The crypto world is constantly evolving, offering countless coins and tokens for investors to explore. Among these, Ethereum stands out as one of the most popular and widely used blockchains. But have you heard of Wrapped Ether (WETH)? It’s not just another token — it’s a bridge that makes Ethereum even more versatile.

In this article, we’ll take a closer look at WETH—what it is and how it works. Let’s dive in.

What is Wrapped Ether (WETH)?

Wrapped Ether (WETH) is simply Ethereum (ETH) that has been “wrapped” to comply with the ERC-20 token standard. While ETH is Ethereum’s native token, it wasn’t originally ERC-20 compatible, which is the standard used for most tokens on the Ethereum network.

By wrapping ETH into WETH, it becomes fully compatible with decentralized applications (dApps), decentralized exchanges (DEXs), and smart contracts. Essentially, WETH unlocks Ethereum’s full potential within the DeFi ecosystem.

For every WETH token minted, one ETH is locked in a smart contract. This ensures that WETH is always backed 1:1 by real ETH, making it a fully redeemable token.

How Does WETH Work?

The process is simple:

1- Wrap ETH – You send your ETH to a smart contract that locks it.

2- Receive WETH – The contract mints the equivalent amount of WETH to your wallet.

3- Use WETH – Trade, stake, or interact with DeFi protocols just like any ERC-20 token.

4- Unwrap WETH – Redeem your WETH back for ETH whenever you want.

This wrapping mechanism allows seamless interaction across Ethereum-based platforms and makes liquidity pools, yield farming, and token swaps much easier.

Why WETH Matters?

Wrapped Ether may seem like a technical nuance, but it’s actually a crucial component of the Ethereum ecosystem. Here’s why:

-

DeFi Compatibility – Almost all DeFi applications require ERC-20 tokens. WETH ensures ETH can participate in these protocols.

-

Liquidity Boost – WETH improves liquidity on DEXs like Uniswap, SushiSwap, and Balancer.

-

Simplified Swaps – Swapping ETH with other ERC-20 tokens becomes faster and more efficient.

In short, WETH acts as a bridge between Ethereum’s native token and the broader DeFi universe, unlocking more opportunities for investors and developers alike.

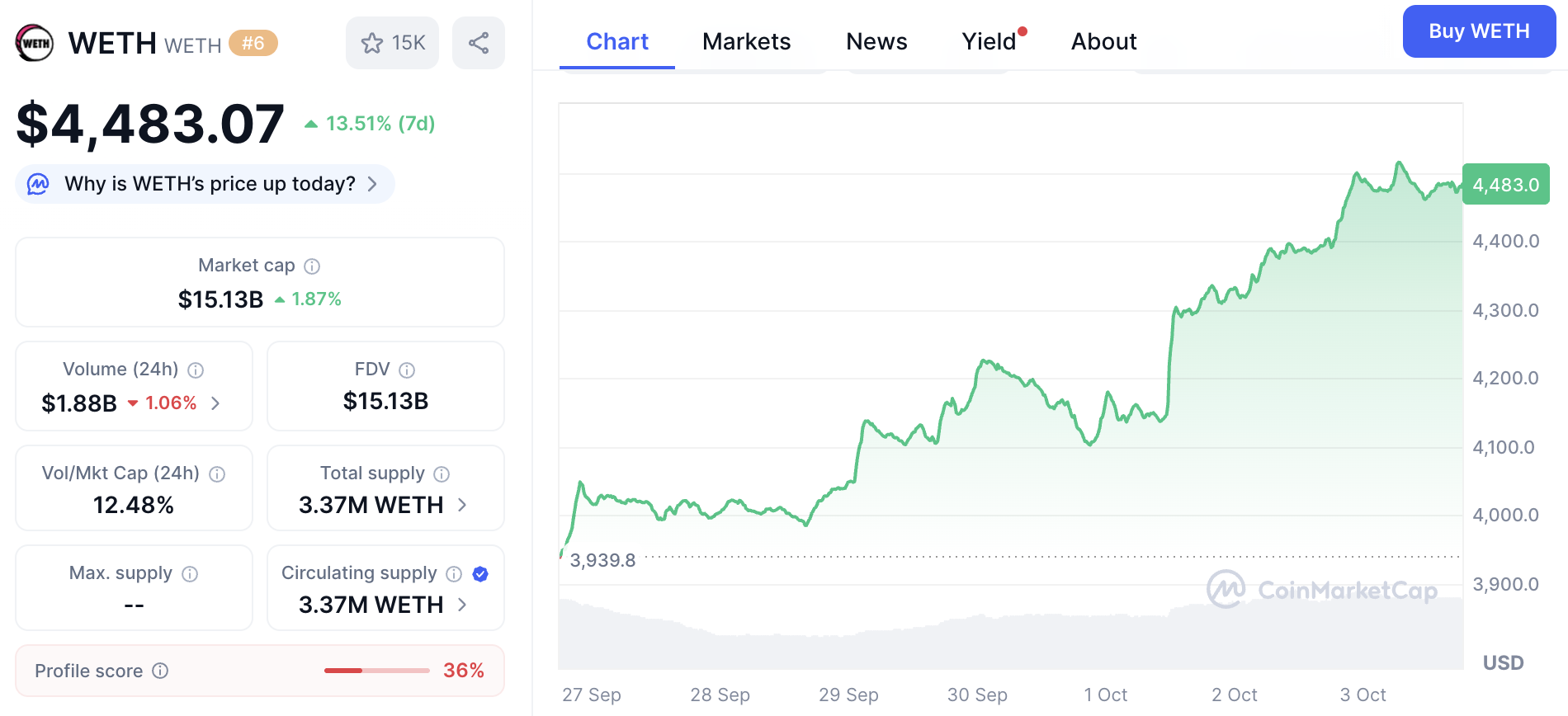

Is WETH a Good Investment?

When considering an investment, it’s important to weigh both advantages and disadvantages.

Advantages of WETH ✅

-

Full Ethereum Backing – Each WETH is redeemable 1:1 for ETH, providing transparency and security.

-

DeFi Access – Unlocks opportunities in lending, staking, and liquidity pools that require ERC-20 tokens.

-

High Liquidity – WETH is widely used across DEXs, ensuring smooth trading and minimal slippage.

-

Interoperability – Works seamlessly with most Ethereum-based dApps and smart contracts.

Disadvantages of WETH ⛔

-

No Additional Appreciation – WETH’s value mirrors ETH, so it doesn’t offer independent price growth.

-

Smart Contract Risks – Wrapping relies on smart contracts, which, while audited, are not entirely risk-free.

-

Gas Fees – Converting ETH to WETH and back requires Ethereum network fees, which can be high during congestion.

If you’re already bullish on Ethereum, WETH is more of a utility token than a speculative investment. It doesn’t increase in value independently, but it allows you to engage with DeFi opportunities that ETH alone can’t access. For active DeFi users, WETH is essential. For long-term investors who simply want exposure to Ethereum’s price movements, holding ETH might be more straightforward.

Whether you’re looking to participate in DeFi or simply want to explore the Ethereum ecosystem, WETH is an essential asset to understand and use. At Guardarian, you can easily buy WETH or 1000+ cryptocurrencies quickly and securely. No hidden fees, no complicated registration — just fast, reliable crypto access. Check us out at www.guardarian.com! Or buy it right here 👇