If you’re building a fintech app or an e-commerce platform in 2026, you know the drill: your “on-ramp” isn’t just a technical utility—it’s where your user experience either wins or fails. In the high-stakes world of financial payments (YMYL), trust is the only foundation that actually holds weight.

Picking between Guardarian and Banxa usually comes down to a choice between agility and institutional scale. While both offer solid bridges between fiat and crypto, their approaches to partner support and fee transparency look very different when you’re actually running the business.

Key Takeaways

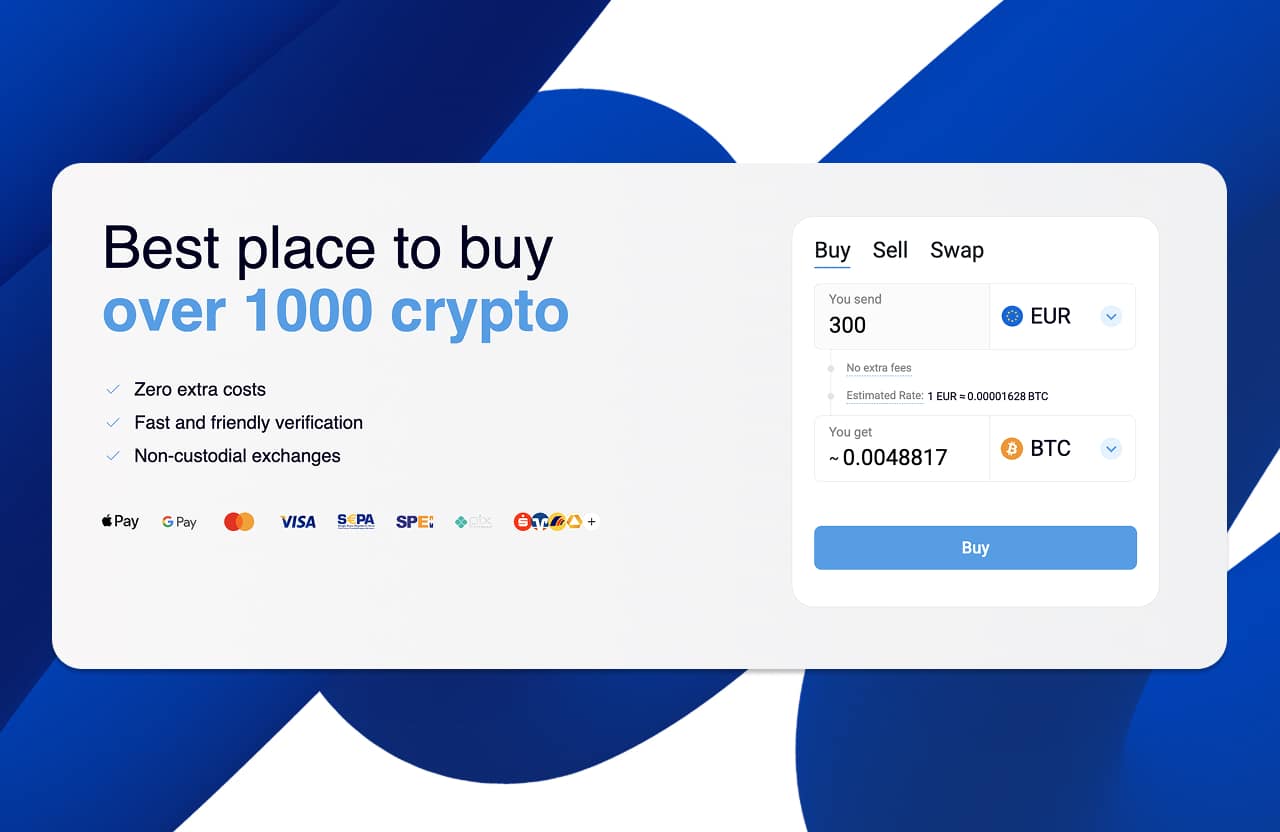

- Asset Support: Guardarian offers a massive library of 1,000+ tokens, providing a significant advantage if you need more than just the “Top 10” coins.

- Integration: You can go live with Guardarian’s widget in about 10 minutes with zero setup costs. Banxa’s SDK-heavy approach is tailored for longer, enterprise-level development cycles.

- Pricing: Guardarian uses a single “all-in” rate. Banxa typically applies a spread plus processing fees, which can sometimes lead to unexpected “price gaps”.

- Service: Guardarian’s B2B model is built around personal account managers, moving away from the “ticket-only” support seen at larger incumbents.

Guardarian vs Banxa: Payment solutions for Business

| Feature | Guardarian | Banxa |

|---|---|---|

| Coins Supported | 1,000+ (Leading diversity) | ~130+ (Focus on majors) |

| Setup Time | ~10 Minutes (Widget) | Variable (SDK/API-led) |

| Fee Model | Fees included in final rate | Spread (2-5%) + Processing fees |

| Support | Dedicated Personal Manager | Automated Ticket Portal |

| Registration | No-account swaps available | Full account creation required |

Guardarian overview

Guardarian is a VASP (Virtual Asset Service Provider) that has successfully positioned itself as the “agile” alternative for modern Web3 businesses. Operating since 2017, they focus on removing traditional fintech friction—letting users swap 50+ fiat currencies for over 1,000 different tokens without a mandatory registration flow. For businesses, they offer a modular “G-Series” suite, including(https://guardarian.com/G-OTC), G-Payments, and G-Custody services.

Banxa overview

Banxa is a publicly listed entity (TSX-V: BNXA) that provides institutional-grade infrastructure for global leaders like MetaMask. Their strength lies in their heavy regulatory footprint, including a MiCA license in the Netherlands and FCA registration in the UK. They are built to handle high-compliance volumes for massive enterprise partners.

What are Guardarian and Banxa: Crypto payment solutions

Both companies serve as the “bridge” between legacy banking and the blockchain. They handle the messy parts of the business—liquidity, KYC/AML compliance, and the actual delivery of assets—so you don’t have to. Essentially, they turn a complex financial transaction into a simple “Buy” button for your users.

Business features breakdown: Guardarian vs Banxa

Integration & Settlement

- Guardarian is engineered for time-to-market. Their customizable widget can be integrated via an iframe in roughly 10 minutes, and their non-custodial REST API is built for developers who want a custom UI without the complexity of a full SDK. This “zero setup cost” model is a massive plus for businesses that want to start earning revenue immediately.

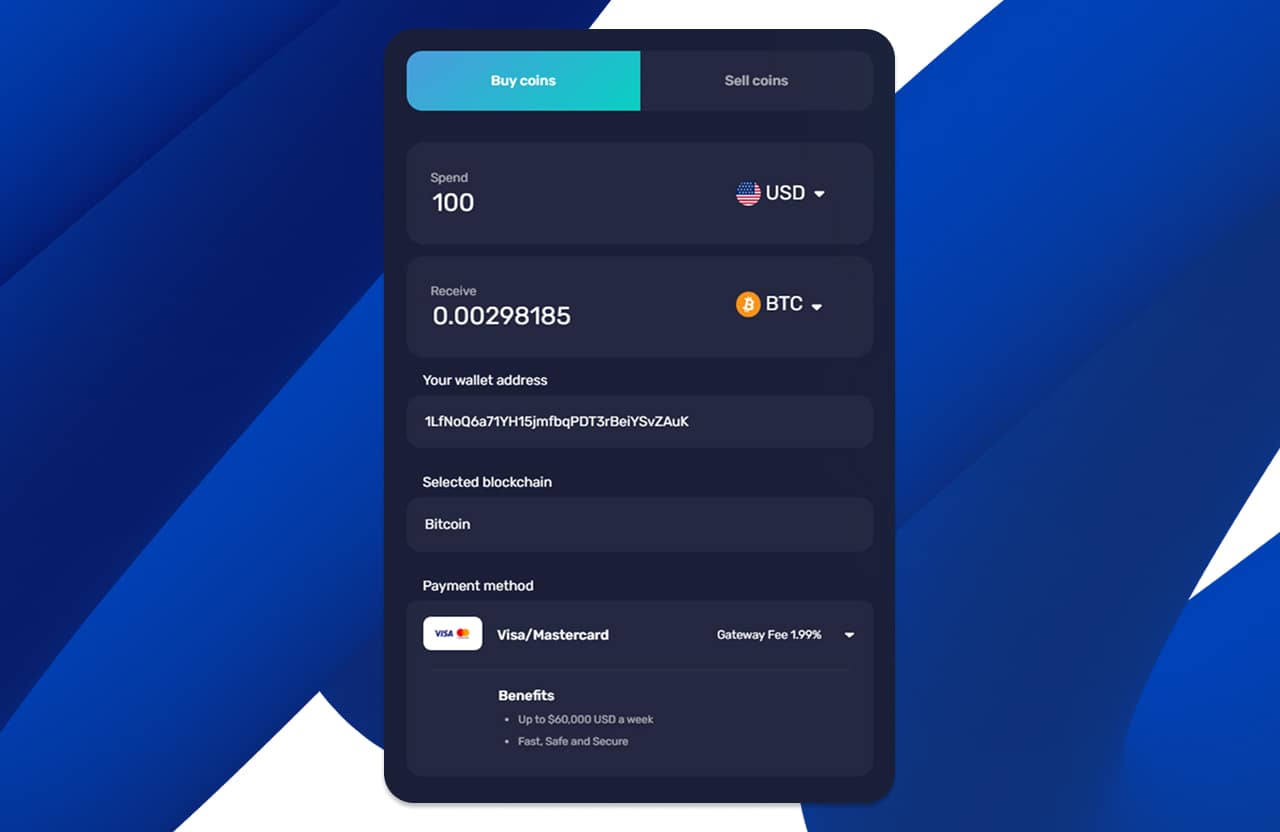

- Banxa provides a more traditional developer experience with native SDKs. This is great for deep mobile integration, but it generally takes more engineering resources to implement than Guardarian’s plug-and-play options.

Fees & Final rate transparency

In the on-ramp world, “sticker shock” at the final step is the #1 cause of lost conversions.

- Guardarian: They use an all-in rate. The fee is transparently baked into the price you see at the start. There are no extra line items popping up at checkout, ensuring the user gets exactly what they expect.

- Banxa: Their pricing is more complex. According to their official pricing guide, the total spread is a sum of the Banxa spread (2–4%), an optional partner spread (0–1%), and a recovery spread (up to €1). Additionally, a 1.99% processing fee applies specifically to card and Apple Pay transactions.

Payment methods

- Both cover the essentials: Visa, Mastercard, Apple Pay, Google Pay, and Revolut Pay. They also excel at regional rails—you’ll find bank transfers, Faster Payments for the UK, and PIX for Brazil.

- Guardarian’s agility often allows it to add new regional methods, like SPEI in Latin America, faster than larger public entities.

Supported countries & Fiat currencies

- Guardarian supports 170+ countries and 50+ fiat currencies, making it a global powerhouse for businesses with a diverse user base.

- Banxa maintains a similar global reach, with specific expertise in the US, UK, EU, and Australia.

KYC & Compliance

- Guardarian is known for its “fast and friendly” verification. By utilizing Low KYC, they allow users who have passed KYC on other platforms to skip repeating the process, which significantly boosts partner conversion rates.

- Banxa follows a more rigid, institutional compliance flow. While this “safety first” approach is ideal for large corporate partners, it can occasionally lead to higher friction for the end-user during onboarding.

Supported crypto assets & Networks

- This is where Guardarian shines. They support 1,000+ cryptocurrencies across multiple networks like Arbitrum, Optimism, and Polygon. If your project involves a niche token or a new Layer-2, Guardarian is often the only ramp that supports it.

- Banxa focuses on a curated list of 130+ major assets.

UX & Ease of use

- Guardarian’s UX is built for speed—it’s an “in and out” experience with no mandatory account creation for simple swaps.

- Banxa’s interface is a more structured, fintech-style flow that provides a high sense of security but often requires more steps to complete.

Delivery & Speed

- Guardarian transactions are typically processed in 5 to 20 minutes.

- Banxa reports that over 90% of their orders are processed in under 30 minutes, though first-time purchases can take longer due to initial compliance checks.

Refunds, chargebacks & Disputes

In crypto, “final” means final.

- To protect partners, Guardarian uses 3DS security for cards and matched bank account names for transfers, ensuring near-zero chargeback risk.

- Banxa also implements strict fraud prevention as part of their “merchant-of-record” service.

Partners support

- Guardarian offers a “boutique” service model: every B2B partner gets a Personal Account Manager. This is a massive benefit if you need technical or compliance issues solved quickly.

- Banxa primarily uses a ticket-based support portal, which is efficient but can feel less personal for smaller partners.

Security measures & Trust

- Both platforms are non-custodial—they don’t hold user funds; they simply facilitate the swap. They use standard security measures for data at rest and follow strict GDPR guidelines to ensure user privacy.

- Guardarian’s blog highlights their compliance, while Banxa’s public status provides institutional transparency.

Pros & Cons summary

Guardarian – Pros & Cons

| Pros | Cons |

|---|---|

| 1,000+ assets (Best in class variety) | Minimalist UI may lack some advanced reporting |

| Personal Account Manager for all partners | KYC triggers can sometimes be hard to predict |

| 10-minute integration with zero setup costs | |

| Transparent pricing (All-in rates) |

Banxa – Pros & Cons

| Pros | Cons |

|---|---|

| Institutional credibility (Publicly listed) | Higher-friction KYC process |

| Strong mobile SDKs (Native iOS/Android) | Complex fees (Spread + Processing) |

| Broad global licensing (MiCA/FCA) | Support is ticket-based, not personal |

Real User Opinions: What the Community Says

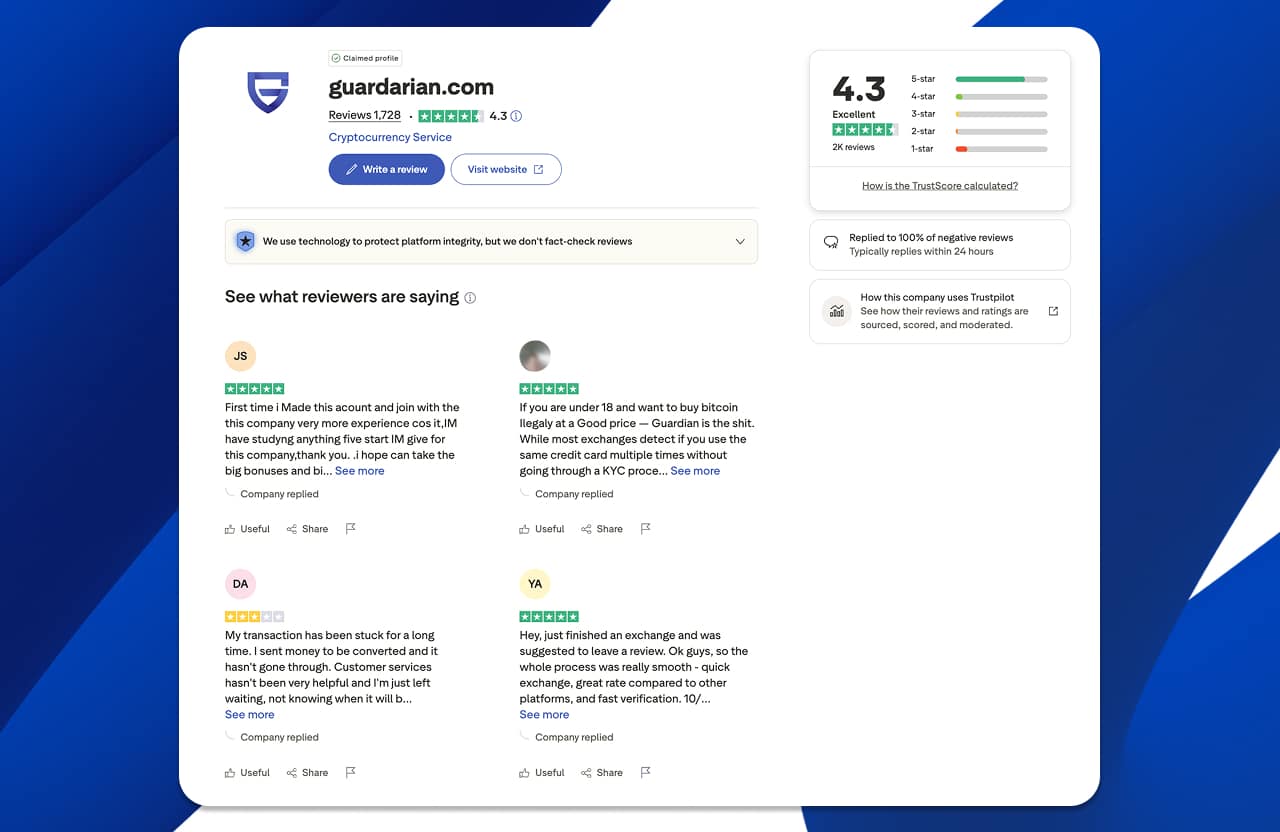

Reviews of Guardarian

Users on Trustpilot generally report a “smooth process” and “fast execution.” A few users highlighted the platform’s speed in 2026, with many users appreciating the non-custodial model.

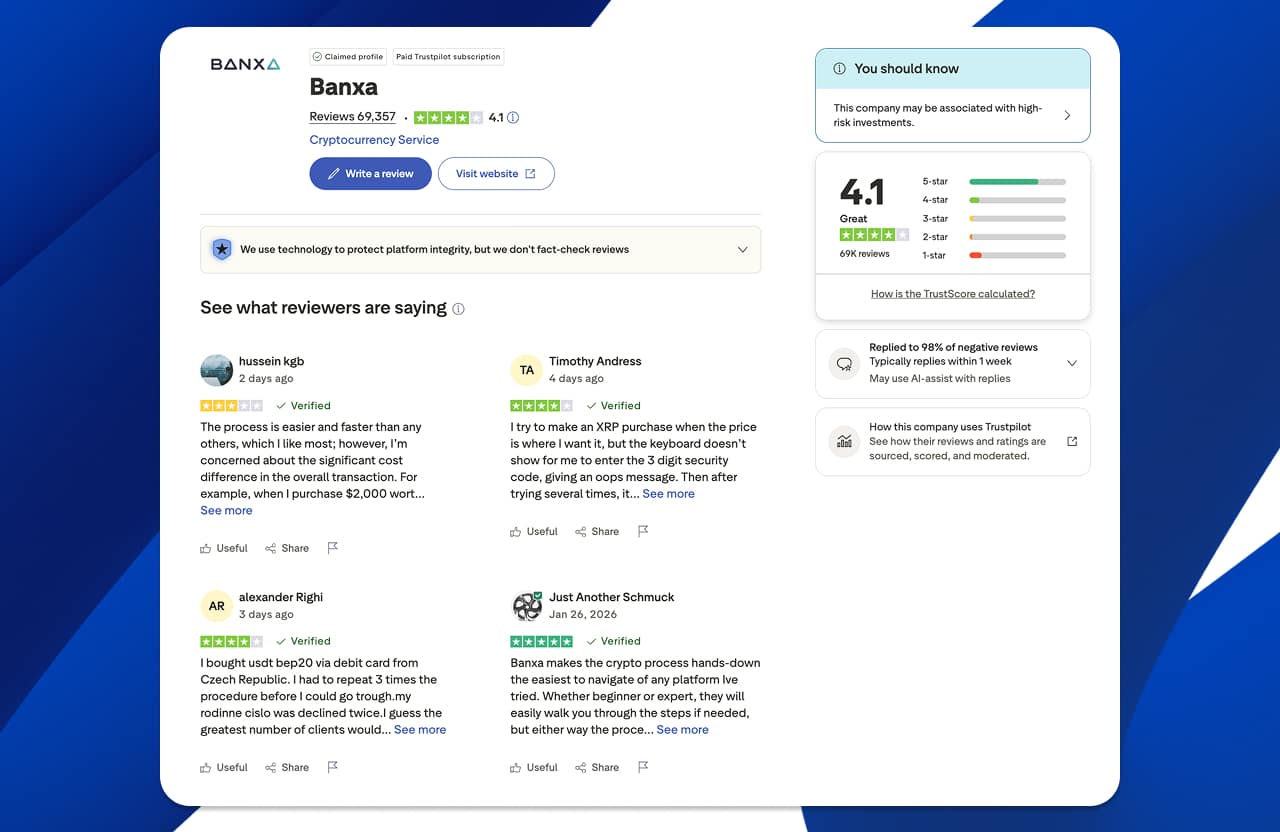

Reviews of Banxa

While many users find Banxa reliable, some have pointed out technical friction in the checkout UI or a lack of clarity regarding the final execution price compared to market spot, leading to occasional 12-36 hour delays for first-time buyers.

Which should you choose?

The bottom line? Your choice depends on whether you need a corporate giant or an agile partner who will answer the phone when you call.

Choose Guardarian if…

- You need to support niche tokens or multiple blockchain networks (1,000+ assets).

- You want a launch-ready solution that takes 10 minutes to integrate.

- You value personal service and want a dedicated manager for your account.

- You want your users to have a simple, all-in price at checkout.

Choose Banxa if…

- You are a large institutional platform that requires a publicly listed partner.

- Your app requires native mobile SDKs for iOS or Android.

- Your legal team requires a partner with specific global registrations (FCA/MiCA).

- You are building a massive wallet (like MetaMask) and need institutional reach.

FAQ

How long does it take to integrate Guardarian?

Most partners are integrated and ready to earn revenue in about 10 minutes using the widget.

Does Guardarian charge for B2B integration?

Guardarian offers zero-cost integration for its B2B on/off ramp services.

What happens if a user provides the wrong wallet address?

Since crypto transactions are final, funds cannot be recovered if sent to the wrong address. Guardarian emphasizes double-checking addresses during checkout.

Can I list my own project’s token?

Guardarian offers a dedicated “List Your Token” service to provide a fiat on-ramp for your project’s community.

How we compared Guardarian vs Banxa

This comparison was compiled by analyzing 2026 developer documentation, current fee schedules from Banxa’s documentation and Guardarian’s public Business details, and verified user feedback from Trustpilot and Reddit.

- Is Guardarian Safe? – | Guardarian, accessed February 5, 2026, https://guardarian.com/blog/is-guardarian-safe/

- Guardarian vs MoonPay (2026): Fees, KYC, Limits & Speed, accessed February 5, 2026, https://guardarian.com/blog/guardarian-vs-moonpay/

- Guardarian vs Overpay: Which Business solution is better?, accessed February 5, 2026, https://guardarian.com/blog/guardarian-vs-overpay/

- Buy and Sell 1000+ Crypto with Trust – Guardarian, accessed February 5, 2026, https://guardarian.com/currencies

- Guardarian Crypto Solutions For Business | Guardarian, accessed February 5, 2026, https://guardarian.com/for-partners

- Integrate Crypto On-Ramp & Off-Ramp | Guardarian, accessed February 5, 2026, https://guardarian.com/integrate-us

- Privacy Policy | Guardarian, accessed February 5, 2026, https://guardarian.com/privacy-policy

- Crypto Asset Management Solutions – Banxa, accessed February 5, 2026, https://banxa.com/solutions/by-use-case/user-assets/

- Buy, Sell, and Swap crypto on Guardarian | Fiat On/Off Ramp & Best rates, accessed February 5, 2026, https://guardarian.com/

- Banxa pricing, accessed February 5, 2026, https://support.banxa.com/en/support/solutions/articles/44002465167-how-does-banxa-set-the-price-of-cryptocurrency-

- B2B Crypto Exchange & Fiat-to-Crypto Services | Guardarian for …, accessed February 5, 2026, https://guardarian.com/business

- Buy Crypto Without Verification | Guardarian, accessed February 5, 2026, https://guardarian.com/buy-crypto-without-verification

- Supported Cryptocurrencies and Blockchains – Overview – Banxa, accessed February 5, 2026, https://docs.banxa.com/docs/available-cryptocurrencies-and-blockchains

- What are Banxa transactions limits and fees?, accessed February 5, 2026, https://support.qredo.com/faq/what-are-banxa-transactions-limits-and-fees

- Biometric Privacy Disclosure and Consent – Banxa, accessed February 5, 2026, https://banxa.com/wp-content/uploads/2025/02/Biometric-Privacy-Disclosure-and-Consent.pdf

- Terms of service – Guardarian, accessed February 5, 2026, https://guardarian.com/terms-of-service

- Pricing – Banxa, accessed February 5, 2026, https://banxa.com/pricing/

- Security – Banxa, accessed February 5, 2026, https://banxa.com/security/

- Global Licenses (Non-USA) – Banxa, accessed February 5, 2026, https://banxa.com/Global-License

- Customer Terms & Conditions – Banxa, accessed February 5, 2026, https://banxa.com/wp-content/uploads/2025/10/Customer-Terms-and-Conditions-16-October-2025-BANXA.pdf

- Guardarian payment gateway – the only solution for your business …, accessed February 5, 2026, https://guardarian.com/G-payments

- Guardarian G-OTC – Secure & Efficient Crypto Trading, accessed February 5, 2026, https://guardarian.com/G-OTC

- Banxa Secures MiCA Licence in the Netherlands, Expanding Regulated Crypto Services Across Europe, accessed February 5, 2026, https://banxa.com/press/banxa-secures-mica-licence-in-the-netherlands/

- BNXA UK VASP Limited – FCA Register – Financial Conduct Authority, accessed February 5, 2026, https://register.fca.org.uk/s/firm?id=0014G00003BZWsGQAX

- Card vs P2P: The Best Way to Buy Crypto in 2026 – Guardarian, accessed February 5, 2026, https://guardarian.com/blog/best-way-to-buy-crypto-card-vs-p2p/

- Crypto On/Off-Ramps: Building the Bridge Between Fiat and the Tokenized Economy: Part 5 of 8 in the Traditional Finance Meets Crypto Series | by Rama Ituarte | Medium, accessed February 5, 2026, https://medium.com/@rama.ituarte/crypto-on-off-ramps-building-the-bridge-between-fiat-and-the-tokenized-economy-part-4-of-8-in-the-64d9fa8437ba

- How to Use Banxa on OKX: Complete Payment, Fees & KYC Guide, accessed February 5, 2026, https://www.okx.com/learn/how-to-use-banxa-with-okx

- Buy crypto with Bank Account & Bank Transfer | Guardarian, accessed February 5, 2026, https://guardarian.com/cz/buy-crypto-with-bank-transfer

- Read Customer Service Reviews of guardarian.com – Trustpilot, accessed February 5, 2026, https://www.trustpilot.com/review/guardarian.com

- Buy Crypto Instantly with Google Pay – Guardarian, accessed February 5, 2026, https://guardarian.com/blog/buy-crypto-instantly-with-google-pay/

- Guardarian Payment Methods – Buy & Sell & Swap Crypto Easily, accessed February 5, 2026, https://guardarian.com/payment-methods

- General Data Protection Regulation – Wikipedia, accessed February 5, 2026, https://en.wikipedia.org/wiki/General_Data_Protection_Regulation

- No More Repeating KYC: Buy, Sell & Swap Crypto | Guardarian, accessed February 5, 2026, https://guardarian.com/blog/no-more-repeating-kyc-buy-sell-swap-crypto/

- Global Privacy and Cookies Policy – Banxa, accessed February 5, 2026, https://banxa.com/privacy-and-cookies-policy/

- Are long Banxa delays normal on MetaMask? – Reddit, accessed February 5, 2026, https://www.reddit.com/r/Metamask/comments/17twd0b/are_long_banxa_delays_normal_on_metamask/

- How long will my order take? – Support : Banxa, accessed February 5, 2026, https://support.banxa.com/en/support/solutions/articles/44002216503-how-long-will-my-order-take-

- How long will my order take? : Banxa, accessed February 5, 2026, https://support.banxa.com/en/support/solutions/articles/44002190041-how-long-will-my-order-take-

- What Is GDPR Compliance? – Palo Alto Networks, accessed February 5, 2026, https://www.paloaltonetworks.com/cyberpedia/gdpr-compliance