Understanding the term “market cap” is essential for any individual investor eyeing the crypto space. But what exactly is market cap, and why is it so crucial? In this comprehensive guide, we’ll dissect what market cap means, its significance, and how you can use this metric to invest into crypto in a smart way.

In the sections ahead, you’ll get insights into:

- How market cap is calculated and what it represents.

- The role of market cap in evaluating a cryptocurrency’s value and risk.

- Comparisons between market cap and other pivotal metrics like trading volume and liquidity.

- Different categories of market cap and their implications for your investment strategy.

Ready to become a savvy investor with a solid grasp of market cap? Let’s get started. 👇

What is Market Cap?

Market capitalization, commonly referred to as market cap, is a simple yet powerful metric used to evaluate the size and significance of a cryptocurrency—or any asset, for that matter. In essence, it gives you a snapshot of how the market values a particular coin or token at any given time.

Definition of Market Cap

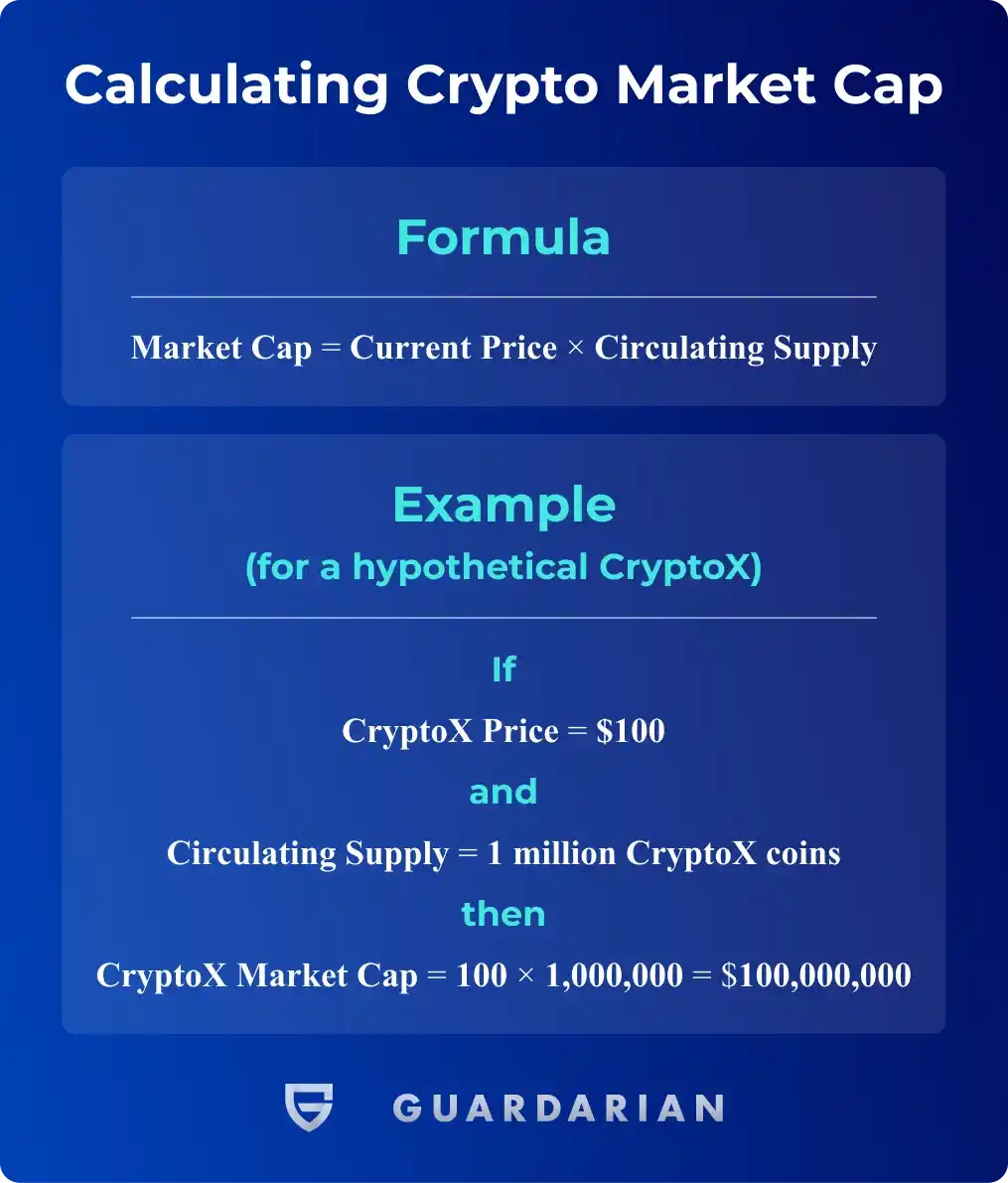

Market cap is calculated by multiplying the current price of a cryptocurrency by its total circulating supply. The formula is:

Market Cap=Current Price×Circulating Supply

How to Calculate Market Cap: An Example

Let’s take a real-world example to make this concept clearer. Suppose the current price of a hypothetical cryptocurrency, let’s call it “CryptoX”, is $100. If there are 1 million CryptoX coins in circulation, the market cap would be:

Market Cap of CryptoX=100×1,000,000=100,000,000

So, the market cap of CryptoX would be $100 million.

Understanding the market cap can provide insights into the relative size and stability of a cryptocurrency. A higher market cap generally indicates more stability and less risk, while a lower market cap could signify the opposite. However, market cap should not be looked at in isolation, as we’ll explore in upcoming sections.

Why Market Cap Matters

Understanding the market cap of a cryptocurrency isn’t just a numbers game; it’s a vital part of assessing both the asset’s stability and its potential for future growth. In this section, we’ll explore several key reasons why you should pay close attention to this metric.

1. Indicator of Stability

A high market cap generally signifies a stable asset. Stability in this context doesn’t necessarily mean a lack of volatility; rather, it implies that the cryptocurrency is less susceptible to market manipulation or drastic changes in price.

2. Asset Valuation

Market cap can provide an initial ballpark figure for the worth of a cryptocurrency. However, remember that it’s not an end-all-be-all metric. It should be part of a more extensive due diligence process when assessing an asset’s true value.

3. Portfolio Diversification

Knowing the market cap of various cryptocurrencies can aid in diversifying your investment portfolio. Typically, a mix of high, medium, and low market cap assets can offer a balance between risk and reward.

4. Risk Assessment

While a high market cap can indicate stability, a low market cap can be a red flag. Lower market cap coins are generally more susceptible to volatility and can carry higher risks. However, they also offer higher potential returns, making them attractive to some investors.

5. Market Sentiment

Market cap trends can often indicate market sentiment. A steadily increasing market cap generally signifies positive sentiment, while a declining market cap can indicate the opposite.

Market Cap vs. Other Metrics

While market cap is undoubtedly an important metric, it’s not the only one you should be paying attention to. In this section, we’ll compare market cap with other key metrics like trading volume, price, and liquidity to give you a well-rounded understanding of asset evaluation.

Market Cap vs. Trading Volume

- Definition: Trading volume refers to the total number of coins traded in a specific time period, often 24 hours.

- Comparison: A high market cap coupled with low trading volume may indicate a less active market, while a high trading volume can often signal strong investor interest.

Market Cap vs. Price

- Definition: Price is the current value of a single unit of cryptocurrency.

- Comparison: Price alone doesn’t offer a complete picture of an asset’s health. A low-priced coin could still have a high market cap if there are many coins in circulation, and vice versa.

Market Cap vs. Liquidity

- Definition: Liquidity refers to the ease with which an asset can be bought or sold without affecting its price.

- Comparison: High liquidity generally pairs well with a high market cap, making it easier to enter or exit positions. However, a high market cap doesn’t always guarantee high liquidity.

The Importance of a Balanced View

It’s crucial to look at these metrics in conjunction with market cap to get a holistic view of a cryptocurrency’s stability, popularity, and potential for growth. Relying solely on market cap can lead to skewed perceptions and potentially misguided investment decisions.

Types of Market Cap: What They Mean for Your Investment

Just as all cryptocurrencies aren’t created equal, neither are all market caps. In this section, we’ll examine the various categories of market cap—namely, large-cap, mid-cap, and small-cap—and discuss what they indicate about a cryptocurrency’s potential for both risk and reward.

Large-Cap Cryptocurrencies

- Definition: Cryptocurrencies with a market cap over $10 billion.

- Characteristics: Generally stable, less volatile, and considered safer investments.

- Examples: Bitcoin, Ethereum, Solana,

Mid-Cap Cryptocurrencies

- Definition: Cryptocurrencies with a market cap between $1 billion and $10 billion.

- Characteristics: Often less stable than large-caps but offer a higher potential for returns.

- Examples: Cardano, Polkadot, Litecoin

Small-Cap Cryptocurrencies

- Definition: Cryptocurrencies with a market cap under $1 billion.

- Characteristics: These are the riskiest but also offer the highest potential for significant returns.

- Examples: Various DeFi tokens and newer blockchain projects.

Navigating Your Investment Strategy

Knowing the different types of market cap can help you tailor your investment strategy. For instance, a portfolio heavy on large-cap cryptocurrencies may be safer but offer less potential for high returns. Conversely, including some small-cap assets can increase your risk but also your potential for substantial gains.

Conclusion

Understanding the market cap of a cryptocurrency is essential for making informed investment decisions. This metric provides valuable insights into an asset’s stability, risk profile, and valuation. However, it should not be the sole metric used for asset evaluation.

And if you are thinking of diversifying their crypto portfolio, Guardarian offers an intuitive, secure, and instant crypto-to-fiat gateway.

We support over 400 cryptocurrencies and 40+ fiat currencies, all exchanges are conducted at the best rates and require no registration. Try buying, selling, and swapping crypto with Guardarian and we guarantee you will not be dissapointed!