The Decentralized Finance (DeFi) sector has grown in value over the years due to its utility. DeFi platforms have provided users with alternative ways to save, borrow, and otherwise utilize their assets without third-party control or interference.

This has contributed to an increase in adoption of DeFi applications while increasing the profit potential of DeFi crypto assets.

Some crypto analysts predict another boom for the DeFi industry this year while DeFi token holders anticipate solid profits from their holdings. And for those who are not familiar with the DeFi sector, we’ve compiled a list of what we think are the 10 Best DeFi tokens to look into in the beginning of 2023.

But first, let’s take a brief look at what DeFi coins are and their role in the DeFi ecosystem. 👇

What are DeFi tokens?

DeFi tokens are cryptocurrencies used as a means of exchange or investment in decentralized finance (DeFi) protocols. DeFi itself refers to financial applications built on top of blockchain, which aim to provide financial services in a decentralized, permissionless, and transparent manner.

DeFi tokens are designed to provide various functions within DeFi protocols. These include governance, utility, and liquidity. Some tokens provide voting rights for holders to participate in the decision-making process of a protocol or organization, while others are used as collateral to borrow or lend funds.

One of the key advantages of DeFi tokens is their potential to provide a high degree of interoperability between different DeFi protocols. This allows users to move their assets across different protocols seamlessly, enabling them to access a wider range of financial services without intermediaries or middlemen.

10 Best DeFi tokens to invest in

There is a multitude of different DeFi tokens on the market right now. The list before includes 10 examples of interesting projects, both old and new, that you should consider when looking for DeFi-centered investments. 👇

1. Maker (MKR)

MKR is is the native token of MakerDAO, a decentralized autonomous organization (DAO) that provides a stablecoin called DAI.

MakerDAO uses smart contracts to allow users to lock up collateral in the form of other cryptocurrencies, and then issue DAI stablecoins against that collateral. The value of DAI is pegged to the US dollar, meaning that one DAI is worth approximately one USD.

Holding MKR tokens gives users voting rights within the MakerDAO ecosystem. They can vote on important decisions such as changes to the stability fee (the interest rate paid on borrowed DAI), or changes to the collateralization ratio (the amount of collateral required to issue a certain amount of DAI).

Is MKR a good investment?

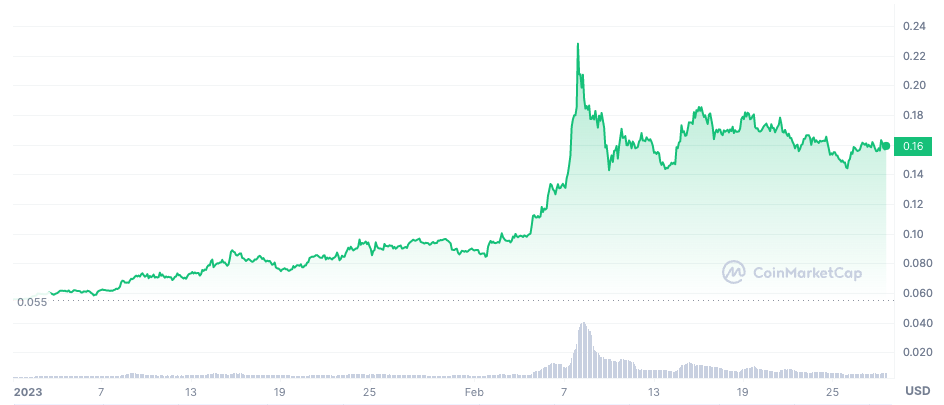

XTZ price in 2023. Source: Coinmarketcap

MKR may prove to be a good investment for a couple of readsons. Firstly, the MakerDAO ecosystem has a solid track record and is widely used within the DeFi space. Secondly, MKR holders have a say in the governance of the ecosystem, making it a community-driven project. Finally, the value of MKR is tied to the success of MakerDAO, meaning that as the platform grows, so too should the value of the MKR token.

2. Chainlink (LINK)

Chainlink is a decentralized oracle network that aims to provide real-world data to smart contracts on the blockchain. Oracles are responsible for providing external data to the blockchain, and Chainlink’s decentralized network allows smart contracts to access real-time data from multiple sources, providing a secure and reliable means of data delivery. Chainlink has partnerships with numerous companies in the blockchain industry and beyond, including Google, SWIFT, and Oracle.

What makes Chainlink unique is its ability to provide reliable, tamper-proof data to smart contracts on the blockchain. This allows for the creation of decentralized applications (dApps) that can access real-world data in a trustless manner, enabling a wide range of use cases such as insurance, finance, and supply chain management.

Is LINK a good investment?

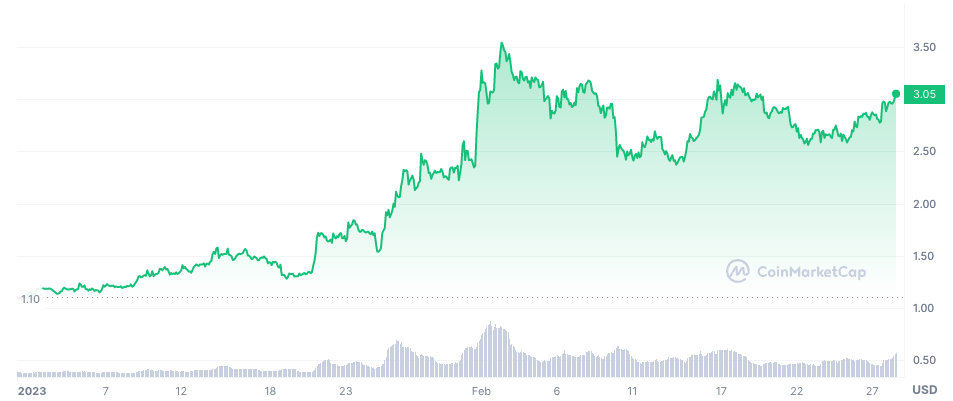

LINK price in 2023. Source: Coinmarketcap

The LINK token is used to incentivize the node operators on the Chainlink network who provide the data feeds to the smart contracts. Additionally, LINK tokens can be staked to help secure the network, earning stakers a return on their investment. This creates a demand for LINK tokens, as more usage of the Chainlink network will require more node operators and stakers. As such, LINK can be a good investment for those who believe in the long-term growth of decentralized applications and the need for secure and reliable data delivery to smart contracts.

3. Uniswap (UNI)

UNI is the native currenccy of Uniswap, a decentralized exchange built on the Ethereum blockchain. Uniswap enables users to trade cryptocurrencies without the need for an intermediary like a centralized exchange. UNI tokens are used to govern the protocol, enabling users to vote on changes and upgrades to the platform. Additionally, UNI holders can earn a share of the trading fees generated by the Uniswap exchange.

Is UNI a good investment?

UNI price in 2023. Source: Coinmarketcap

UNI has a strong use case as an integral part of the Uniswap ecosystem. As the popularity of decentralized finance (DeFi) continues to grow, Uniswap has become a major player in the space, with billions of dollars in trading volume. As more users participate in the Uniswap ecosystem, the demand for UNI tokens is likely to increase, potentially driving up the price. Additionally, with Uniswap constantly adding new features and updates, UNI holders have the potential to earn significant passive income through their participation in the governance process.

4. The Graph (GRT)

The Graph is a decentralized protocol for querying and indexing blockchain data. It enables developers to build and deploy applications that can access blockchain data in a fast, secure, and decentralized way. The GRT token is used to pay for query and indexing services on The Graph network, and it is also used for governance purposes.

Is GRT a good investment?

GRT price in 2023. Source: Coinmarketcap

People invest in GRT for different reasons. Firstly, it is a relatively new cryptocurrency with significant growth potential. The protocol has seen strong adoption and partnerships with other blockchain projects, indicating growing demand for its services. Additionally, as the DeFi ecosystem continues to expand, the demand for fast, secure, and decentralized data indexing and querying services is likely to increase, creating more demand for GRT.

5. Synthetix (SNX)

Synthetix is a decentralized protocol built on the Ethereum blockchain that enables the creation of synthetic assets that track the price of real-world assets, including currencies, commodities, and cryptocurrencies. These synthetic assets, or “synths,” are backed by the Synthetix Network Token (SNX) and can be traded on decentralized exchanges.

Synthetic protocols value comes from its ability to provide exposure to real-world assets without requiring investors to hold the underlying asset. This can be especially valuable for investors looking to diversify their portfolios or get exposure to assets that are difficult to access or trade.

SNX holders are also able to stake their tokens as collateral to mint new synths, earning fees in the process. This creates a sustainable economic model that incentivizes participation in the Synthetix ecosystem.

Is SNX a good investment?

SNX price in 2023. Source: Coinmarketcap

Synthetic protocol is being actively developed, having released its 3rd version on the Ethereum network in February 2023. Fast development rate, combined with its innovative approach to creating synthetic assets and growing adoption make SNX an interesting DeFi investment.

6. Balancer (BAL)

Balancer is a DeFi platform that enables users to create custom portfolios of cryptocurrency assets. It operates as an automated market maker, which means that it uses an algorithm to determine the price of assets in a given pool based on supply and demand.

The BAL token is used as the native currency for the Balancer ecosystem. Holders of BAL can participate in governance decisions, such as deciding on updates or changes to the protocol. Additionally, BAL holders are rewarded with a portion of the fees generated by the platform.

Is BAL a good investment?

BAL price in 2023. Source: Coinmarketcap

BAL has become a popular investment option within the DeFi space, as the Balancer platform has experienced significant growth in recent years. Its unique approach to creating customizable pools of assets has attracted a growing user base.

7. DYDX (DYDX)

Dydx is a fast-growing decentralized exchange (DEX) protocol that supports perpetual crypto trading in about 35+ cryptocurrencies. It is regarded as one of the leading DEX platforms by trading volume and market share. DYDX provides users with four key products, namely perpetual trading, governance, staking, and NFTs.

Perpetual trading is the platform’s leading utility. It allows users to trade open markets with contracts that are non-expirable. This allows traders to hold their buy or sell position for long until the predetermined trade conditions are met. The platform’s native token, DYDX, serves governance purposes. It can be staked to earn passive rewards, and users can equally leverage it to earn DYDX NFTs.

Is DYDX a good investment?

DYDX price in 2023. Source: Coinmarketcap

Investing in DYDX is a good option for those looking to participate in a growing decentralized exchange market. With its low fees, user-friendly interface, and focus on security, dYdX is well-positioned to compete with centralized exchanges. And with the recent fall of FTX and more traders choosing DEXes to CEXes, DYDX is sometimes hailed as the next big thing on the crypto exchanges arena.

8. Aave (AAVE)

Aave is an Ethereum-based DeFi platform that enables users to borrow and lend a variety of cryptocurrencies without the need for intermediaries such as banks. Aave utilizes a unique system of “flash loans” that allow users to borrow funds without collateral for a short period, enabling arbitrage and other trading strategies.

The AAVE token serves as the native currency of the Aave platform and is used for staking, governance, fee payments and other purposes. One of the unique propositions of Aave is its innovative lending pools system, which allows users to earn variable interest rates on their deposited assets. Aave’s protocol also incorporates a collateral liquidation mechanism that ensures the safety of the deposited assets in case of market volatility.

Is AAVE a good investment?

AAVE price in 2023. Source: Coinmarketcap

AAVE is a potentially good investment due to its strong use case and increasing adoption in the DeFi ecosystem. As the demand for DeFi lending and borrowing increases, the use of Aave’s protocol is likely to grow, leading to potential appreciation in the value of the AAVE token.

9. Fantom (FTM)

Fantom is a blockchain project that aims to provide fast & secure decentralized transactions at a low cost. It uses a Directed Acyclic Graph (DAG) architecture, which allows for high scalability and throughput, making it suitable for a wide range of applications.

FTM token is the native cryptocurrency of the Fantom network and serves as a medium of exchange for transactions on the platform. It is also used for staking and governance purposes. Staking FTM tokens allows users to participate in network consensus and earn rewards, while governance allows holders to vote on platform upgrades and changes.

What makes Fantom unique is its integration with other blockchain networks, allowing for cross-chain interoperability. This means that assets from other blockchains can be transferred and used on the Fantom network, increasing its utility and potential use cases.

Is FTM a good investment?

FTM price in 2023. Source: Coinmarketcap

As the adoption of decentralized applications and blockchain technology continues to grow, the utility of Fantom and its interoperability with other networks make it a promising investment opportunity. Additionally, its low transaction fees and fast transaction times make it a competitive alternative to other blockchain platforms.

10. Tezos (XTZ)

Tezos is a decentralized blockchain network that aims to provide a more efficient and secure way to create and operate decentralized applications (dApps). It uses a consensus mechanism called Liquid Proof of Stake (LPoS), which allows token holders to participate in network consensus by staking their XTZ tokens. Staking not only helps secure the network but also earns stakers a reward in the form of additional XTZ tokens.

Tezos is also highly flexible, with a built-in smart contract language called Michelson that allows developers to create and customize dApps to meet specific business needs. This flexibility, combined with its unique governance model, has attracted developers and businesses alike to the Tezos ecosystem.

Is XTZ a good investment?

XTZ price in 2023. Source: Coinmarketcap

As more dApps are developed and deployed on the Tezos network, the demand for XTZ tokens is likely to increase, leading to potential price appreciation. Tezos has also recently launched a new partnership with Google that will soon allow validators to create nodes using Google Cloud. Overall, it is a project with a big potential and strong community support, so DeFi-interested investors should definitely keep an eye out for XTZ.

Conclusion

During the 2022 bear market, DeFi sector has experienced a 76% drop in TVL (total value locked. Despite that, however, it was the biggest year in terms of institutional adoption for decentralized finance. Notably, JP Morgan, the multinational bank corporation has executed its first blockchain transaction in November. And according to experts, DeFi is likely to grow at an annual rate of 42.5% from 2022 to 2030.

So overall, the future of DeFi looks bright, and we can expect to see continued growth and innovation in this space in the years to come. That said, it is important that you do your own research and weigh out all the risks and benefits before making any investments.

And if you are looking for a reliable place to buy and sell crypto, we recommend you check out Guardarian.

With us you can buy and sell over 400 different cryptocurrencies securely and without registration.

Since our exchange is non-custodial, we don’t hold on to your assets at any point. Instead, they get transferred straight to your address of choice.

Simply select what you want to buy & how you want to pay – and your assets will be on their way to your wallet in no time!

Give us a try at www.guardarian.com and we wish you good luck and safe investing!

The information provided in this article is the author’s opinion and not investment advice. There is always the risk of seeing your investment go down in value due to price fluctuations. Make sure your portfolio aligns with your investment objectives and risk tolerance by reviewing it regularly and investing only money you can afford to lose.