds that are essential for RWA smart contracts to interact with external asset prices and events.

-

Algorand (ALGO): Algorand offers a scalable and secure blockchain optimized for creating tokenized assets, including RWAs, with a focus on compliance and instant transaction finality.

-

Avalanche (AVAX): Avalanche’s high throughput and customizable subnetworks enable the creation and trading of RWA tokens with interoperability across multiple blockchains.

-

Injective (INJ): Injective is a decentralized derivatives exchange protocol that enables trading of tokenized real-world assets with low fees and fast settlement, supporting liquidity for RWA markets.

-

Stellar (XLM): Stellar provides a fast, low-cost blockchain platform ideal for issuing and transferring tokenized assets, including RWAs, making cross-border asset transactions simpler and more efficient.

Alongside these projects, popular cryptocurrencies such as Bitcoin and Ethereum continue to serve as foundational digital assets, but RWAs bring an added layer of tangible value bridging traditional finance and blockchain innovation.

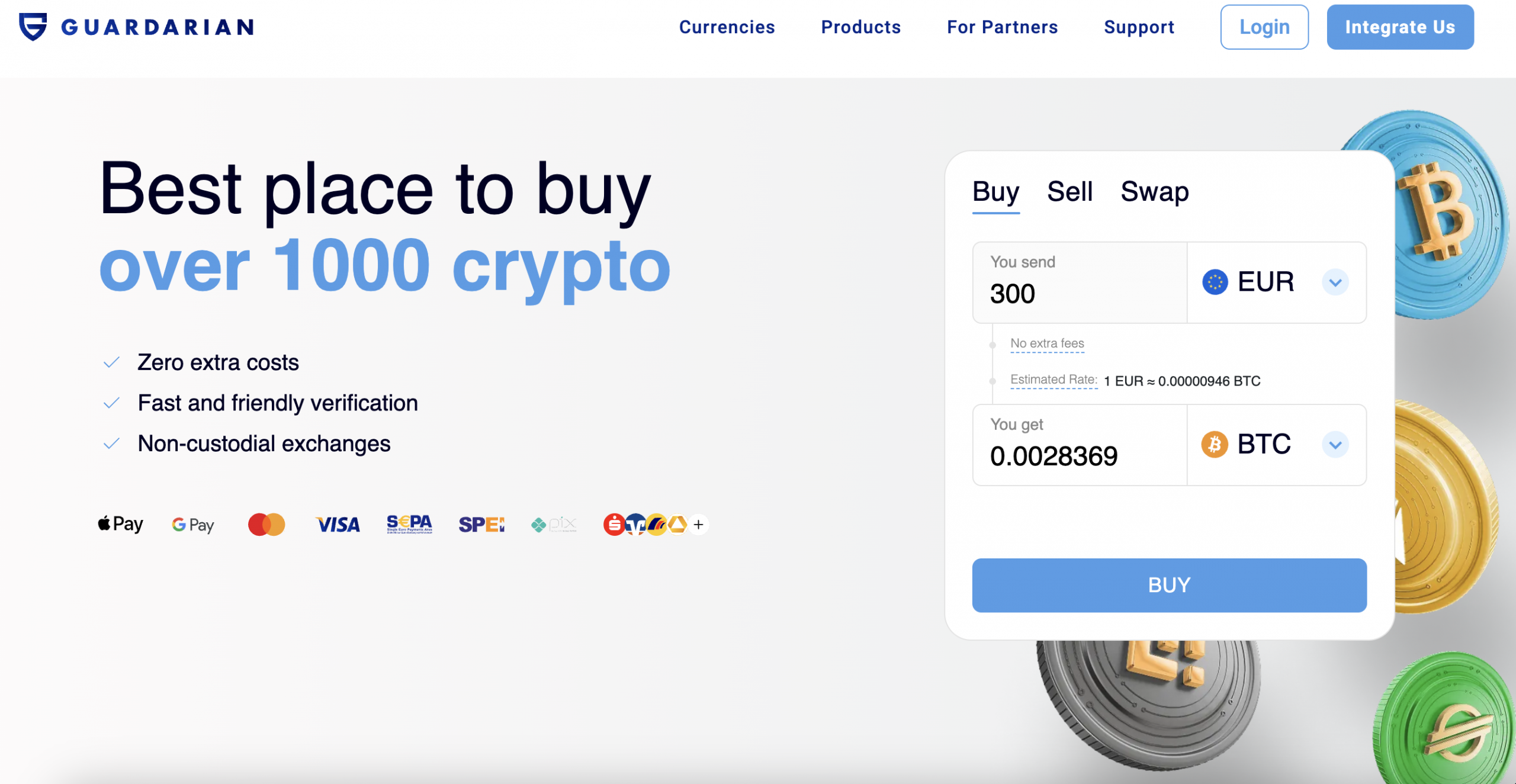

Explore the Crypto World with Guardarian

Source: Guardarian

At Guardarian, we make it simple to buy crypto, sell crypto, and swap crypto — with access to over 1000+ cryptocurrencies on a secure, user-friendly platform. Start diversifying your portfolio today and experience the future of finance at your fingertips. Visit guardarian.com to join thousands of users worldwide who trust Guardarian for seamless crypto transactions.