In the world of cryptocurrencies, stablecoins like USDT and USDC are well-known players. But there are other options on the market, including USDD – an over-collateralized decentralized stablecoin linked to 11 mainstream blockchains. Offering an innovative blend of collateralized solutions and monetary policies, USDD is carving a unique path in the industry.

In this article, we’ll explore USDD’s background, functionality, unique benefits, and how to buy it at the best rates using Guardarian.

Ready to dive into the world of USDD? Let’s get started.

What is USDD? Understanding the Basics

USDD, or ‘decentralized USD,’ is a unique stablecoin connected to the TRON blockchains, such as: TRON, Ethereum, BNBChain and so forth, ranking among the top 10 stablecoins with a market cap of $725 million.

Instead of solely relying on real-world assets, USDD uses over-collateralization, backed by assets like TRX, BTC, USDT, and USDC, to maintain stability. On 7 October 2022, it marked a significant milestone by becoming legal tender in the Commonwealth of Dominica.

USDD’s distinctiveness stems from its monetary policies, adopted by the TRON DAO Reserve, which adjusts based on market conditions to maintain its stable value. Its connection to the TRON blockchain emphasizes its unique role in the global financial ecosystem.

How Does USDD Work? A Closer Look

Understanding the mechanism behind USDD requires a closer look at the distinctive features that enable its stability and innovation. Let’s delve into the key components that set USDD apart from conventional stablecoins.

Over-collateralization

USDD sets itself apart by being over-collateralized, with more than 170% of its value backed by over $848 million worth of TRX and $372 million of BTC. This foundational stability sets the stage for the stablecoin’s innovative features.

Peg Stability Module

Adding to this stability, USDD offers a Peg Stability Module, or PSM, allowing users to swap USDD with other stablecoins like USDT or USDC at a 1:1 rate, without slippage.

Fluctuation Around the U.S. Dollar

Unlike centralized stablecoins, USDD, given its decentralized nature, is not bound to a strict 1:1 pegging but fluctuates around the U.S. dollar, governed by market conditions. It operates on a linked exchange rate system, allowing for fluctuations within a defined band, akin to the Linked Exchange Rate System (LERS) used with the Hong Kong dollar.

Unique Benefits of USDD

USDD distinguishes itself from other stablecoins through a set of innovative features and approaches. Governed by the TRON DAO Reserve, its decentralized nature is at the core of its design. Unlike centralized stablecoins that strictly adhere to 1:1 pegging, USDD operates with over-collateralization and allows price fluctuations within a controlled range.

Its Linked Exchange Rate System (LERS) provides flexibility in pricing, while the Peg Stability Module (PSM) enables interaction with other stablecoins. The acceptance of USDD as legal tender in the Commonwealth of Dominica further signifies its growing relevance in the global financial landscape.

In essence, USDD’s unique benefits are rooted in its decentralization, innovative pegging system, and legal recognition, making it an intriguing alternative in the stablecoin market.

Is USDD a Good Investment?

Diversification and strategic investments are crucial in the crypto realm, and USDD may stand out as an appealing option for some investors. TRON DAO Reserve’s innovative efforts are clear in USDD’s design, and a series of measures have been taken to preserve its value, even during turbulent market conditions. Collateralizing the token with stable assets such as BTC and USDT, in addition to TRX, demonstrates a mindful approach to maintaining stability.

Moreover, USDD has an active community and a growing ecosystem that includes wallets, exchanges, and DeFi applications that support it. These factors showcase not just growth but a commitment to continuous development and innovation.

However, it’s essential to underscore that all crypto investments inherently carry risk, and USDD is no exception. While the above factors make USDD worth considering, it must be done with due diligence and careful consideration. So make sure to always DYOR and be conscious of your investment goals and risk tolerance.

How to Buy USDD Using Guardarian

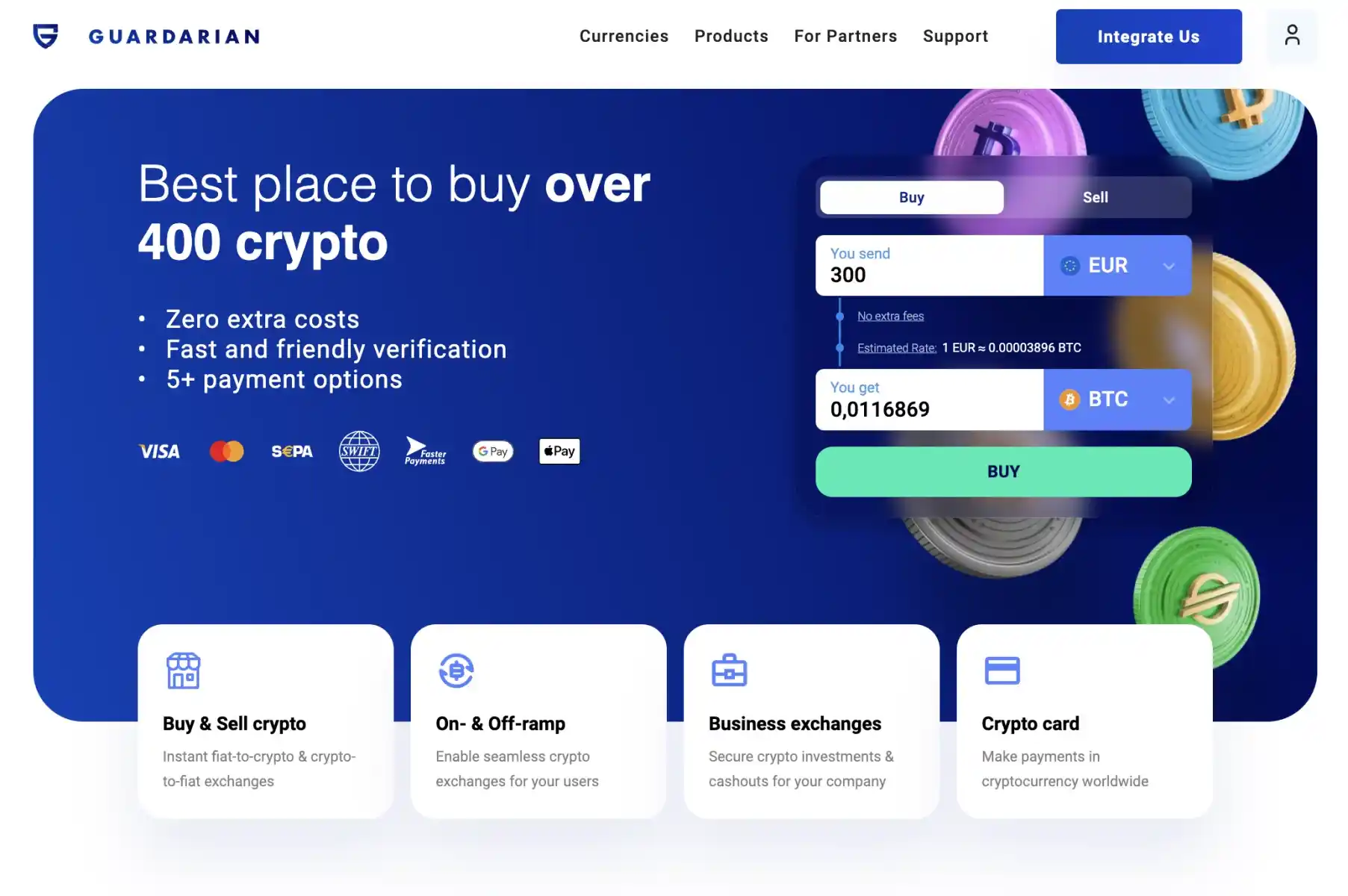

Among the many exchanges and platforms available today, we recommend you use Guardarian to buy USDD. We support over 400 different cryptocurrencies and more than 40 fiat currencies, offering instant and non-custodial exchanges. With no registration required, intuitive checkout process, and a focus on keeping you in control of your funds, Guardarian ensures a secure and seamless experience.

Here’s how to buy USDD using Guardarian in minutes:

- Visit our website at www.guardarian.com.

- Choose USDD as the cryptocurrency you want to buy, enter the desired amount, and select the fiat currency you’d like to pay with, then click “Buy”.

- Enter your USDD wallet address and select the payment method that suits you best.

- Complete our instant and intuitive checkout process – no registration required!

- Check Your Wallet: Your USDD will be available within minutes, ready for you to use.

Conclusion

In the ever-evolving crypto landscape, USDD emerges as a decentralized stablecoin with distinct features and mechanisms. From its connection to the TRON blockchain to its innovative stability approaches, USDD has solidified itself in the top 50 cryptocurrencies on the market.

Understanding the unique benefits of USDD, such as its over-collateralization and unique monetary policies and contrasting them with other stablecoins like USDT and USDC, reveals its potential to gain wider popularity in the future.

For those considering exploring or buying USDD, Guardarian offers a simple, secure, and intuitive way to do so. So make sure to visit our website to buy USDD at the best rates.

The information provided in this article is for educational and informational purposes only. We encourage you to do your own research (DYOR) and consult with appropriate professionals to ensure that you are making decisions that align with your individual needs and goals. Always approach investments with caution and awareness of the potential risks involved.