Integrating a crypto on-ramp in 2026 is no longer a luxury—it is a critical piece of infrastructure for any global platform. However, for businesses operating in the financial sector (YMYL), the stakes are higher than just technical compatibility. Success is measured by how much friction you remove from the user’s journey and how clearly you communicate costs.

The debate between Guardarian and Simplex centers on a choice between versatile modern agility and legacy institutional stability. While both are heavyweights, their philosophies regarding asset diversity and partner-level support offer distinct advantages depending on your project’s specific goals.

Key Takeaways

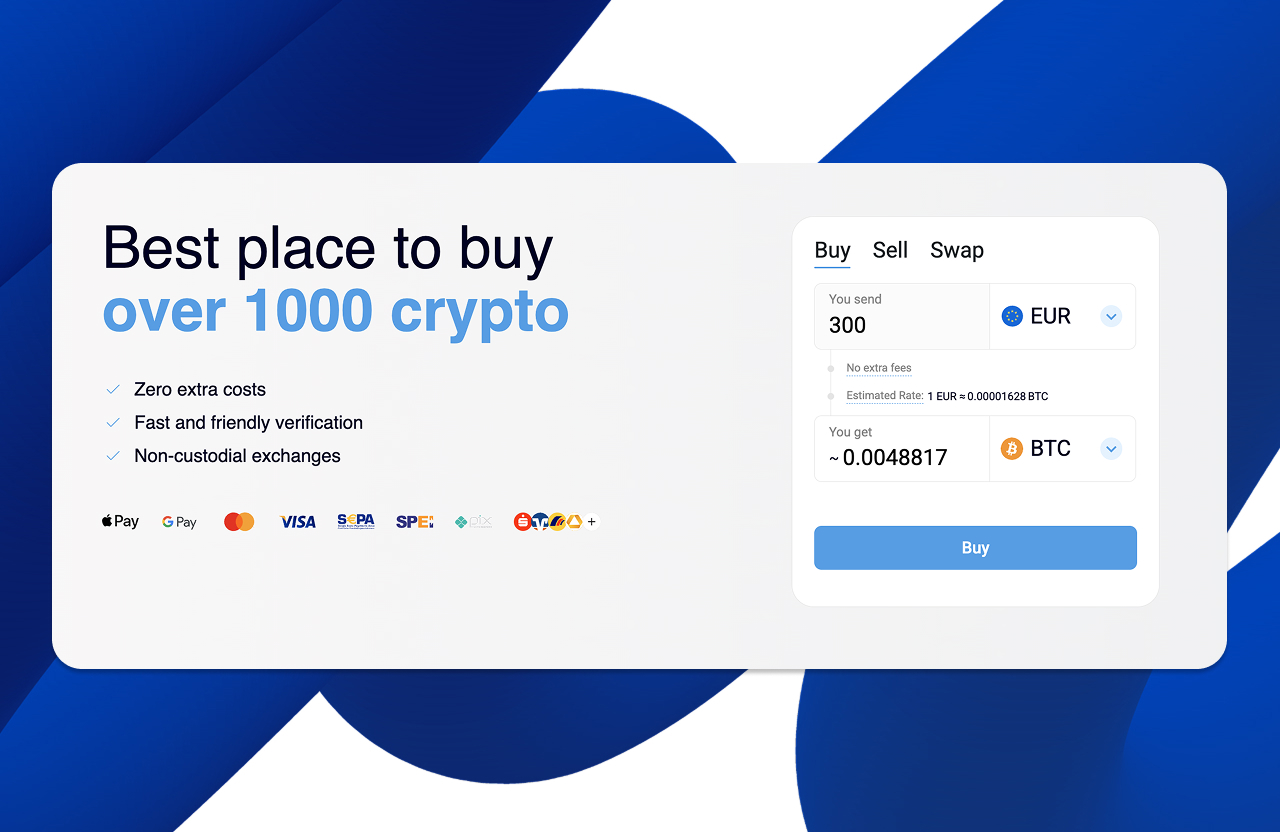

- Asset Support: Guardarian remains the industry benchmark for variety, supporting 1,000+ tokens, which is a decisive advantage for platforms moving beyond major coins.

- Integration: You can go live with Guardarian’s customizable widget in about 10 minutes with zero setup costs, enabling immediate revenue generation.

- Pricing: Guardarian utilizes an “all-in” rate that prevents cart abandonment by showing the final price upfront. Simplex typically applies a fee between 3.5% and 5% with a mandatory $10 minimum, which can be high for small purchases.

- Service: Guardarian’s model centers on personal account managers for B2B partners, offering a human touch that is often lost in larger, ticket-driven ecosystems.

Guardarian vs Simplex: Payment solutions for Business

| Feature | Guardarian | Simplex |

|---|---|---|

| Coins Supported | 1,000+ (Web3-wide coverage) | 200+ (Focus on majors) |

| Setup Time | ~10 Minutes (Widget) | Variable (Merchant approval) |

| Fee Model | Fees baked into final rate | 3.5%–5% (+ $10 minimum) |

| Support | Personal Account Manager | 24/7 Ticket Portal |

| Registration | Account-free swaps available | Mandatory KYC/Account flow |

Guardarian overview

Guardarian is a licensed EU Virtual Asset Service Provider (VASP) that has built its reputation on being the most flexible gateway in the European market. Since its launch in 2017, the company has focused on stripping away the complexities of crypto adoption by offering over 1,000 cryptocurrencies and 50+ fiat currencies. Their modular business artnership, which includes G-Payments and G-OTC, is specifically designed to help businesses scale their crypto operations without the traditional bureaucratic overhead.

Simplex overview

Simplex is an industry pioneer, widely recognized for launching the first secure card-to-crypto flows back in 2014. Now a core part of Nuvei’s global payment ecosystem, Simplex offers massive institutional reach and is a Visa Principal Member. Their primary value proposition is a “Zero Chargeback Guarantee” powered by proprietary AI risk analysis, making them a safe haven for high-volume, enterprise exchanges like Binance.

What are Guardarian and Simplex: Crypto payment solutions

Both entities function as the essential “bridge” between the legacy banking world (SEPA, SWIFT, cards) and the decentralized economy. They handle the heavy lifting—from liquidity sourcing to complex KYC/AML compliance, allowing businesses to integrate a high-conversion fiat on-ramp or off-ramp directly into their apps.

Business features breakdown: Guardarian vs Simplex

Integration & Settlement

- Guardarian is engineered for time-to-market. Their API documentation is developer-friendly, and the widget can be embedded via an iframe in roughly 10 minutes. The standout feature here is the zero setup cost model, which allows startups and mid-sized firms to launch without any upfront financial barriers.

- Simplex offers a Hosted Payment Page (HPP) that is technically straightforward but often involves a more rigorous B2B onboarding and approval process. Because they operate within the Nuvei corporate framework, the path to “going live” is generally longer than Guardarian’s streamlined approach.

Fees & Final rate transparency

In the on-ramp sector, transparency is the greatest driver of conversion.

- Guardarian: They utilize an all-in rate model, where the final quote includes all network and processing fees. This ensures the user sees exactly what they will receive in their wallet, eliminating the “sticker shock” that often leads to abandoned transactions.

- Simplex: Their fees usually range between 3.5% and 5%. However, the official pricing guide confirms a minimum fee of $10. For a user buying $50 worth of crypto, this fixed minimum can represent a 20% effective fee, making Guardarian a more cost-effective choice for smaller consumer transactions.

Payment methods

Both providers excel at localization, offering Visa, Mastercard, Apple Pay, Google Pay, and Revolut Pay. Guardarian, however, shows superior agility in integrating regional rails like bank transfers and local payment methods (like SPEI for Mexico), which is vital for businesses targeting high-growth emerging markets.

Supported countries & Fiat currencies

- Guardarian currently supports 170+ countries and 50+ fiat currencies, including BRL, GBP, and EUR.

- Simplex maintains a reach into 245+ global markets, but they have a strict list of unsupported regions, including several US states like New York and Washington, which businesses need to factor into their expansion plans.

KYC & Compliance

- Guardarian focuses on a low-friction onboarding experience. It allows users who have passed KYC on other platforms to skip repeating the steps, which significantly boosts conversion for B2B partners.

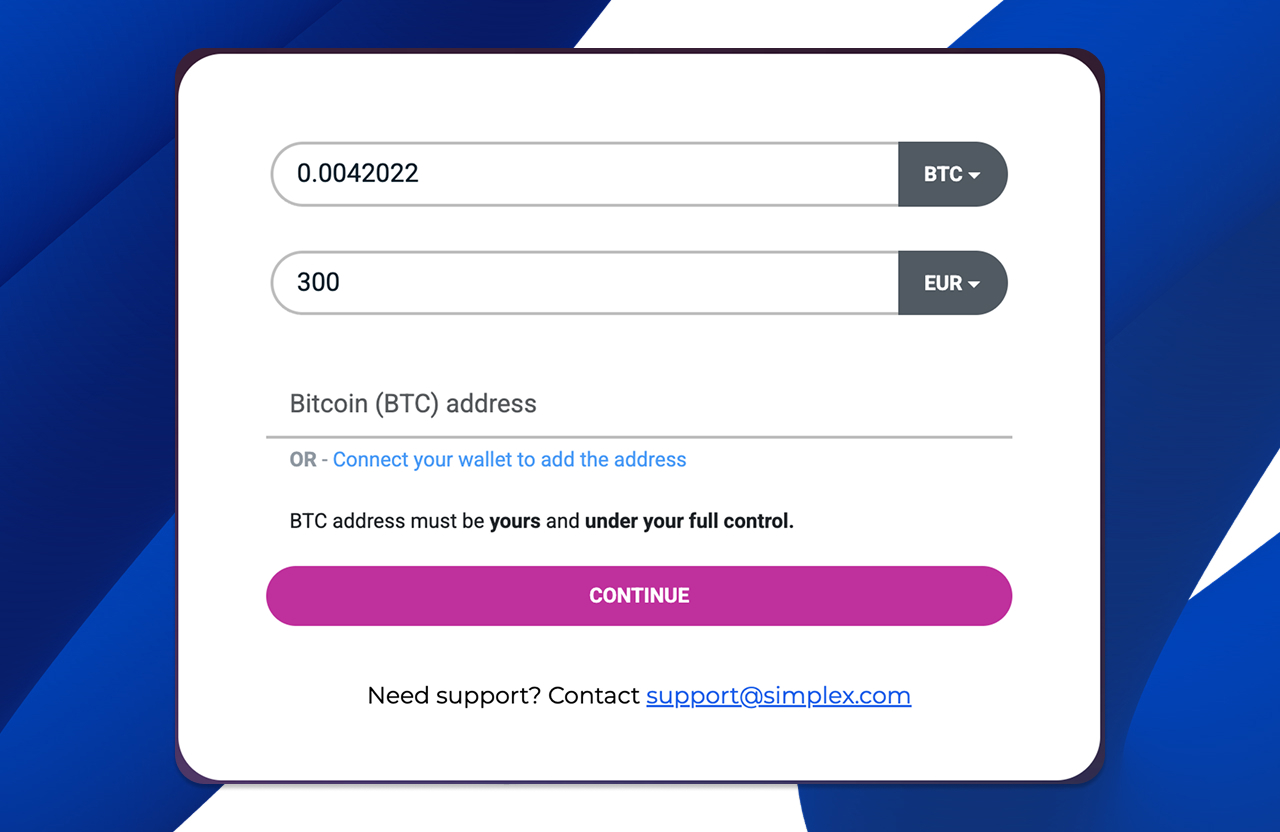

- Simplex prioritizes security via its “Zero Chargeback” AI layer. While this offers 100% protection to the merchant, the initial user verification can be more intensive, sometimes requiring more data points during the verification process compared to Guardarian’s flexible approach.

Supported crypto assets & Networks

- If your project is built on a modern Layer-2 or involves niche tokens, Guardarian is the clear winner. It supports over 1,000 assets, including gas-free USDT on the Tron network.

- Simplex focuses on a curated list of 200+ major coins, which is highly reliable but may be limiting for diversified Web3 ecosystems.

UX & Ease of use

- Guardarian’s interface is designed for speed, often allowing account-free swaps that keep users moving through the funnel.

- Simplex’s UX is a classic “one-page” flow, but it still follows a more traditional, banking-style sequence that emphasizes identity confirmation before finalizing the payment.

Delivery & Speed

- Guardarian typically completes transaction delivery in 5 to 20 minutes.

- Simplex is similarly fast, claiming that most card transactions complete within 30 minutes, although their strict fraud detection can sometimes flag first-time orders for manual review.

Refunds, chargebacks & Disputes

- Guardarian protects partners using 3DS security and matched-name bank transfers to ensure near-zero chargeback risk.

- Simplex is the market leader for risk-averse merchants because it acts as the merchant of record, assuming 100% of the chargeback liability on behalf of its partners.

Partners support

- The “Guardarian Advantage” is their boutique service model. Every B2B partner is assigned a Personal Account Manager, providing a direct line to solve integration or compliance issues instantly.

- Simplex offers world-class global support, but for most partners, the experience is primarily ticket-based through an automated portal.

Security measures & Trust

Both platforms utilize encryption for data at rest and are strictly non-custodial, ensuring they never hold user funds. Guardarian’s safety credentials highlight their EU licensing, while Simplex’s status as a Nuvei subsidiary provides the institutional backing required for YMYL-sensitive fintech content.

Pros & Cons summary

Guardarian – Pros & Cons

| Pros | Cons |

|---|---|

| 1,000+ Assets (Unrivaled diversity) | Dashboard may feel minimalist for some |

| Dedicated B2B Manager for every partner | High-volume KYC triggers |

| Zero setup costs and 10-min launch | |

| Transparent All-in rates (Zero gaps) |

Simplex – Pros & Cons

| Pros | Cons |

|---|---|

| 100% Fraud Protection (Zero liability) | High $10 minimum fee |

| Nuvei institutional backing | No account-free swap option |

| Visa Principal Membership | Smaller asset selection (200+) |

Real User Opinions: What the Community Says

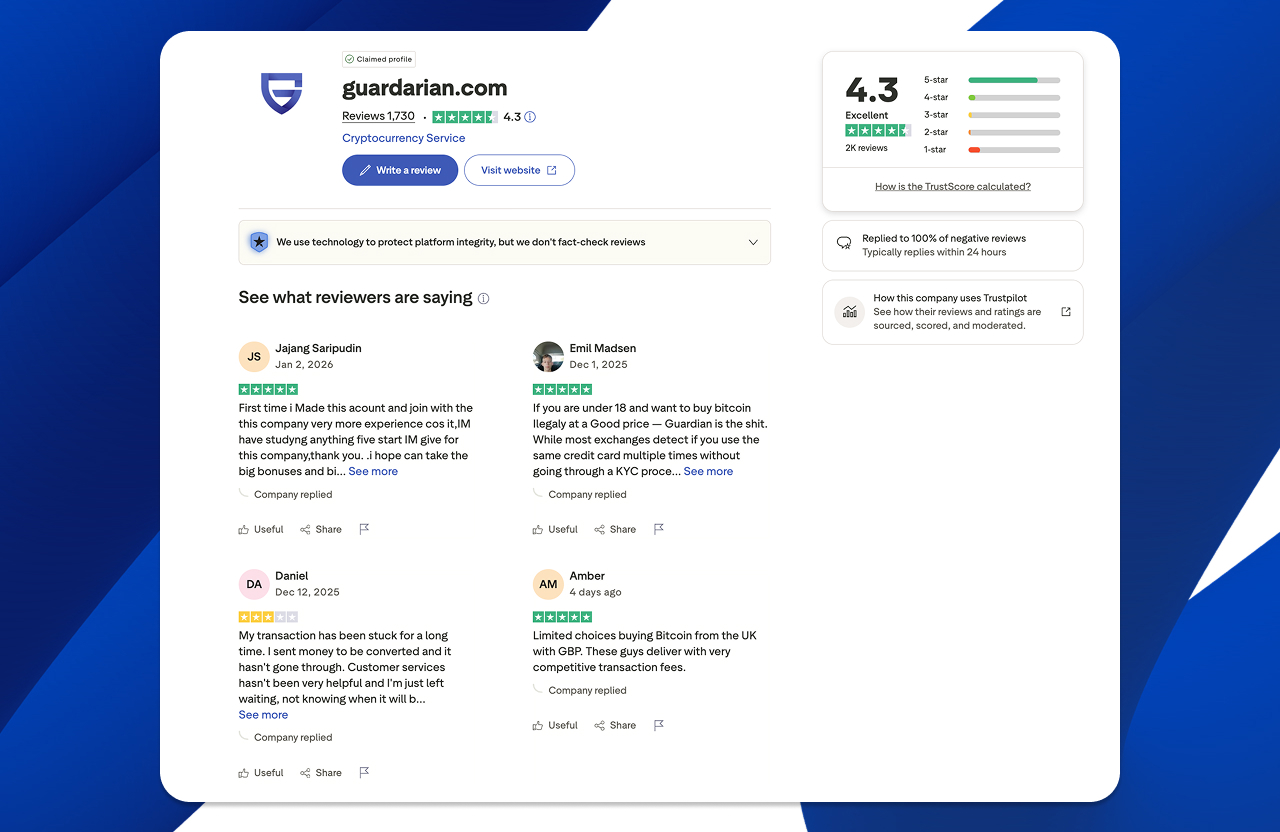

Reviews of Guardarian

A look at Trustpilot shows a recurring theme of “speed and reliability.” Users like Nelson Caramelo and Thomas Goralczyk have specifically praised the non-custodial execution and the ability to buy crypto instantly without account walls.

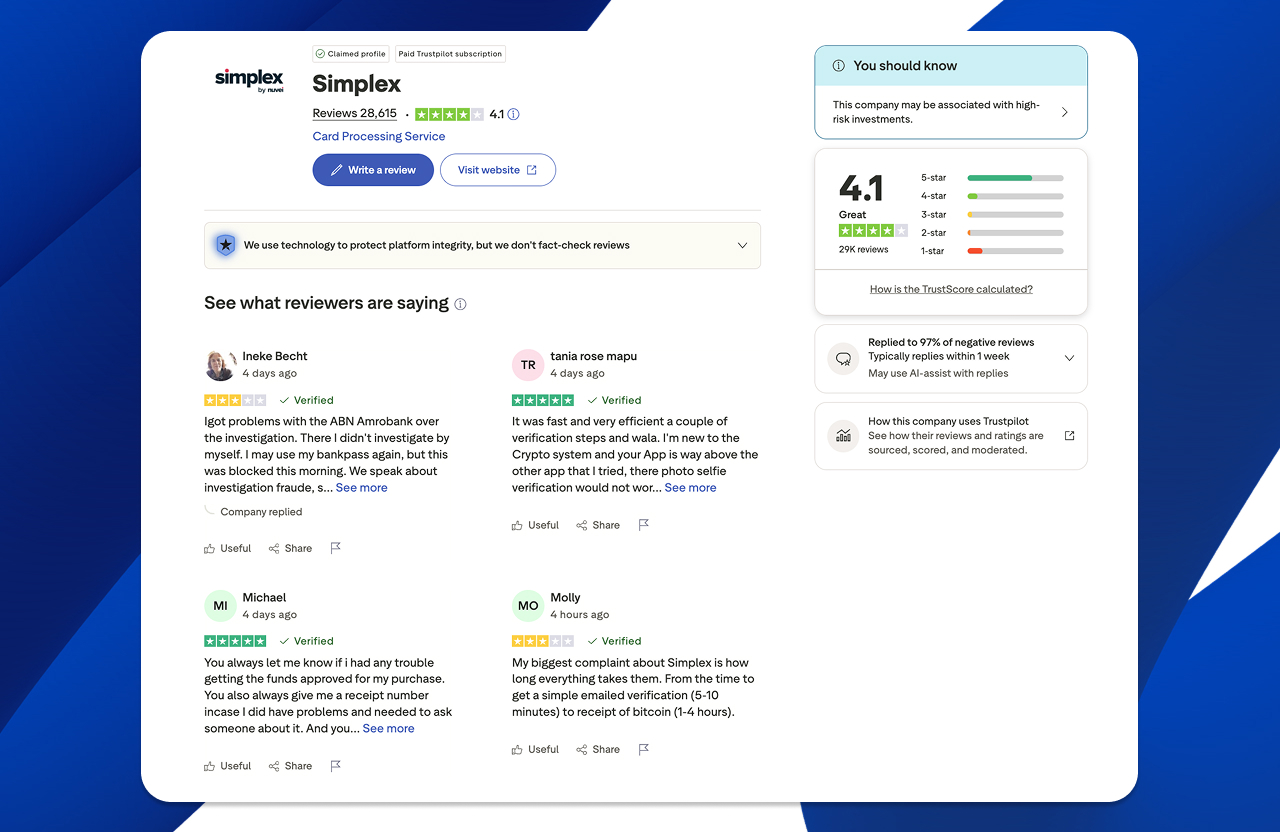

Reviews of Simplex

While many users find Simplex dependable, some have expressed frustration on Trustpilot regarding price discrepancies between the initial quote and final execution, or blocked payments due to rigid internal fraud checks.

Which should you choose?

Choose Guardarian if…

- You need to support niche tokens or multiple Layer-2 networks (1,000+ assets).

- You want a launch-ready solution with zero setup fees and a 10-minute integration.

- You value dedicated personal support and want a direct line to a manager.

- You want your users to have a clear, transparent price at checkout.

Choose Simplex if…

- You are an enterprise-level exchange needing a 100% chargeback guarantee.

- You require a partner with Nuvei’s global institutional scale.

- You deal primarily in major cryptocurrencies only.

FAQ

How we compared Guardarian vs Simplex

This analysis was based on early 2026 developer documentation, official fee schedules from Guardarian’s business page and Simplex’s shared details, and verified feedback from Trustpilot and community forums.

- Is Guardarian Safe? | Guardarian, accessed February 5, 2026, https://guardarian.com/blog/is-guardarian-safe/

- Buy, Sell, and Swap crypto on Guardarian | Fiat On/Off Ramp & Best rates, accessed February 5, 2026, https://guardarian.com/

- Guardarian vs MoonPay (2026): Fees, KYC, Limits & Speed, accessed February 5, 2026, https://guardarian.com/blog/guardarian-vs-moonpay/

- Simplex Integration Checklist, https://www.simplex.com/integration-checklist

- Simplex Fee Schedule, https://www.simplex.com/kb/what-fees-do-you-charge-for-card-payments

- Simplex Verification Process, https://www.simplex.com/kb/buying-cryptocurrency-through-simplex

- Simplex Unsupported Locations, https://www.simplex.com/kb/what-are-your-supported-locations-countries-states-and-territories

- Simplex Delivery Speed, https://www.simplex.com/kb/why-was-i-charged-before-receiving-my-cryptocurrency

- Simplex Transaction Limits, https://www.simplex.com/kb/transaction-limits

- Simplex Privacy Policy, https://www.simplex.com/privacy-policy

- Simplex SEPA Support, https://www.simplex.com/kb/a-list-of-countries-that-participate-in-sepa-and-sepa-instant

- Nuvei Simplex Acquisition, https://www.fintechfutures.com/press-releases/nuvei-to-acquire-simplex-a-payment-solution-provider-to-the-cryptocurrency-industry

- Guardarian Business Page, https://guardarian.com/business

- Guardarian Partner Terms, https://guardarian.com/for-partners

- Guardarian FAQ, https://guardarian.com/faq