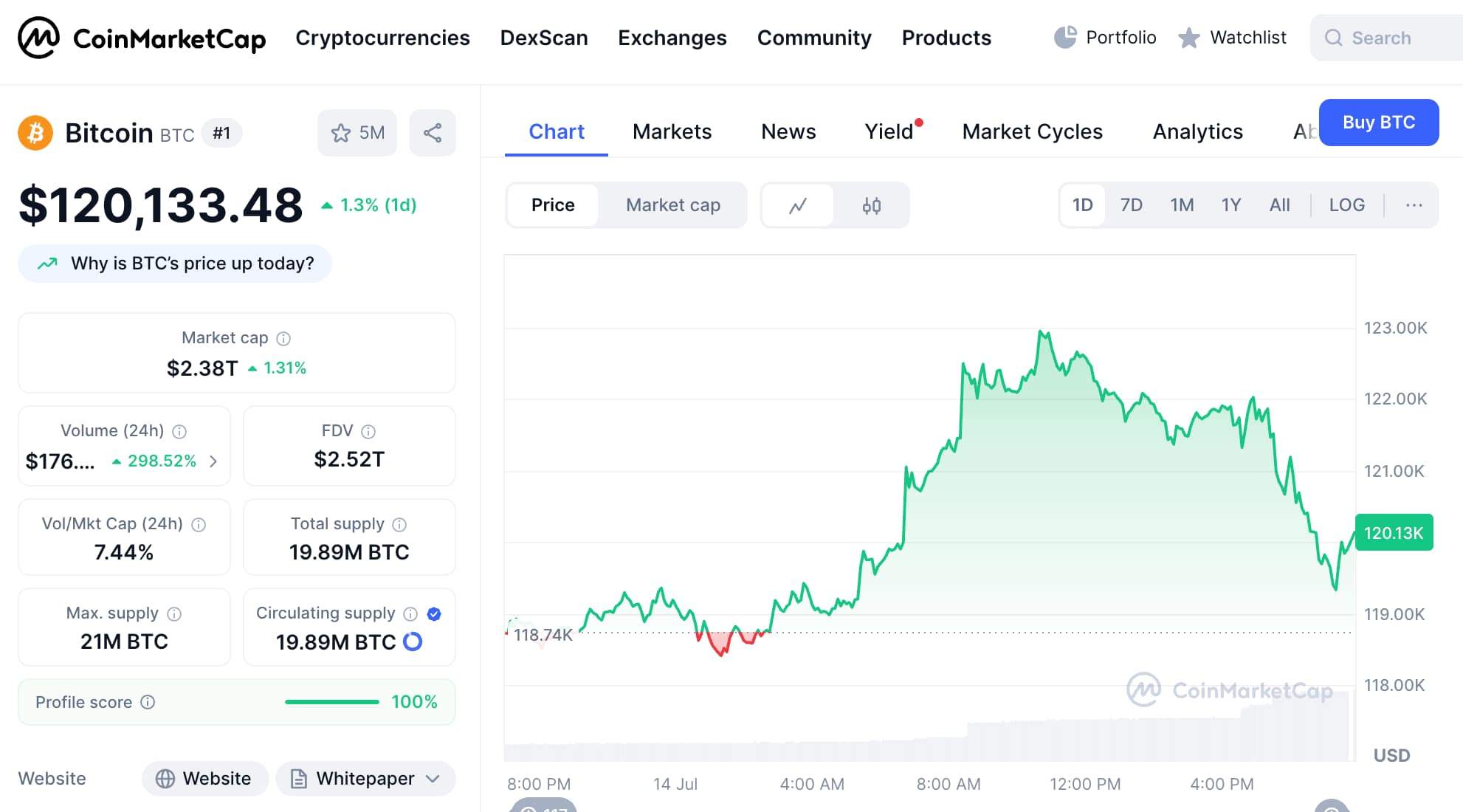

In July 2025, Bitcoin (BTC) shattered expectations, soaring to an all-time high above $122,000 and cementing its position as the cornerstone of the crypto market. This explosive rally has sparked widespread excitement, with investors and analysts buzzing about the factors fueling this surge. From institutional adoption to macroeconomic shifts, let’s dive into why Bitcoin surged in July 2025 and what it means for the future of cryptocurrency.

Institutional FOMO: Corporations and ETFs Fuel the Fire

One of the primary drivers behind Bitcoin’s July 2025 surge is the unprecedented wave of institutional adoption. Major financial institutions like BlackRock and Fidelity have doubled down on Bitcoin exchange-traded funds (ETFs), with BlackRock alone holding over $65 billion in BTC through its iShares Bitcoin ETF. Since the approval of spot Bitcoin ETFs in January 2024, inflows have skyrocketed, with $14.4 billion in net inflows recorded by July 3, 2025. These ETFs have made Bitcoin more accessible to institutional and retail investors, broadening the market’s capital base.

Additionally, Bitcoin treasury companies like MicroStrategy, which holds 576,230 BTC, and newer players like Metaplanet have embraced BTC as a reserve asset. Posts on X highlight corporate FOMO, with companies like Addentax ($1.3B) and Mogo ($50M) announcing significant Bitcoin purchases, further driving demand. This institutional influx has created a supply-demand imbalance, pushing prices higher as only 14.5% of Bitcoin’s supply remains liquid.

Institutional investments and ETF inflows are key reasons why Bitcoin surged in July 2025, signaling growing mainstream acceptance.

Post-Halving Supply Shock: A Classic Bitcoin Catalyst

The Bitcoin halving in April 2024 reduced mining rewards from 6.25 BTC to 3.125 BTC, cutting the rate of new Bitcoin issuance. Historically, halvings trigger supply shocks that drive price increases, as seen in 2013, 2017, and 2021. In July 2025, this effect is in full swing, with miners holding back supply and ETF demand outpacing new BTC issuance by nearly 3:1 (51,500 BTC accumulated vs. 13,850 BTC mined in December 2024).

Analysts like Michael Saylor of MicroStrategy predict this supply crunch will continue to propel Bitcoin’s value, with some forecasting a peak of $170,000 within the next year. The combination of reduced supply and growing demand has created a perfect storm for Bitcoin’s July 2025 rally.

The 2024 halving’s supply reduction continues to drive Bitcoin’s price upward in July 2025.

Pro-Crypto Policies and Regulatory Clarity

The re-election of Donald Trump in November 2024 has been a game-changer for Bitcoin. Trump’s pledge to make the U.S. the “crypto capital of the planet” and establish a Strategic Bitcoin Reserve has boosted investor confidence. Proposals like Senator Cynthia Lummis’s plan to acquire 200,000 BTC annually for five years signal strong governmental support, further legitimizing Bitcoin as a reserve asset.

Moreover, the SEC’s approval of spot Bitcoin ETFs and hints at favorable crypto regulations in Q3 2025 have reduced uncertainty, encouraging institutional participation. Posts on X also note easing geopolitical tensions, such as reduced war-related fears, which have shifted market sentiment from risk-off to risk-on, benefiting Bitcoin.

Macroeconomic Tailwinds: Liquidity and Inflation Hedges

The macroeconomic environment in July 2025 is highly favorable for Bitcoin. The Federal Reserve’s rate pause and potential rate cuts have increased global liquidity, historically a bullish signal for BTC. Posts on X highlight that global liquidity hitting all-time highs has often preceded Bitcoin rallies, and July 2025 is no exception.

Bitcoin’s narrative as a hedge against inflation and a “digital gold” alternative has gained traction, especially as the U.S. dollar weakens and M2 money supply reaches $21.94T. With traditional markets like the S&P 500 and Nasdaq hitting record highs, Bitcoin’s correlation with risk assets (0.73–0.90) has further fueled its rally.

Favorable macroeconomic conditions and Bitcoin’s safe-haven status are driving its July 2025 price surge.

Technical Indicators Signal Bullish Momentum

From a technical perspective, Bitcoin’s price action in July 2025 is strongly bullish. Trading at $116,505.1 on July 11, BTC is above key moving averages (EMA 100 at $108,664 and EMA 200 at $108,472), with the Relative Strength Index (RSI) at 60.47, indicating sustained momentum without overbought conditions. Analysts predict a breakout above $110,529.18 could push BTC toward $120,000 by mid-July, with support zones at $105,000–$108,000.

The Fear & Greed Index at 71 (Greed) and 57% green days over the past month further confirm bullish market sentiment. Posts on X also point to a historical July pattern, with Bitcoin often rallying during this month.

Strong technical indicators and historical patterns support Bitcoin’s upward trajectory in July 2025.

What’s Next for Bitcoin in 2025?

With Bitcoin’s price hitting $122,000 in July 2025, analysts are optimistic about further gains. Forecasts range from $120,000 by month-end to $200,000–$250,000 by year-end, driven by continued ETF inflows, corporate adoption, and supportive policies. However, volatility remains a risk, with potential pullbacks to $100,000–$107,000 if bearish pressures emerge, such as geopolitical flare-ups or regulatory surprises.

For investors, strategies like dollar-cost averaging can mitigate risks while capitalizing on Bitcoin’s long-term potential. As the crypto market evolves, staying informed about Bitcoin price predictions 2025, regulatory developments, and macroeconomic trends will be crucial.