Moving money across Europe is easier than ever with SEPA. But what exactly is a SEPA payment, and how does it differ from SEPA Instant? In this guide, we explain both methods and show how you can buy crypto with SEPA quickly, securely, and efficiently.

What is a SEPA Payment?

The term Single Euro Payments Area (SEPA) describes a region-wide payment framework for euro-denominated transfers across participating European countries. The goal of SEPA is to make sending money in euros across borders just as simple, speedy and cost-effective as a domestic transfer.

How it works

A SEPA payment (often a SEPA Credit Transfer or SEPA Direct Debit) enables an individual or a business in one participating country to send funds in euros to another account in another participating country, under the same conditions as if it were domestic. Most banks will require the payer’s International Bank Account Number (IBAN) and sometimes the Bank Identifier Code (BIC) when making the payment.

Key benefits

-

Efficiency & cost-effectiveness: SEPA payments reduce the cost and complexity of cross-border euro transfers.

-

Uniform process: Payments in euros across SEPA countries follow the same rules regardless of the sending and receiving country.

-

Broader participation: The SEPA area covers EU member states and additional countries/territories, making it a broad euro-payment zone.

Use-case: Crypto and SEPA

For users of cryptocurrency exchanges or platforms, the availability of a SEPA payment route means you can buy crypto using your bank account in the euro zone via SEPA. That is, you can transfer euros via a SEPA payment from your bank into a crypto platform, enabling the purchase of digital assets.

What is SEPA Instant (or “SEPA Instant Credit Transfer”)?

While standard SEPA payments are efficient, they typically require banking hours and one business-day settlement or more. The enhanced scheme, SEPA Instant Credit Transfer (SCT Inst), is designed to process euro payments in real-time, 24 hours a day, 365 days a year.

How SEPA Instant differs

-

Speed: Funds are typically credited to the recipient within seconds (often under 10 seconds) after the payment order is submitted.

-

Availability: The service is designed to operate round-the-clock (24/7/365) rather than being limited to banking hours.

-

Scope: Subject to participating banks/payment service providers, the SCT Inst scheme allows for euro transfers across the SEPA region under the instant-payment regime.

Why this matters for crypto

If you want to buy crypto with SEPA Instant, you can benefit from faster settlement of funds into your crypto wallet or exchange account compared to standard SEPA transfers. This means reduced waiting time between sending the payment and being able to trade or invest.

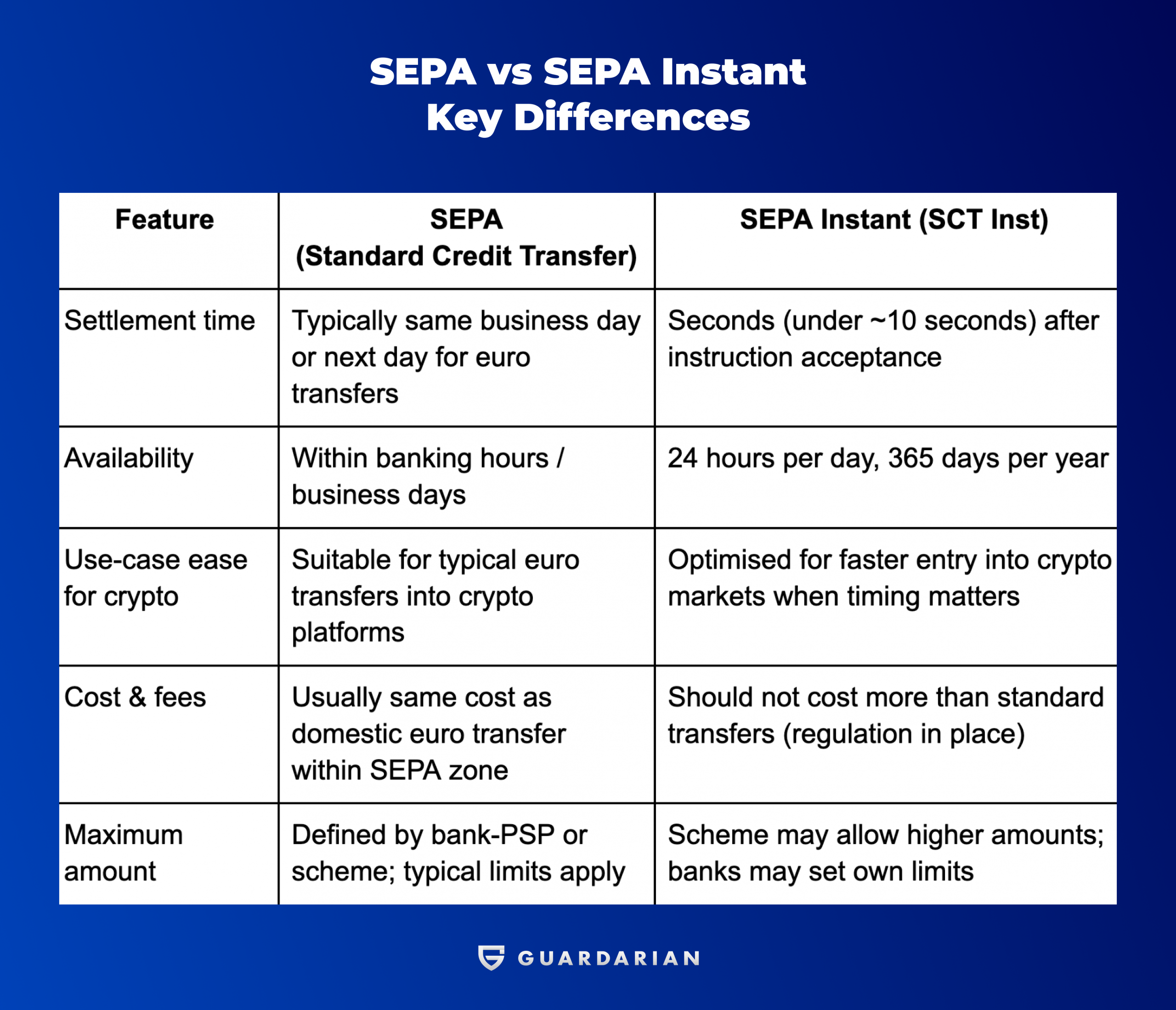

SEPA vs SEPA Instant — Key Differences

Which should you use to buy crypto?

-

If you are planning a buy crypto transaction and standard settlement time (e.g., next business day) is acceptable, you can use a standard SEPA transfer.

-

If timing is critical (e.g., reacting to a market move) and your bank/exchange support it, choose the option to buy crypto with SEPA Instant for near-real-time fund availability.

-

Always check with your bank and crypto platform whether they support SCT Inst and whether there are any additional conditions or fees.